Silence and invisibility are how crypto wins people’s hearts | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Crypto has never suffered from a lack of noise: ICO boom, DeFi summer, NFTs, FTX and Terra collapse, etc. For more than a decade, the industry has relied on volume — louder narratives, bigger promises, faster cycles — to explain itself to the world.

- People already believe in speed, ownership, and empowerment, but mass adoption stalls because crypto exposes complexity (keys, gas, chains, risk) instead of hiding it. Friction, not skepticism, is the real barrier.

- Winning technologies embed themselves into daily life by hiding infrastructure. Crypto succeeds when it runs in the background, not when users are forced to understand the machinery.

- UX is the true scaling challenge, and ambiguity, not regulation, scares users away. Web3 doesn’t need more believers or louder ethos; it needs usable, forgiving products that feel safe, stable, and human.

Whitepapers promised revolutions. Conferences promised inevitability. Social feeds promised riches. And yet, despite billions in investment, regulatory breakthroughs, and institutional participation, mass adoption still hasn’t happened. That failure isn’t ideological. It’s experiential.

Crypto didn’t lose because people rejected its values. It stalled because it asked everyday users to care about things they shouldn’t have to think about. Private keys. Gas fees. Bridges. Wallet security. Chain selection. Compliance ambiguity. None of these concepts wins hearts. None of them should be prerequisites for participation in a global financial system. The uncomfortable truth is this: crypto won’t win by being seen. It will win by disappearing, by being the core and basis.

Adoption doesn’t fail because people don’t believe — it fails because it’s hard

If belief were enough, crypto would already be mainstream and even the only financial instrument, in my opinion. People believe in faster payments. They believe in ownership. They believe in global access. They believe in programmable money — even if they don’t call it that. They believe in empowerment. They believe in decentralization. What they don’t believe in is friction.

