India’s RBI Warns: CBDCs Must Replace Stablecoins to Prevent Financial Chaos

India’s central bank has warned that the growing use of privately issued stablecoins could threaten financial stability and undermine trust in money, arguing that central bank digital currencies should take precedence if countries want to avoid systemic risks.

The warning came in the Reserve Bank of India’s latest Financial Stability Report, released this week, which reflects the collective view of India’s major financial regulators.

RBI Warns Stablecoins Could Amplify Financial Stress; How?

The RBI indicated in the report that the central bank digital currencies maintain the singleness of money and the integrity of the financial system, and therefore, they are the ultimate settlement asset and the source of trust.

In comparison, the central bank considered stablecoins to be a rapidly expanding source of risk, especially when markets become stressed. It asserted that jurisdictions should closely consider the risks that stablecoins present and develop policy responses that fit their system.

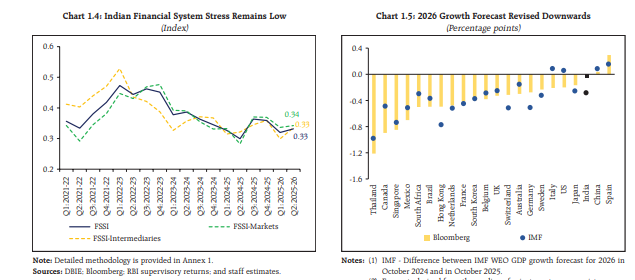

The RBI made the remarks when financial conditions of the world seem stable at face value, yet are susceptible below.

The report indicated that the world in 2025 was growing better than expected, and it was supported by government expenditure, heavy investment in artificial intelligence, and an acceleration in trade activity before the establishment of new tariffs.

Source: RBI

Source: RBI

Meanwhile, risks have persisted in accumulating because the prices of assets are now overstretched, the amount of debt in the hands of the populace is great, and the connections between financial institutions are becoming more and more intertwined.

New market segments like private credit and stablecoins have grown at a very fast rate, and there is a concern about the spread of shocks across markets.

Within this environment, stablecoins received specific attention. The RBI noted that the global stablecoin market has grown sharply, reaching about $300 billion by the end of 2025, with most tokens pegged to the U.S. dollar and dominated by a small number of issuers.

The report said stablecoins are closely linked to traditional financial markets because issuers hold large amounts of government bonds as reserves. In a stress scenario, sudden redemptions could force fire sales of these assets, amplifying volatility.

The central bank also pointed to risks such as loss of pegs, deposit flight from banks, circumvention of capital controls, and increased use in illicit finance.

India Sees CBDCs as Path to Faster Payments Without Financial Risk

Against this backdrop, the RBI reiterated its preference for sovereign digital money. It said CBDCs can offer faster payments, programmability, and instant settlement, similar to stablecoins, but without weakening monetary sovereignty or financial stability.

The report added that privately issued stablecoins could create parallel forms of money that do not always trade at par, undermining the uniformity of the monetary system.

India’s own financial system, the RBI said, remains resilient despite global uncertainty. Economic growth continues to be driven by domestic demand, inflation has eased, and banks are well capitalized with low levels of bad loans.

Stress tests show that banks and non-bank financial companies can withstand severe shocks, although pockets of risk are emerging in areas such as unsecured retail lending, fintech credit, and microfinance.

The report stressed that these risks require close monitoring, especially as financial linkages grow more complex.

Globally, CBDC adoption remains limited, as only a handful of countries have launched live CBDCs, while dozens more are in pilot or research phases, according to international trackers.

You May Also Like

Structural job strain caps rand gains – Commerzbank

Trump gushes over Nicki Minaj's skin to mark Black History Month: 'So beautiful'