Cardano Founder Hoskinson Signals Reset For 2026, Not An Exit

Charles Hoskinson rang in 2026 from his Wyoming ranch with a message that sounded, at first blush, like an exit. It wasn’t. The Cardano founder said he is “not leaving the cryptocurrency space,” but he is walking away from day-to-day life on X and retooling how he shows up publicly, arguing that his visibility has become a liability for Cardano and Midnight adoption.

Cardano Founder Plans To Move Into The Background

Hoskinson opened the New Year’s livestream titled “Happy New Year and Farewell” with a post-mortem on 2025, framing it as a year in which parts of the industry chased success faster than it built systems capable of delivering on crypto’s broader promises. In his telling, the space “lost our way” by letting incentives and spectacle override first principles.

He was also explicit about what the “farewell” refers to and what it does not. “So, to get this right off the bat, I’m not leaving the cryptocurrency space,” Hoskinson said. “I’m cognizant and aware that every single time I make a live stream or I say something, it gets misconstrued. So, let’s just definitively put that on the table. I’m not going anywhere. I’m not leaving.”

Instead, he described a strategic retreat from hyper-online discourse, claiming that the “weaponization” of his persona creates a barrier for would-be users who might otherwise participate in Cardano or Midnight.

The problem, he argued, is that public perception increasingly substitutes for product evaluation: “We don’t ask what it do. We ask who made it… If we hate them, what that thing is is evil and wrong. If we love them, what that thing is must be good.”

The clearest operational change is his decision to step back from X entirely. “I’ve outgrown X,” he said. “So it’s my farewell to that platform and I’ll turn it over to curators and AI. It’ll go into silent mode for probably a few weeks to a few months as we build up that infrastructure because I have more important things to do, but I’m going to uninstall the app and never think of it again.”

Hoskinson said he plans to focus instead on “long form writing,” AMAs, livestreams, and experimenting with new media formats, floating Twitch as one possible outlet. The goal, as he framed it, is to preserve community connection while reducing the surface area for what he described as increasingly hostile, toxic cycles during down markets.

Beyond the social pivot, Hoskinson emphasized a shift into “deep focus,” saying he has returned to a level of product specificity he hasn’t had “in a very long time.” He cited drafting a “specification for a zkVM,” working on “adding privacy to intents,” and thinking through “chain abstraction” and the roles across “application and permission and solver and settlement” layers.

He repeatedly anchored that renewed focus to scale targets, explicitly tying his 2026 mindset to Midnight’s longer-term arc. “Every day I wake up and I ask, ‘How do I build something a million people can use?’ And then I ask, ‘How do I build something a billion people can use?’” he said, adding that he has been thinking through what it would take for Midnight to reach “a billion users and a trillion dollars of transactions on the platform by 2030.”

Personal Changes For 2026

Hoskinson also made the personal operational changes unusually concrete. He said he traveled “more than 260 days” in 2025, averaged “only five and a half hours of sleep a night,” and described that pace as unsustainable. After Japan and Hong Kong, he said, he intends to travel less and spend more time at his ranch or farm, focusing on health, reading, and calmer reflection.

The closing stretch blended motivation with ecosystem-specific claims about the year ahead: he said “we finally launched Midnight,” pointed to RealFi efforts that “gave out a million loans over the last 18 months” in Uganda and Kenya, and framed 2026 as the year “Leios ships,” “Hydra gets good,” and Cardano’s “decentralized governance becomes hardened” as the community gains “full agency.”

But he also delivered a blunt cultural critique that doubles as a signal to his audience about what he wants his next chapter to optimize for. “If all you can think about is the price, you’ve already lost,” Hoskinson said. “Even if it goes up, you’ve lost. Not just at crypto, but at life.”

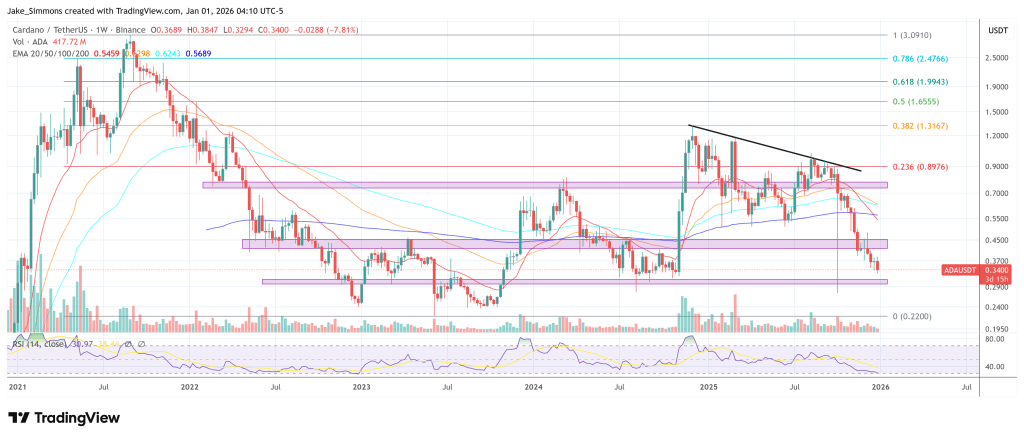

At press time, ADA traded at $0.34.

You May Also Like

Pi Network (PI) Daily Market Analysis 22 February 2026

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”