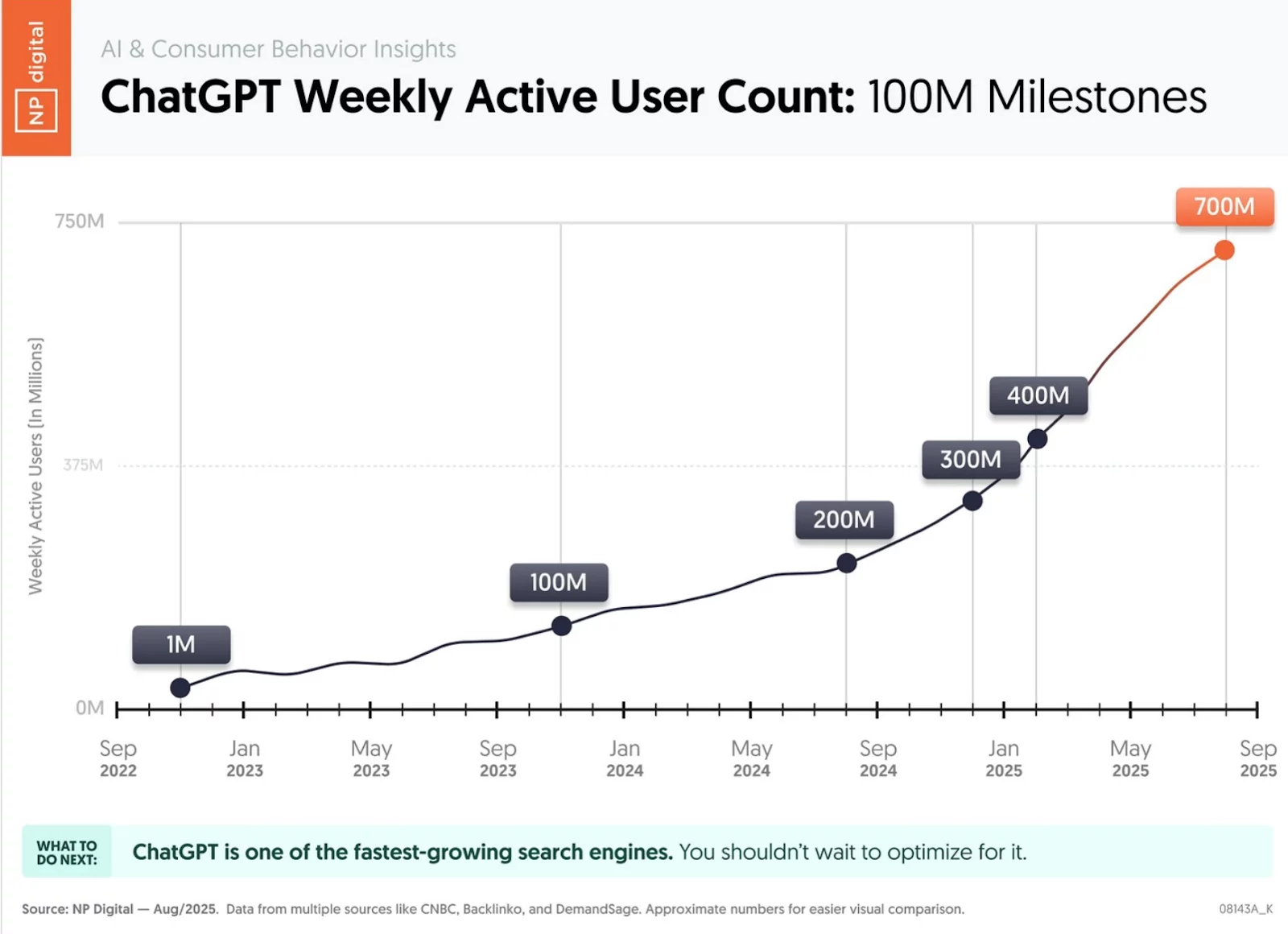

Every successful consumer technology in history followed the same arc: complexity moved inward, experience moved outward. Email hid SMTP. Smartphones hid operating systems. Streaming hid infrastructure. Users never had to understand how the system worked — only that it worked. The latest example: the adoption of AI use, such as ChatGPT, for example.

Crypto reversed that logic. It exposed the machine, and can still not reverse this process. Instead of onboarding users, it onboarded them into responsibility. Instead of hiding risk, it transferred it. Instead of building trust through familiarity, it demanded trust through education. “Read the docs” became the default response to confusion — as if mass markets have ever adopted anything by reading documentation. This is why adoption hasn’t arrived. Not because people are hostile, but because the cost of participation remains higher than the perceived benefit.

Silence is a feature, not a failure

The next phase of crypto growth won’t look like the last. It won’t be loud, ideological, or tribal. It will be quiet — almost boring — and that’s exactly the point. Winning technologies don’t announce themselves. They embed into our daily lives.

Payments that clear instantly without mentioning — but built on — blockchain. Identity systems that verify without asking users to manage keys. Financial products that feel familiar while running on entirely new rails. The less visible the crypto infrastructure is, the more powerful it becomes. This isn’t a retreat from ethos. It’s the real fulfillment of all decentralized tech promises.

Decentralization was never meant to be a daily burden for users. It was meant to be an invisible guarantee — like encryption in messaging apps. Most people don’t think about cryptography when they send a message. They just expect privacy. Crypto should aspire to the same standard.

UX is the real scaling problem

The industry often frames scalability as a technical challenge: throughput, latency, cost. But the most binding constraint on growth isn’t TPS — it’s usability. Wallets still feel experimental. Onboarding still feels way too complicated. One wrong click can mean irreversible loss. For a first-time user, crypto doesn’t feel empowering; it feels fragile. And fragility kills trust.

Link it to the psychological changes humanity is going through: our attention span has dropped to 8.5 seconds. We are no longer tolerant of complexity and nuances. We deemed simplicity (not we, neoliberal logic of the mass consumption, of course). Unsurprisingly, mass adoption requires forgiving systems. Defaults that protect users. Recovery that doesn’t rely on perfect behavior. Experiences that assume mistakes will happen, because they always do.

The future of web3 belongs to products that make participation feel safe, familiar, and reversible, even if the underlying system isn’t. Users shouldn’t need to understand self-custody to benefit from it. They shouldn’t need to pick chains to use applications. They shouldn’t need to think about gas at all. When UX improves, retention follows. When retention follows, adoption compounds.

Regulation is not the enemy of adoption — ambiguity is

Another myth holding crypto back is that regulation slows growth. In reality, uncertainty does. Clear rules don’t scare users away. They reassure them.

Most people aren’t waiting for permission to speculate. They’re waiting for confidence that the system they’re using won’t disappear, break, or retroactively become illegal. Regulatory transparency doesn’t dilute decentralization; it provides the social trust layer mass markets require.

We’re already seeing this shift. As frameworks mature and institutions enter, the narrative is moving from “permissionless rebellion” to “reliable infrastructure.” That’s not a loss of soul. It’s a sign of adulthood. For crypto to reach everyday users, it must feel legitimate before it feels revolutionary. People adopt systems that feel stable, not systems that feel experimental.

Web3 doesn’t need more believers — it needs usable products

The industry often mistakes cultural alignment for adoption. But shared values don’t create habits. Products do. People don’t use email because they believe in open protocols. They use it because it works. They don’t use cloud storage because they love abstraction layers. They use it because their files are there when they need them.

Web3 will follow the same path, or it won’t succeed at all. The ethos of crypto — ownership, openness, and empowerment — is genuinely compelling. But ethos alone doesn’t onboard users. Experience does. If participating in web3 still feels like joining a movement rather than using a product, mass adoption will remain out of reach.

The ultimate success of crypto won’t be measured by headlines, price milestones, or ideological dominance. It will be measured by invisibility. When users don’t know they’re using crypto — but would miss it if it disappeared — that’s the win. When wallets feel like apps, not tools. When compliance feels like safety, not friction. When decentralization operates quietly in the background, protecting users without demanding attention.

That future isn’t anti-crypto. It’s post-crypto. And it’s closer than it looks. The industry doesn’t need to shout louder to win people’s hearts. It needs to listen harder — and then build systems so seamless that belief becomes irrelevant.

Silence, not spectacle, is how crypto finally becomes human.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

Doorbraak voor altcoins: SEC keurt Grayscale’s GDLC ETF goed