VIRTUAL Rallies 28% as AI Token Sector Leads Crypto Market Recovery

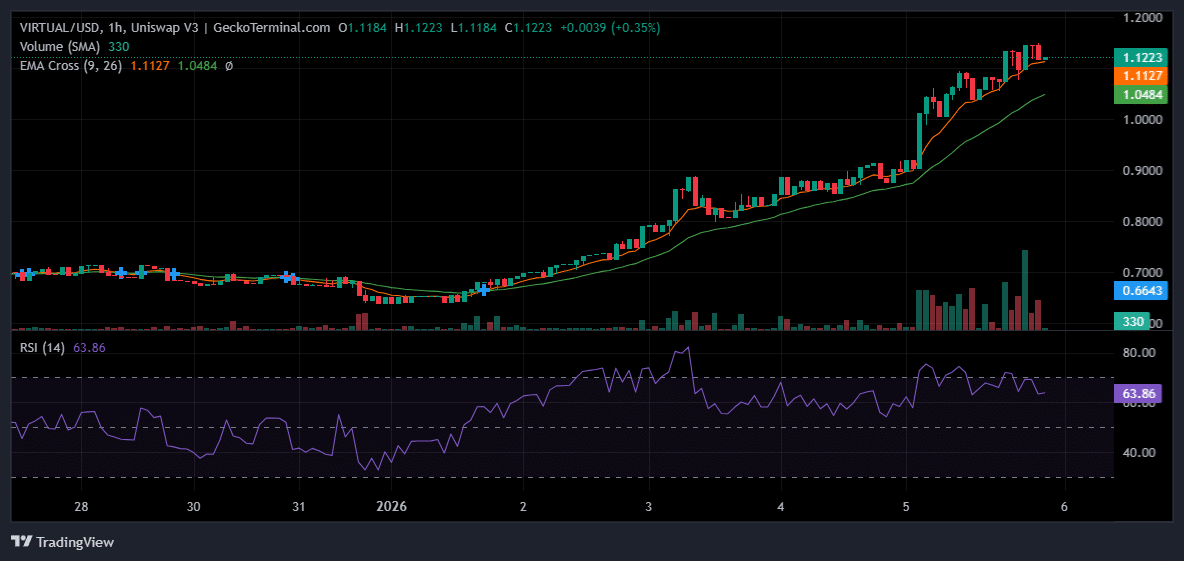

VIRTUAL VIRTUAL $1.10 24h volatility: 23.3% Market cap: $723.60 M Vol. 24h: $423.50 M , the native token of AI platform Virtuals Protocol, posted a 27.84% gain over the past 24 hours. The token climbed from $0.89 to $1.14 as trading activity increased across AI-related tokens.

The token’s 24-hour trading volume reached $427.59 million, up by 172.62% compared to the previous day, according to CoinGecko data. VIRTUAL currently trades 77.73% below its all-time high of $5.07 set in January 2025. Market capitalization stood at $740.13 million at the time of writing.

VIRTUAL price 1H | Source: TradingView

Virtuals Protocol operates within the Base and Ethereum blockchain ecosystems and falls under the AI Agents category. The project recently integrated x402, a Coinbase payment system in October 2025, which sparked a price rally at the time, as reported by Coinspeaker.

The rally extends a strong week for the token, which has gained 64.56% over the past seven days.

What’s Driving VIRTUAL Rally

According to some analysts, the gains reflect a broader shift into Base tokens and the AI sector, which has outperformed the broader market over the past week. The rally extended beyond VIRTUAL itself, with tokens built on the Virtuals Protocol platform also posting significant gains, suggesting buyers are targeting the entire ecosystem.

Top Virtuals Protocol Ecosystem Tokens by Market Capitalization | Source: CoinMarketCap

Trader @CryptoFaibik pointed to a chart pattern that often precedes price increases as confirmation of the move. Other analysts observed that VIRTUAL tends to move quickly once momentum builds, with limited pullbacks during rallies.

Broader Market Conditions

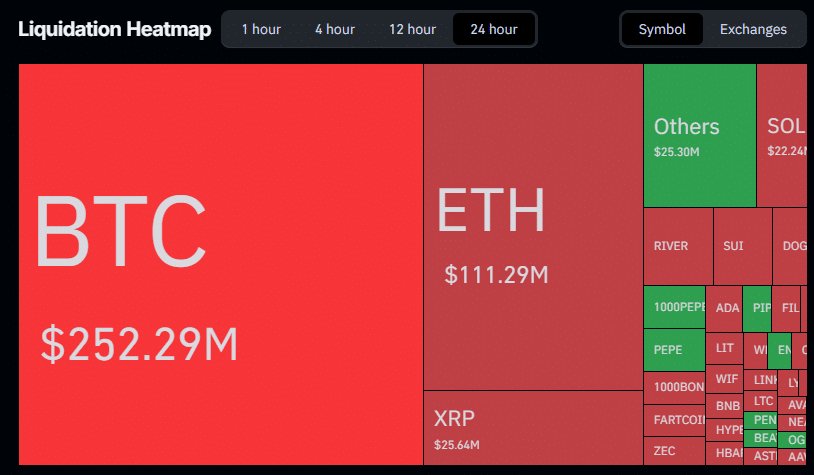

Data from Coinglass showed $522.26 million in forced selling across crypto markets over 24 hours. Traders betting on price drops accounted for $438.07 million of those losses, while those betting on gains lost $84.08 million.

Crypto market liquidations | Source: CoinGlass

The Fear & Greed Index, which measures market sentiment on a scale of 0 to 100, registered 26. This reading indicates fear among traders, though it improved slightly from 25 the previous day. The broader crypto market added 1.83% to total market capitalization, which reached $3.27 trillion as the previous year wrapped up.

nextThe post VIRTUAL Rallies 28% as AI Token Sector Leads Crypto Market Recovery appeared first on Coinspeaker.

You May Also Like

This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital

Willy Woo Warns Liquidity Breakdown Could Cap Bitcoin’s Rally Despite Short-Term Relief