Ethereum’s New Holder Count Jumped 110% Since December’s Fusaka Upgrade

Ethereum price is approaching a critical technical moment as it trades near the upper boundary of a descending wedge. ETH’s slow but steady climb has placed it inches from a breakout.

This momentum is widely attributed to the Fusaka upgrade, which went live on December 3 and aims to improve scalability while lowering Layer 2 costs, a long-standing Ethereum challenge.

These changes arrive as market participants position for 2026, creating favorable conditions for network growth and price stabilization.

Ethereum Holders Show Strength

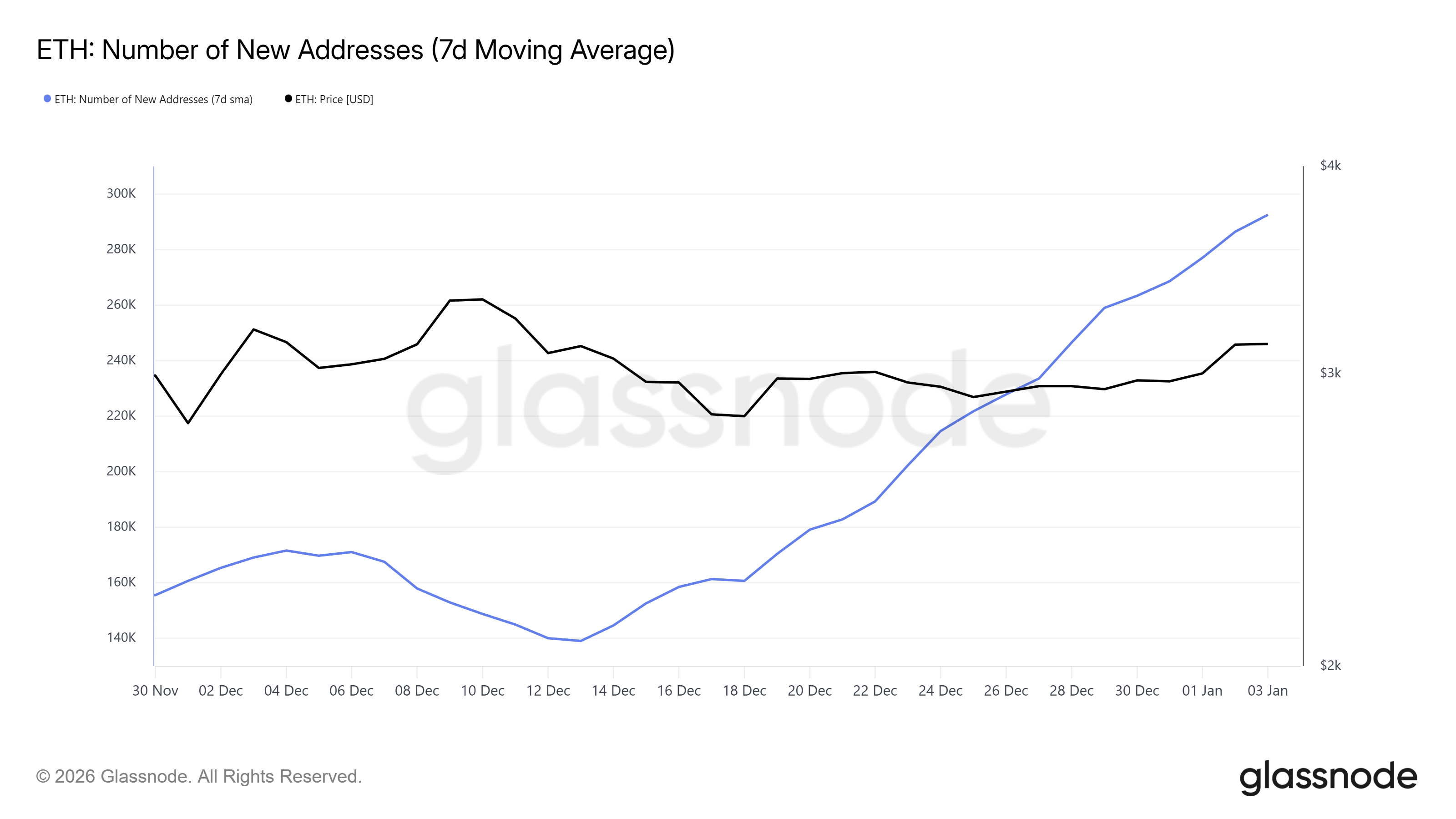

Ethereum network activity has expanded quickly over the past three weeks. Data shows a sharp rise in new addresses, defined as wallets interacting with ETH for the first time. This metric has increased by roughly 110% during the period, highlighting accelerating user adoption.

Ethereum now adds approximately 292,000 new addresses per day. This surge reflects a combination of seasonal factors and structural upgrades.

Christmas 2025, New Year positioning, and optimism surrounding the Fusaka upgrade appear to be driving renewed engagement across the ecosystem.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum New Addresses. Source: Glassnode

Ethereum New Addresses. Source: Glassnode

Rising address creation often precedes increased transaction demand. While not every new address represents a long-term investor, sustained growth at this scale suggests expanding participation. Broader user inflows typically improve liquidity depth and reinforce price resilience during volatile market phases.

