Dow Jones loses 100 points as markets eye Trump’s tariff moves

Major U.S. stock indices were mixed, with the Dow Jones registering losses amid ongoing trade tensions.

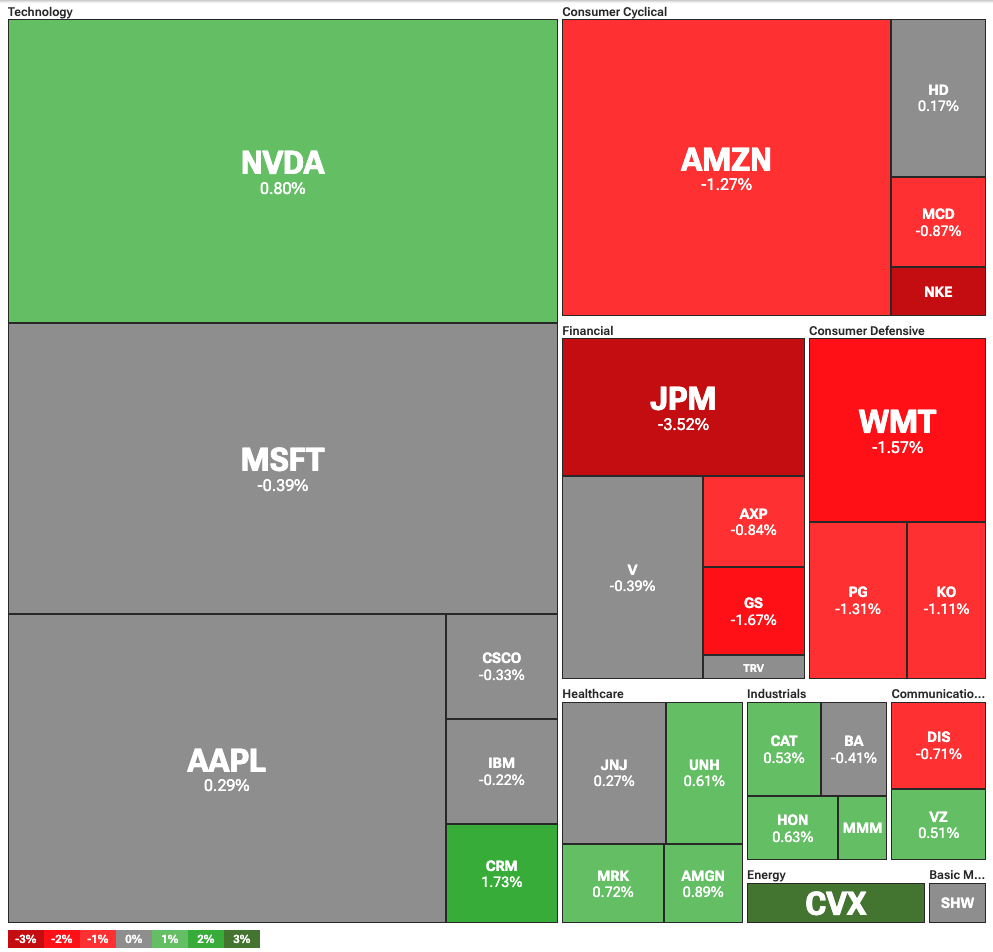

U.S. stocks were mixed on Tuesday, July 8, as renewed trade tensions weighed on market sentiment. The Dow Jones Industrial Average fell 108 points, or 0.24%, amid growing investor concerns over potential new tariffs. Meanwhile, both the S&P 500 and the tech-heavy Nasdaq Composite posted marginal gains, rising 0.08% and 0.18%, respectively.

Dow Jones-listed banking and consumer-facing firms were among the hardest hit. JP Morgan dropped 3.5%, despite reports of potential expansion in Italy. Amazon declined 1.26%, while Walmart fell 1.57%, largely due to its extensive exposure to the Chinese market.

At the same time, crypto markets were also relatively unchanged, with Bitcoin (BTC) rising 0.47% in the last 24 hours. The overall crypto market cap was up just 0.13%, while Ethereum (ETH) was a standout performer, with a 2% gain.

Markets eye Trump’s next moves on Trade

Investors remain focused on shifting trade dynamics, as signals from the White House remain mixed. On Tuesday, President Donald Trump extended the July 9 deadline for reinstating punitive tariffs on U.S. trading partners to April 1.

Still, tensions escalated as Trump threatened South Korea and Japan with new tariffs, while China responded with warnings of its own. Beijing cautioned against the implementation of new tariffs and indicated it may retaliate against countries entering trade agreements with the U.S.

The warning is significant, since Trump threatened further retaliation against countries that side with “anti-American” policies or the BRICS bloc. While the President did not specify what would constitute a hostile policy, he has previously warned the bloc against creating its own currency.

Further escalation could lead to a broader decoupling of global trade, with the U.S. and BRICS nations forming increasingly separate economic and geopolitical spheres.

You May Also Like

Bhutanese government transfers 343.1 Bitcoins and may deposit them again on CEX

SEC Grants WisdomTree Relief for 24/7 Trading of Tokenized Fund Shares