Noya.ai Research Report: The Predictive Market Intelligent Agent Revolution Under the AI×DeFi Narrative

Author: 0xjacobzhao

In our previous Crypto AI research reports, we have consistently emphasized that the most practically valuable applications in the current crypto space are primarily concentrated in stablecoin payments and DeFi , with agents serving as the key user interface for the AI industry. Therefore, in the trend of Crypto and AI integration, the two most valuable paths are: in the short term, AgentFi based on existing mature DeFi protocols (basic strategies such as lending and liquidity mining, as well as advanced strategies such as Swap, Pendle PT, and funding rate arbitrage); and in the medium to long term, Agent Payment centered around stablecoin settlement and relying on protocols such as ACP/AP2/x402/ERC-8004.

Prediction markets have become an undeniable new industry trend in 2025, with total annual trading volume surging from approximately $9 billion in 2024 to over $40 billion in 2025, representing a year-on-year growth of over 400%. This significant growth is driven by multiple factors: demand arising from uncertainty caused by macro-political events (such as the 2024 US election), the maturation of infrastructure and trading models, and a breakthrough in the regulatory environment (Kalshi's victory and Polymarket's return to the US). Prediction market agents are expected to take early shape in early 2026 and are poised to become a new product form in the agent field within the coming year.

I. Predicting Markets: From Betting Tools to the “Global Truth Layer”

Prediction markets are financial mechanisms that facilitate trading around the outcomes of future events . Contract prices essentially reflect the market's collective judgment on the probability of these events occurring. Their effectiveness stems from the combination of collective wisdom and economic incentives : in an environment of anonymity and real-money betting, dispersed information is rapidly integrated into price signals weighted by willingness to pay, thereby significantly reducing noise and false judgments.

By the end of 2025, the prediction market had largely formed a duopoly dominated by Polymarket and Kalshi . According to Forbes, total trading volume in 2025 reached approximately $44 billion , with Polymarket contributing about $21.5 billion and Kalshi about $17.1 billion . Kalshi achieved rapid expansion by leveraging its legal victory in the election contract case, its first-mover advantage in compliance in the US sports prediction market, and relatively clear regulatory expectations. Currently, their development paths have clearly diverged:

- Polymarket adopts a hybrid CLOB architecture of "off-chain matching and on-chain settlement" and a decentralized settlement mechanism to build a global, non-custodial, highly liquid market. After returning to the United States in compliance with regulations, it has formed a dual-track operation structure of "onshore + offshore".

- Kalshi integrates into the traditional financial system, connecting to mainstream retail brokerages via APIs and attracting Wall Street market makers to participate deeply in macro and data-driven contract trading. However, its products are subject to traditional regulatory processes, resulting in a relative lag in long-tail demand and responses to unforeseen events.

Aside from Polymarket and Kalshi, other competitive players in the prediction market have primarily developed along two paths:

- One is the compliant distribution path , which embeds event contracts into the existing account system of securities firms or large platforms, and establishes advantages by relying on channel coverage, clearing capabilities and institutional trust (such as ForecastTrader, which is a collaboration between Interactive Brokers and ForecastEx, and FanDuel Predicts, which is a collaboration between FanDuel and CME).

- Secondly, there is the path to on-chain performance and capital efficiency . Taking Solana's perpetual contract DEX Drift as an example, it has added a prediction market module BET (prediction markets) to its original product line.

The traditional financial compliance entry point and the native performance advantages of cryptography together constitute the diverse competitive landscape of the prediction market ecosystem.

Prediction markets superficially resemble gambling and are essentially a zero-sum game. However, the core difference lies not in their form, but in whether they possess positive externalities: aggregating dispersed information through real-money transactions, publicly pricing real-world events, and forming a valuable signal layer. Despite limitations such as entertainment-oriented participation, the trend is shifting from a game-like approach to a "global truth layer"—with the integration of institutions like CME and Bloomberg, event probabilities have become decision metadata that can be directly accessed by financial and corporate systems, providing more timely and quantifiable market-based truths.

II. Predictive Agents: Architecture Design, Business Models, and Strategy Analysis

Currently, prediction market agents are entering their early practical phase. Their value lies not in "more accurate AI predictions," but in amplifying the efficiency of information processing and execution in prediction markets. Prediction markets are essentially information aggregation mechanisms, where prices reflect collective judgments about the probability of events. Real-world market inefficiencies stem from information asymmetry, liquidity constraints, and attentional limitations. The appropriate positioning of prediction market agents is executable probabilistic portfolio management : transforming news, rule texts, and on-chain data into verifiable pricing biases, executing strategies faster, more disciplined, and at lower cost, and capturing structural opportunities through cross-platform arbitrage and portfolio risk control.

