3 African startups reshaping mobility, management, and markets

Startups On Our Radar spotlights African startups solving African challenges with innovation. In our previous edition, we featured five game-changing startups pioneering agritech, fintech, HRTech, and cleantech. Expect the next dispatch on January 9, 2026.

This week, we explore three African startups in the ecommerce, HRTech, and mobility sectors and why they should be on your watchlist. Let’s dive into it:

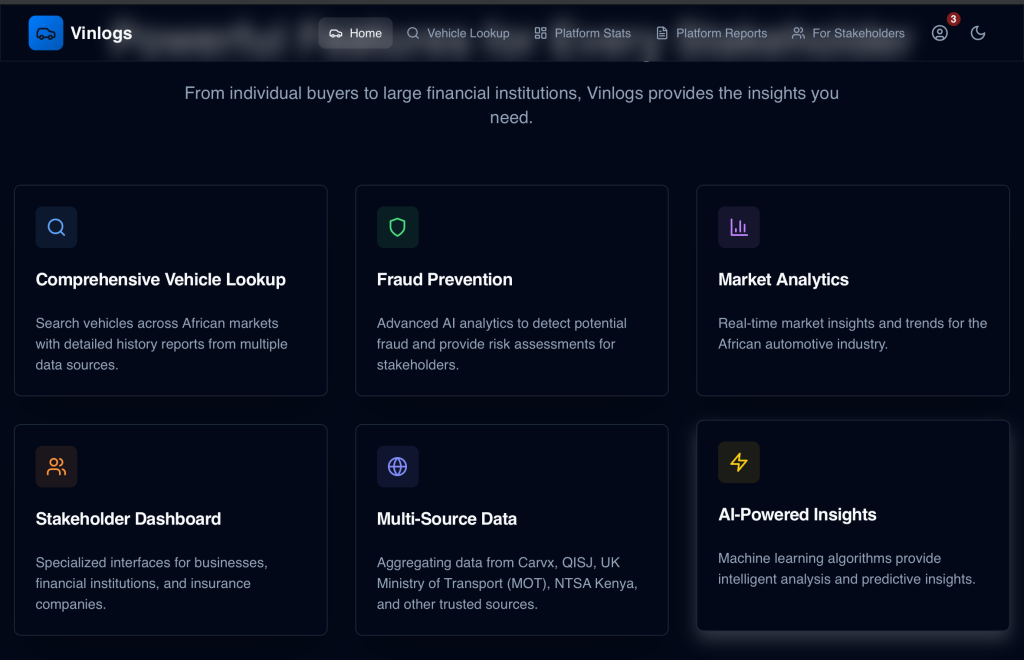

Vinlogs wants to end vehicle fraud with its blockchain-powered verification platform (Mobility, Kenya)

Morris Wairimu founded Vinlogs in 2025 to combat the vehicle fraud crisis in emerging markets, where tampered histories, odometer fraud, and the resale of stolen vehicles from North America result in significant financial losses and contribute to higher accident rates, as unsafe vehicles remain in circulation. Vehicle fraud in the used-car market is a global issue, as data shows that roughly 2.45 million vehicles are suspected of having odometer tampering, with buyers losing an average of $3,300 to $4,000 per vehicle due to misrepresented mileage. For consumers, insurers, and financiers in these regions, the lack of reliable verification tools often makes buying used cars a risky gamble.

Vinlogs’ solution is a blockchain-secured vehicle history verification platform that aggregates automotive data from multiple sources, including government registries, inspection bodies, insurance claims, and service centres. The data is then aggregated to create tamper-proof vehicle histories, which users can access through a web dashboard, and businesses can integrate verification directly into their workflows using APIs.

Vinlogs collects data from verified sources, including the UK Ministry of Transport, Quality Inspection Services Japan (QISJ), and the National Transport and Safety Authority (NTSA) in Kenya. It then cross-checks records for consistency and stores them on blockchain infrastructure to prevent tampering. On top of this data layer, Vinlogs applies AI-powered analysis to detect fraud patterns, flag mileage discrepancies, and generate risk scores that support decision-making for buyers, dealerships, banks, and insurers.

