XRP Price Faces Early 2026 Pressure Despite Huge ETF Success

Here’s why XRP is facing pressure at the start of the new year, despite a major SEC settlement and massive spot ETF inflows last year.

XRP has now entered a new year, and is now facing several mixed signals.

Many traders expected the cryptocurrency to continue rallying permanently after the long legal battle between Ripple and the SEC ended.

Instead, the token has struggled to keep its standing above the $2 mark. And so far, despite over $1.4 billion flowing into spot ETFs; the price still seems to be trapped under a difficult ceiling.

Analyzing the XRP Price Outlook for the New Year

XRP’s outlook for the new year depends strongly on the $2.80 support zone.

This level in particular has become a line in the sand for the bulls because if the price stays above this floor; a test of $2.20 could happen quickly.

However, if XRP were to fall below this price level, a cascade of selling would follow. Some analysts even believe that a break of $1.80 would lead the token toward $1.60 or even lower.

XRP starts the year under pressure | source: CoinMarketCap

XRP starts the year under pressure | source: CoinMarketCap

This tension comes even after Ripple Labs settled its lawsuit with the SEC on May 8 and spot XRP ETFs launched months later.

These events were supposed to be the final spark for a massive bull run. However, the market has not responded as expected.

The token reached a peak of $3.66 but quickly gave back half of those gains before the end of the year.

By October, it hit a low of $1.58 before stabilising near $1.85 to close the year.

Whale Accumulation Battles Low Network Activity

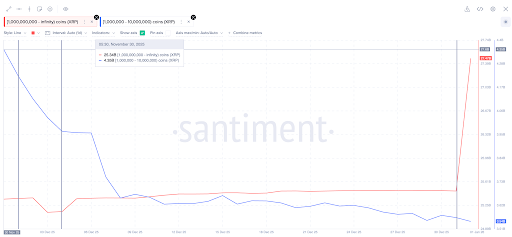

One of the most interesting trends comes from largest holders of the asset. Recent data from Santiment shows that whales holding over 1 billion tokens added $3.6 billion to their holdings in a single day.

This massive accumulation indicates that “smart money” investors are preparing for a long term move.

XRP whales are betting on the future | source: Santiment

XRP whales are betting on the future | source: Santiment

These buyers are looking past the current price dips and they seem to be betting on the long-term growth of the ecosystem.

On the other hand, activity on the XRP Ledger is telling a different story. According to sources, daily active addresses have crashed by over 90% from their highs.

In March of last year, the network saw over 600,000 active users. By December, that number had dropped to around 38,500.

Standard Chartered Predicts a Massive Rally

Despite the current price pressure, some of the biggest names in finance are doubling down on their predictions.

For example, Standard Chartered has restated its forecast that the token could hit $8 by the end of this year. This target implies that XRP could rise by more than 300% from current levels.

The bank also mentioned that this rise in XRP’s price will likely come from improving US regulations and the success of the US spot ETFs.

Related Reading: XRP Signals Breakout as Supertrend Pattern Mirrors Rally

Mixed Signals from Technical Indicators

The technical charts are currently showing a split view of the future. For example, the Relative Strength Index (RSI) currently sits near 48.

This is a neutral reading that gives the price room to move in either direction.

Veteran traders like Peter Brandt have warned of a “double top” pattern, which tends to indicate that an asset has reached its peak and could fall soon.

XRP flashes mixed signals on Indicators | source: TradingView

XRP flashes mixed signals on Indicators | source: TradingView

Some even say that the price could drop below $1 if the current support fails.

The post XRP Price Faces Early 2026 Pressure Despite Huge ETF Success appeared first on Live Bitcoin News.

You May Also Like

Zai Lab to Present at 44th Annual J.P. Morgan Healthcare Conference

CME Group to Launch Solana and XRP Futures Options