An ideal predictive market agent can be abstracted into a four-layer architecture :

- The information layer aggregates news, social media, on-chain, and official data;

- The analysis layer uses LLM and ML to identify mispriced items and calculate the edge;

- The strategy layer converts Edge into positions through the Kelly Criterion, phased position building, and risk control;

- The execution layer completes multi-market order placement, slippage and gas optimization, and arbitrage execution, forming a highly efficient and automated closed loop.

The design of ideal business models for predictive market agents offers opportunities for exploration in different directions at different levels:

- The underlying Infrastructure layer provides multi-source real-time data aggregation, a Smart Money address database, a unified prediction market execution engine and backtesting tools, and charges B2B/B2D to obtain stable income unrelated to prediction accuracy.

- The middle Strategy layer uses open-source or token-gated methods to store modular strategy components and community-contributed strategies, forming a composable strategy ecosystem and achieving value capture.

- The top-level Agent layer runs live trading directly through the entrusted Vault, with transparent on-chain records and a 20-30% performance fee (plus a small management fee) for cashing out.

An ideal market prediction agent is closer to an " AI-driven probabilistic asset management product ," generating returns through long-term disciplined execution and cross-market mispricing, rather than relying on the accuracy of a single prediction. The core logic behind the diversified revenue structure design of "infrastructure monetization + ecosystem expansion + performance participation" lies in the fact that even if alpha converges as the market matures, underlying capabilities such as execution, risk control, and settlement still possess long-term value, reducing reliance on the single assumption that "AI will consistently outperform the market."

Predictive Market Agent Strategy Analysis:

In theory, agents have the advantages of high speed, all-weather operation, and unemotional execution, but they are often difficult to translate into sustained alpha in prediction markets. Their effective applications are mainly limited to specific structures, such as automated market making, cross-platform mispricing capture, and information integration of long-tail events. These opportunities are scarce and constrained by liquidity and capital.

- Market Selection: Not all prediction markets possess tradable value. Participation value depends on five dimensions: settlement clarity, liquidity quality, information advantage, time structure, and manipulation risk. It is recommended to prioritize early-stage new markets , long-tail events with few professional players , and short-term pricing windows caused by time zone differences ; avoid high-profile political events, subjectively settled markets, and instruments with extremely low liquidity.

- Order placement strategy: We employ a strict, systematic position management approach. Entry is based on our own probability assessment being significantly higher than the market's implied probability. We determine position size using the fractional Kelly formula (usually 1/10–1/4 Kelly), ensuring that single-event risk exposure does not exceed 15%, in order to achieve steady growth in the long term with controllable risk, tolerable drawdowns, and the ability to compound advantages .

- Arbitrage strategies: Arbitrage in the prediction market mainly manifests in four categories: cross-platform spreads (caution required due to settlement discrepancies), Dutch Book arbitrage (high certainty but strict liquidity requirements), settlement arbitrage (dependent on execution speed), and related asset hedging (limited by structural mismatch). The key to practice lies not in discovering spreads, but in strictly aligning contract definitions and settlement standards to avoid pseudo-arbitrage caused by subtle differences in rules.

- Smart money copy trading: On-chain "smart money" signals are not suitable as a primary strategy due to their lag, potential for manipulation, and sampling issues. A more reasonable use is as a confidence adjustment factor to assist in core judgments based on information and pricing discrepancies.

III. Noya.ai: Intelligent Agent Networks from Intelligence to Action

As an early exploration of predictive market intelligence, NOYA's core concept is "Intelligence That Acts." In the on-chain market, simple analysis and insights are insufficient to create value—although dashboards, data analysis, and research tools can help users understand "what might happen," there are still significant manual operations, cross-chain frictions, and execution risks between insight and execution. NOYA is built upon this pain point: compressing the entire chain of " research → judgment formation → execution → continuous monitoring " in the professional investment process into a unified system, enabling intelligence to be directly transformed into on-chain action.

NOYA achieves this goal by integrating three core layers:

- Intelligence layer: Aggregates market data, token analysis, and predicts market signals.

- Abstraction: Hides complex cross-linking processes, allowing users to express only their intent.

- Execution Layer: The AI Agent performs operations across chains and protocols based on user authorization.