Its business model combines pay-per-report pricing for retail buyers, subscription plans and API access for enterprise clients, and a marketplace layer for vendors. Vinlogs reports over 100 committed users, including car sellers and brokers, ready to onboard before its MVP launch. The startup says it is in active discussions with regulators in Uganda, South Africa, Ghana, Ethiopia, and Tanzania to expand its presence.

Why we’re watching: The Kenyan used-car market size is expected to reach $1.50 billion (KES 193.5 billion) by 2030. Vinlogs is positioning itself at this intersection. Unlike competitors such as Autocheck, Carfax, CarChek, and CarVertical, Vinlogs emphasises blockchain storage, AI-driven fraud detection tailored for emerging markets, and multi-country regulatory alignment. Its advantage also lies in its integration with Japanese vehicle exports and African import markets. The startup plans to expand into five key African countries within the next 12 months and aims to reach operational break-even by the end of its first year.

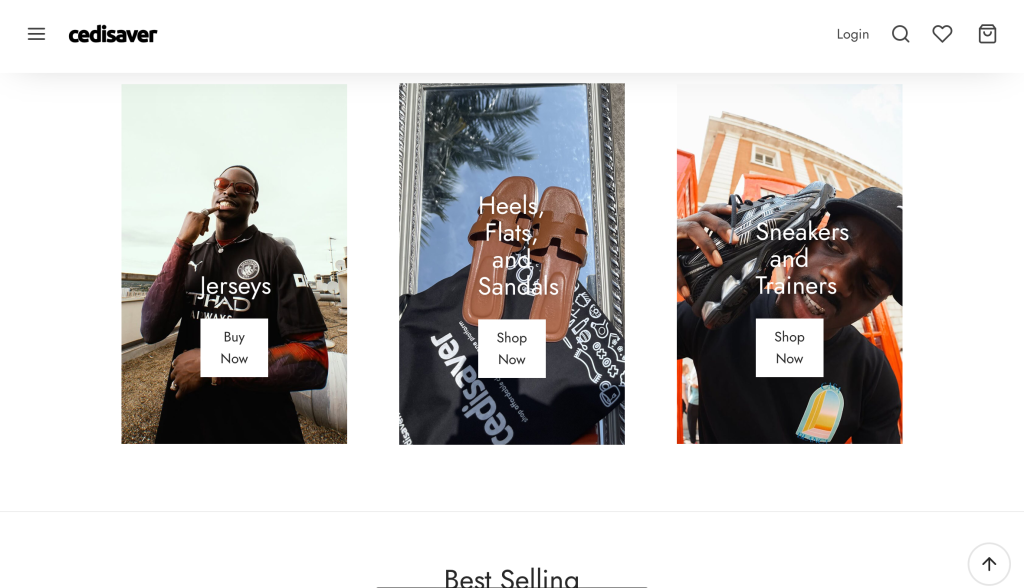

Cedisaver wants to unite Ghana’s informal clothing sellers on one platform (E-commerce, Ghana)

Founded in 2015 by Moriah Adika, Cedisaver aims to address a fragmented fashion market that Adika noticed, where shopping for affordable clothing is plagued by stress, online fraud, inconsistent quality, and overpriced products, while local artisans and informal clothing retailers struggle to scale beyond scattered social media pages.

Cedisaver is a centralised e-commerce platform that aggregates trusted informal clothing sellers and artisans into one digital marketplace. Rather than holding bulk inventory, it operates a hybrid direct-to-consumer model that sources products directly from vendors. When a customer places an order, Cedisaver picks up items from retailers and delivers them through local depots, a system that allows users to bundle purchases from multiple sellers into a single delivery.

By avoiding bulk inventory and focusing on logistics, vendor partnerships, and digital marketing, Cedisaver reduces overhead costs and maintains healthier margins. Cedisaver reports an accumulated revenue of GHS64,115 ($6,000) as of April 2025, with over 500 products sold to over 218 customers.

Why we’re watching: The size of Ghana’s fashion market is projected to reach $1.30 billion (GHS 13.6 billion) by 2030. Cedisaver is attempting to modernise the region’s fashion e-commerce market by organising the informal sector rather than competing directly against it. By integrating informal sellers into a single platform, Cedisaver differentiates itself from traditional retailers with high overhead costs and from social media sellers with limited reach and trust gaps. The startup plans to adopt a data-driven approach to trend forecasting and near-shoring-inspired production.