Forced to Hold, But Beneficial to ETH Nonetheless

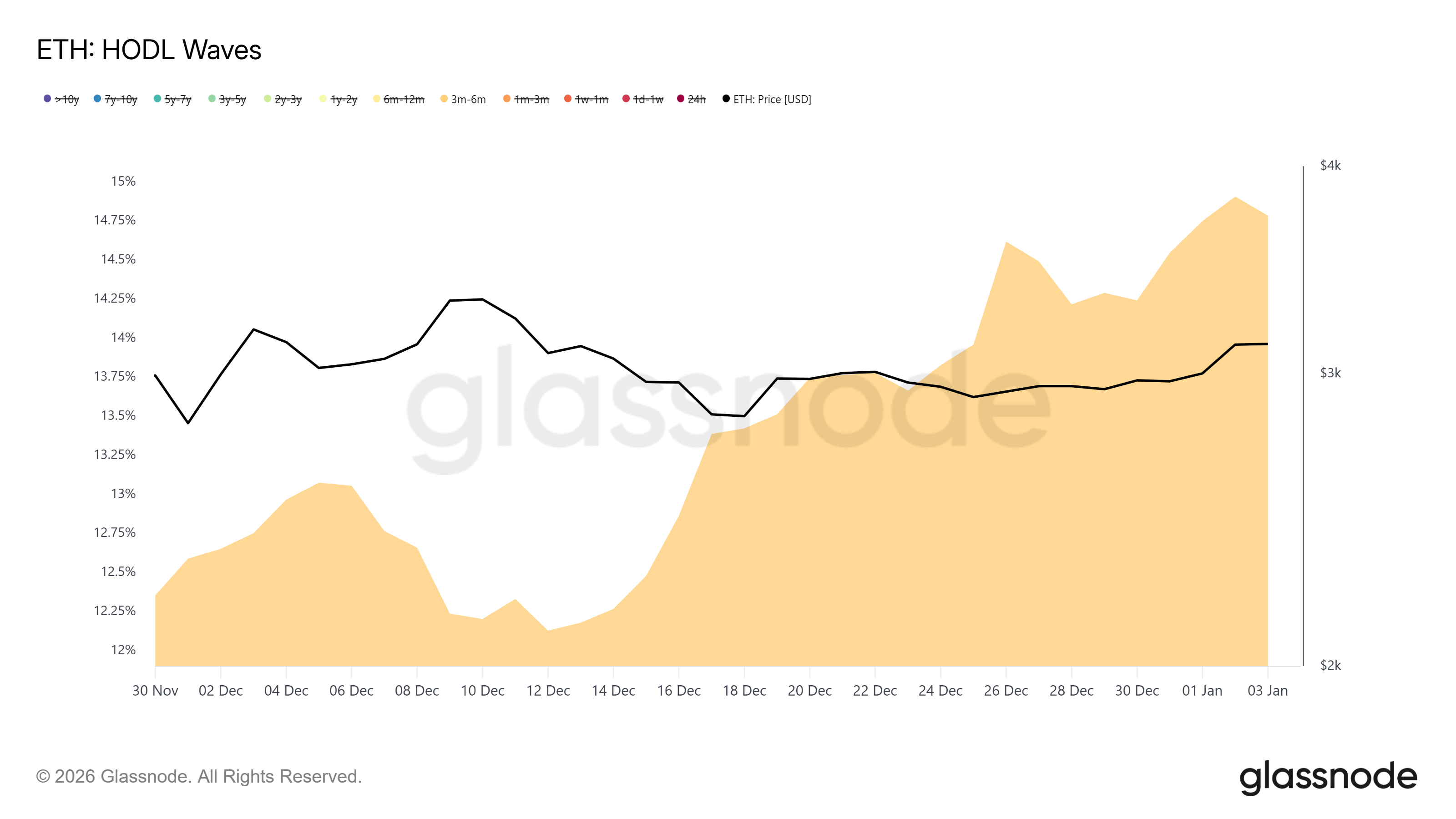

Macro indicators present a mixed but informative picture. HODL Waves show growth among mid-term holders, defined as wallets holding ETH for three to six months. These investors largely entered positions between July and October 2025.

Early July buyers currently sit in profit, while those who entered after mid-July remain underwater. This distribution creates forced holding behavior, as many holders wait for price recovery. Such positioning can provide temporary support by reducing selling pressure during pullbacks.

Ethereum HODL Waves. Source: Glassnode

Ethereum HODL Waves. Source: Glassnode

However, rising prices may trigger distribution from these cohorts. As ETH approaches break-even levels for mid-term holders, selling risk increases. This dynamic could limit upside unless fresh capital offsets profit-taking from trapped supply.

ETH Price Is Nearing A Breakout

Ethereum price continues to trade within a descending wedge that formed in early November. ETH currently changes hands near $3,141, placing it close to a potential breakout. The structure suggests momentum is compressing, often preceding directional expansion.

The wedge projects a theoretical upside of roughly 29.5%, targeting $4,061. While ambitious, such a move would require stronger buying pressure than currently observed. A more realistic scenario involves ETH breaking out and pushing past $3,287, opening a short-term path toward $3,447.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Downside risks remain if macro conditions deteriorate or the breakout fails. A rejection could send Ethereum back below $3,000. In that case, ETH may retest the $2,902 support level, invalidating the bullish thesis and reinforcing range-bound conditions.

You May Also Like

Here’s How Consumers May Benefit From Lower Interest Rates

Discover Mono Protocol: The $2M-Backed Project Built to Simplify Development, Launch Faster, and Monetize Every Transaction