In terms of product form, NOYA supports different participation methods such as passive income users, active traders, and prediction market participants. Through designs such as Omnichain Execution, AI Agents & Intents, and Vault Abstraction , it modularizes and automates multi-chain liquidity management, complex strategy execution, and risk control.

The overall system forms a continuous closed loop: Intelligence → Intent → Execution → Monitoring , which achieves efficient, verifiable and low-friction transformation from insight to execution while ensuring that users always maintain control over their assets.

| hierarchy | Product Module | Function Description | Core Values |

| Intelligence

(Intelligence level) | NOYA Intelligence | Institutional-grade research system based on fundamentals, on-chain data, narratives, and risk factors. | Compressing complex research into actionable alpha clues provides structured input for funding decisions. |

| Intelligence

(Intelligence level) | Prediction Market Intelligence Copilot | Probabilistic analysis for prediction markets, EV calculation, and Smart Wallet behavior and fund flow tracking | Identifying odds mismatches and structural opportunities provides an informational advantage for predicting market trading. |

| Abstraction layer | NOYA AI Agent

(Voice + Text) | Receive Intents in voice/text format and orchestrate cross-chain, cross-protocol on-chain execution. | Translating "human intent" directly into on-chain actions serves as the unified entry point and coordinator for the execution layer. |

| Execution

(Execution layer) | Omnichain Vaults | A risk-adjusted vault covering multiple chains and protocols, scheduled and managed by an agent. | Provide agents with a scalable pool of funds to achieve continuous and systematic returns. |

| Execution

(Execution layer) | Prediction Market Execution | Place orders, rebalance positions, and execute strategies in prediction markets such as Polymarket. | Transforming probabilistic judgments into actual positions completes the closed loop from analysis to results. |

IV. Noya.ai's Product System and Evolution Path

Core Cornerstone: Noya Omnichain Vaults

Omnivaults is NOYA's capital deployment layer, providing cross-chain, risk-controlled automated yield strategies . Users can entrust their assets to the system for continuous operation across multiple chains and protocols through simple deposit and withdrawal operations, without the need for manual portfolio adjustments or market monitoring. The core objective is to achieve stable risk-adjusted returns rather than short-term speculation.

Omnivaults covers standard return and loop strategies, clearly categorized by asset and risk level, and supports optional binding incentive mechanisms. At the execution level, the system automatically handles cross-link routing and optimization, and can incorporate ZKML to provide verifiable proofs of strategy decisions, enhancing the transparency and credibility of automated asset management. The overall design is modular and composable, supporting the future integration of more asset types and strategy formats.

The technical architecture of NOYA Vault is as follows: each vault is uniformly registered and managed through the Registry ; the AccountingManager is responsible for user share (ERC-20) and net asset value pricing; the underlying layer connects to protocols such as Aave and Uniswap through modular Connectors and calculates cross-protocol TVL, relying on the Value Oracle (Chainlink + Uniswap v3 TWAP) to complete price routing and valuation; transactions and cross-chain operations are executed by the Swap Handler (LiFi) ; finally, strategy execution is triggered by Keeper multi-signature , forming a composable and auditable execution closed loop.

Future Alpha: Prediction Market Agent

NOYA's most imaginative module: The intelligence layer continuously tracks on-chain fund activity and off-chain narrative changes, identifying news shocks, sentiment fluctuations, and odds mismatches. When probability biases are detected in prediction markets like Polymarket, the execution layer's AI Agent, with user authorization, can allocate funds from the treasury for arbitrage and portfolio adjustments. Simultaneously, Token Intelligence and Prediction Market Copilot provide users with structured token and prediction market analysis, directly transforming external information into actionable trading decisions.

Prediction Market Intelligence Copilot

NOYA aims to upgrade prediction markets from single-event betting to systematically manageable probabilistic assets . Its core module integrates diverse data such as implied market probabilities, liquidity structure, historical settlements, and on-chain smart money behavior. It uses expected value (EV) and scenario analysis to identify pricing biases and focuses on tracking position signals from high-win-rate wallets to distinguish between information trading and market noise. Based on this, Copilot supports cross-market and cross-event correlation analysis and transmits real-time signals to an AI Agent, driving automated execution of opening and rebalancing positions, enabling portfolio management and dynamic optimization in prediction markets.

The core strategy mechanisms include:

- Multi-source Edge Sourcing : Integrates Polymarket real-time odds, poll data, and private and external information streams to cross-validate the implied probabilities of events and systematically uncover information advantages that have not yet been fully priced in.