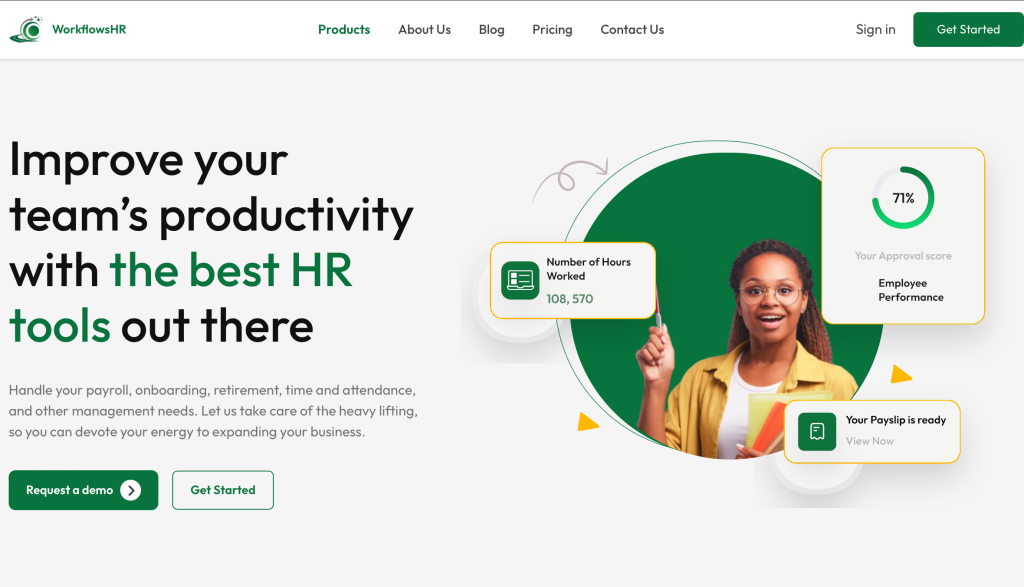

WorkFlowsHR wants to streamline workforce management for Nigerian SMEs (HRTech, Nigeria)

Founded in 2024 by Funsho Oke, WorkFlowsHR was developed to address the fragmented HR systems Nigerian businesses face, which often lead to data inconsistencies, compliance risks, and lost productivity. WorkFlowsHR addresses these pain points with a unified cloud-based platform that handles the entire employee lifecycle. It is an integrated human resources and CRM software built to help employers manage the operational complexity of running a workforce, from payroll and onboarding to time tracking and performance management.

The startup began its journey as a recruitment agency, where its team encountered recurring challenges in employee retention, engagement, and payroll as both its own operations and those of its clients grew.

WorkFlowsHR automates core HR functions, including payroll management, employee onboarding, attendance, leave management, and compliance with local labour laws. Its onboarding module offers self-service workflows with real-time status tracking, automated employee invitations, and categorisation of employment types. It also includes performance management tools that align individual goals with organisational objectives, an Employer of Record (EOR) service for companies hiring across jurisdictions, and the management of complex tasks such as terminating employees, conducting background checks, and handling workers’ compensation for companies expanding into new markets. The startup targets African startups and growth-stage SMEs, particularly companies with about 10 to 200 employees.

The startup operates on a subscription-based revenue model with tiered pricing ranging from ₦500 ($0.35) to ₦4,200 ($2.91) every six months. Additional revenue streams include advertising on social media and newsletters, and partnership revenue sharing. Since its launch in 2024, WorkFlowsHR says it has onboarded over 200 companies, and claims to have delivered 22.2% cost savings for its users, an 18.5% reduction in payroll processing time, and a 24.7% increase in employee satisfaction rates for its clients.

Why we’re watching: WorkFlowsHR is targeting the under-digitised SME sector in Nigeria by addressing the specific barrier of high costs and limited adoption. Its pricing structure is designed to be affordable, and its focus on mobile accessibility ensures utility. WorkFlowsHR emphasises deep localisation, including compliance with Nigerian labour laws, and offers specific features for managing different employment types.

That’s all for today. Expect our next dispatch on January 9th. Know a startup we should feature next? Please nominate here.

You May Also Like

The Channel Factories We’ve Been Waiting For

Solana Prepares Major Consensus Upgrade with Alpenglow Protocol