- Cross-market and cross-event arbitrage (Prediction Market Arbitrage) : Based on pricing differences between different markets, contract structures, or similar events, construct probability and structural arbitrage strategies to capture odds convergence returns while controlling directional risk.

- Odds-driven dynamic position management (Auto-adjust Positions) : When odds shift significantly due to changes in information, funds, or sentiment, the AI Agent automatically adjusts the position size and direction to achieve continuous optimization in the prediction market, rather than a one-time bet.

NOYA Smart Token Intelligence Reports

NOYA's institutional-grade research and decision-making hub aims to automate professional encrypted investment research processes and directly output decision-level signals applicable to real-world asset allocation. This module presents a standardized report structure with clear investment stances, comprehensive scores, core logic, key catalysts, and risk warnings, continuously updated with real-time market and on-chain data. Unlike traditional research tools, NOYA's intelligence goes beyond static analysis. It can be invoked, compared, and questioned using natural language by an AI Agent, and directly transmitted to the execution layer to drive subsequent cross-chain transactions, fund allocation, and portfolio management. This forms an integrated "research-decision-execution" closed loop, making Intelligence an active signal source within the automated capital operation system.

NOYA AI Agent (Speech and Natural Language Driven)

NOYA AI Agent is the platform's execution layer, its core function being to directly translate user intent and market intelligence into authorized on-chain actions . Users can express their goals via text or voice, and the Agent is responsible for planning and executing cross-chain and cross-protocol operations, compressing research and execution into a continuous process. It is a key product for NOYA in lowering the barriers to entry in DeFi and prediction markets.

Users do not need to understand the underlying chain, protocol, or transaction path. They only need to express their goals through natural language or voice to trigger the AI Agent to automatically plan and execute multiple on-chain operations, achieving "intention equals execution." Under the premise of full user signature and non-custodial operation, the Agent operates in a closed loop of "intent understanding → action planning → user confirmation → on-chain execution → result monitoring." It does not replace decision-making but is only responsible for efficient implementation, significantly reducing the friction and threshold of complex financial operations.

Trust Moat: ZKML Verifiable Execution

Trusted execution aims to build a verifiable closed loop throughout the entire process of strategy, decision-making, and execution. NOYA introduces ZKML as a key mechanism to reduce trust assumptions: the strategy is computed off-chain and generates verifiable proofs; only after on-chain verification can the corresponding fund operation be triggered. This mechanism can provide credibility to the strategy output without revealing model details and supports derivative capabilities such as verifiable backtesting. Currently, the relevant modules are still marked as "under development" in public documentation, and engineering details are yet to be disclosed and verified.

Product roadmap for the next 6 months

- Advanced order prediction capabilities : Enhance the accuracy of strategy expression and execution, supporting agent-based trading.

- Expand to more prediction markets : Connect to more platforms beyond Polymarket to increase event coverage and liquidity.

- Multi-source Edge information collection : cross-validation with odds and betting lines to systematically capture probability biases that are not fully priced in.

- Clearer token signals and advanced reports : Outputs actionable trading signals and in-depth on-chain analysis.

- More advanced on-chain DeFi strategy combinations : Launch complex strategy structures to improve capital efficiency, returns, and scalability.

V. Noya.ai's Ecosystem Growth and Incentive System

Omnichain Vaults is currently in the early stages of ecosystem development, and its cross-chain execution and multi-strategy framework have been validated.

- Strategy and Coverage: The platform has integrated mainstream DeFi protocols such as Aave and Morpho, supports cross-chain allocation of stablecoins, ETH and their derivative assets, and has initially built a layered risk strategy (such as the basic return vs. Loop strategy).

- Development stage: The current TVL is limited in size. The core objectives are functional validation (MVP) and refinement of the risk control framework . The architecture design has strong composability and reserves interfaces for the subsequent introduction of complex assets and advanced agent scheduling.

Incentive System: Kaito Collaboration and Space Race – A Dual-Engine Approach

NOYA has built a growth flywheel that uses "real contribution" as its anchor point and deeply binds content narrative and flow.

- Ecosystem Collaboration (Kaito Yaps): NOYA launched on Kaito Leaderboards with a composite narrative of "AI × DeFi × Agent," allocating 5% of the total supply to an unlocked incentive pool and reserving an additional 1% for the Kaito ecosystem . Its mechanism deeply binds content creation (Yaps) with Vault deposits and Bond locking, converting weekly user contributions into Stars that determine tiers and multipliers, thereby simultaneously strengthening narrative consensus and long-term fund stickiness at the incentive level.

- Growth Engine (Space Race): Space Race forms the core growth flywheel of NOYA, replacing the traditional "fund size priority" airdrop model by using Stars as long-term equity tokens. This mechanism integrates Bond lock-up bonuses, a two-way 10% referral incentive, and content dissemination into the weekly Points system, selecting long-term users with high participation and strong consensus, and continuously optimizing the community structure and token distribution.

- Community Building (Ambassador): NOYA employs an invitation-only ambassador program, offering qualified participants the opportunity to participate in community rounds and performance-based rebates (up to 10%) based on actual contributions .

Currently, Noya.ai has accumulated over 3,000 on-chain users, and its X platform has surpassed 41,000 followers, ranking among the top five on the Kaito Mindshare leaderboard. This indicates that NOYA has secured a favorable niche in the prediction market and agent sector.

In addition, Noya.ai's core contracts have passed dual audits by Code4rena and Hacken, and have been integrated with Hacken Extractor.

VI. Token Economic Model Design and Governance

NOYA adopts a single-token ecosystem model, with $NOYA serving as the sole carrier of value and governance.

NOYA employs a buyback & burn value capture mechanism. The value generated at the protocol layer in products such as AI Agent , Omnivaults , and prediction markets is transferred through mechanisms such as staking, governance, access rights , and buyback and burn , forming a closed loop of usage → fees → buyback value, thus converting platform usage into long-term token value.

The project operates on the core principle of Fair Launch , without introducing angel or VC investment. Instead, it distributes tokens through a public community launch-Raise , Space Race, and airdrop at a low valuation ($10M FDV) , deliberately reserving asymmetric upside potential for the community and making the token structure more biased towards active users and long-term participants. Team incentives mainly come from long-term locked token shares.

Token Distribution

- Total supply: 1 billion (1,000,000,000) NOYA

- Initial circulating supply (Low Float): Approximately 10%

- Valuation and Funding (The Raise) : Funding Amount: US$1 million; Valuation (FDV): US$10 million

VII. Predictive Analysis of Competition in the Intelligent Agent Market

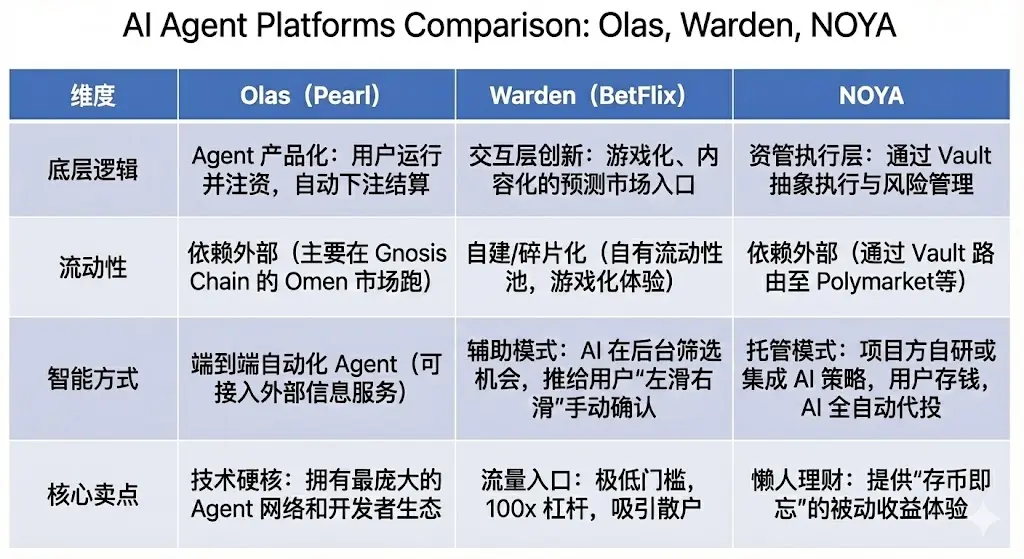

Currently, the prediction market agent sector is still in its early stages , with a limited number of projects. Some of the more representative ones include Olas (Pearl Prediction Agents) , Warden (BetFlix) , and Noya.ai.

From the perspective of product form and user participation methods, each represents one of the three paths currently existing in the predictive market's intelligent agent track :

1) Olas (Pearl Prediction Agents): Productizing and delivering runnable agents. It uses "running an automated prediction agent" as the participation method, encapsulating prediction market transactions into a runnable agent: users invest and run the agent, and the system automatically completes information acquisition, probability assessment, betting, and settlement. This participation method, requiring additional installation, is relatively less user-friendly for ordinary users.

2) Warden (BetFlix): An interactive distribution and consumer-grade betting platform that attracts users through a low-barrier, highly entertaining interactive experience. It adopts an interaction- and distribution-oriented approach, using gamified and content-driven front-ends to reduce participation costs, emphasizing the consumer and entertainment attributes of the prediction market. Its competitive advantage primarily stems from user growth and distribution efficiency, rather than the depth of its strategy or execution.

3) NOYA.ai : Centered on "fund custody + strategy execution," it abstracts prediction markets and DeFi execution into asset management products through Vault, providing a low-operation, low-mental-burden participation method. If Prediction Market Intelligence and Agent execution modules are subsequently added, it is expected to form an integrated workflow of "research-execution-monitoring."

Compared to AgentFi projects like Giza and Almanak, which have already delivered clear products, NOYA's DeFi Agent is still in a relatively early stage. However, NOYA's differentiation lies in its positioning and entry level: it enters the same execution and asset management narrative track with a fair launch valuation of approximately $10M FDV, and at this stage, it has significant valuation discount and growth potential.

- NOYA : An asset management encapsulation AgentFi project centered on Omnichain Vault. Currently, its delivery focuses on infrastructure layers such as cross-chain execution and risk control, while upper-layer Agent execution, prediction market capabilities, and ZKML-related mechanisms are still under development and verification.

- Giza : It can directly run asset management strategies (ARMA, Pulse), and currently AgentFi products have the highest level of completion.

- Almanak : Positioned as an AI Quant for DeFi, it outputs strategies and risk signals through models and quantitative frameworks, mainly targeting the needs of professional funds and strategy management, emphasizing the systematic nature of its methodology and the reproducibility of its results.

- Theoriq is a strategy and execution framework centered on multi-agent collaboration (Agent Swarms), emphasizing a scalable agent collaboration system and a medium- to long-term infrastructure narrative, with a greater focus on building underlying capabilities.

- Infinit : An execution-oriented Agentic DeFi terminal that significantly reduces the execution threshold of complex DeFi operations through the "intent → multi-step on-chain operation" process orchestration, allowing users to perceive the product value relatively directly.

VIII. Summary: Business Logic, Engineering Implementation, and Potential Risks

Business Logic:

NOYA is a relatively rare example in the current market of a project that combines multiple narratives : AI Agent, Prediction Market, and ZKML , and further incorporates an Intent-driven execution product approach. In terms of asset pricing, it started with a FDV of approximately $10 million , significantly lower than the typical $75 million–$100 million valuation range for similar AI/DeFAI/Prediction projects, creating a certain structural price difference.

From a design perspective, NOYA attempts to unify strategy execution (Vault/Agent) and information advantage (Prediction Market Intelligence) into a single execution framework, and establish a value capture closed loop through protocol revenue repatriation (fees → buyback & burn). Although the project is still in its early stages, its risk-reward structure, influenced by multiple narratives and a low initial valuation, is closer to that of a high-odds, asymmetric game .

Engineering Implementation: At the verifiable delivery level, NOYA's currently launched core functionality is Omnichain Vaults , providing cross-chain asset scheduling, yield strategy execution, and delayed settlement mechanisms. The engineering implementation is relatively basic. Its vision emphasizes Prediction Market Intelligence (Copilot) , NOYA AI Agent , and ZKML-driven verifiable execution, all of which are still under development and have not yet formed a complete closed loop on the mainnet. It is not yet a mature DeFAI platform.

Potential risks and key concerns

- Delivery uncertainty: The technological leap from "basic Vault" to "all-around agent" is huge, and we need to be wary of the risk of roadmap delays or ZKML implementation falling short of expectations.

- Potential systemic risks include contract security, cross-chain bridge failures, and oracle disputes unique to prediction markets (such as ambiguous rules leading to inability to adjudicate). Any single point of failure could result in financial losses.

Disclaimer: This article was written with the assistance of AI tools such as ChatGPT-5.2, Gemini 3, and Claude Opus 4.5. The author has made every effort to proofread and ensure the information is true and accurate, but omissions are still inevitable. We apologize for any inconvenience. It is particularly important to note that the cryptocurrency market often experiences a discrepancy between project fundamentals and secondary market price performance. The content of this article is for informational and academic/research exchange purposes only and does not constitute any investment advice, nor should it be considered a recommendation to buy or sell any token.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight