Lighter Protocol Signals Buyback, Fueling LIT Token Rally

- Lighter Protocol’s LIT jumped above $3 after on-chain activity sparked speculation of fee-funded buybacks, pointing to a supply reduction.

- On-chain trackers showed a whale moving USDC into Lighter and buying about 1.12M LIT.

Lighter Protocol’s LIT token rallied over 14% after on-chain activity sparked fresh talk that the decentralized perpetuals exchange may be running a token repurchase program. The move followed unusual treasury flows that traders interpreted as the protocol buying LIT from the market, in line with its previously stated plan to use revenue for growth and buybacks.

Lighter responded to the discussion on X by directing users to its treasury wallet, stating:

The post directed users to the treasury address on the block explorer so they could track fee inflows and any buyback-linked movements in real time. It also restated Lighter’s earlier plan to allocate revenue between ecosystem growth and token repurchases.

Lighter’s On-chain Market Activity and Supply Details

Market data showed LIT trading volume near $35 million, up 77% in 24 hours, while open interest increased 58% to about $1.81 million. On-chain records also showed the treasury holding about $1.35 million in USDC, which market participants cited as capacity for purchases.

Adding to the bullish price action, whale activity also supported the LIT price rally. On-chain trackers flagged a large wallet selling 52.1 WBTC, valued at $4.86 million. The same wallet then deposited about $3.36 million worth of USDC on Lighter. It later used the funds to buy roughly 1,119,001 LIT at around $3 per token.

Whale Onchain Activity | Source: X

Lighter has described the program as routing fee revenue into LIT market buys, rather than distributing revenue through dividends.

Lighter launched LIT in late December last year, as CNF earlier reported. This was after a $68 million funding round that valued the project at about $1.5 billion. Investors included Ribbit Capital, Founders Fund, Haun Ventures and Robinhood Ventures.

The token has a fixed supply of 1 billion units. Lighter has said it will allocate 50% of its supply to the ecosystem, with the remainder split across the team and investors. At launch, an airdrop distributed about 25% of the total supply, and investor tokens follow a three-year vesting schedule.

The Ethereum-based exchange launched its public mainnet in October and reported more than $200 billion in monthly trading volume in December.

Earlier concerns around Lighter’s token distribution and wallet activity have done little to sway the momentum against the project. CNF previously reported that on-chain trackers flagged wallets linked to the protocol for selling millions of LIT after the airdrop, alongside claims of large withdrawals that fueled insider-trading concerns.

At the time of writing, LIT traded at $3.12, up 14% in 24 hours, with a $781.58 million market cap.

]]>You May Also Like

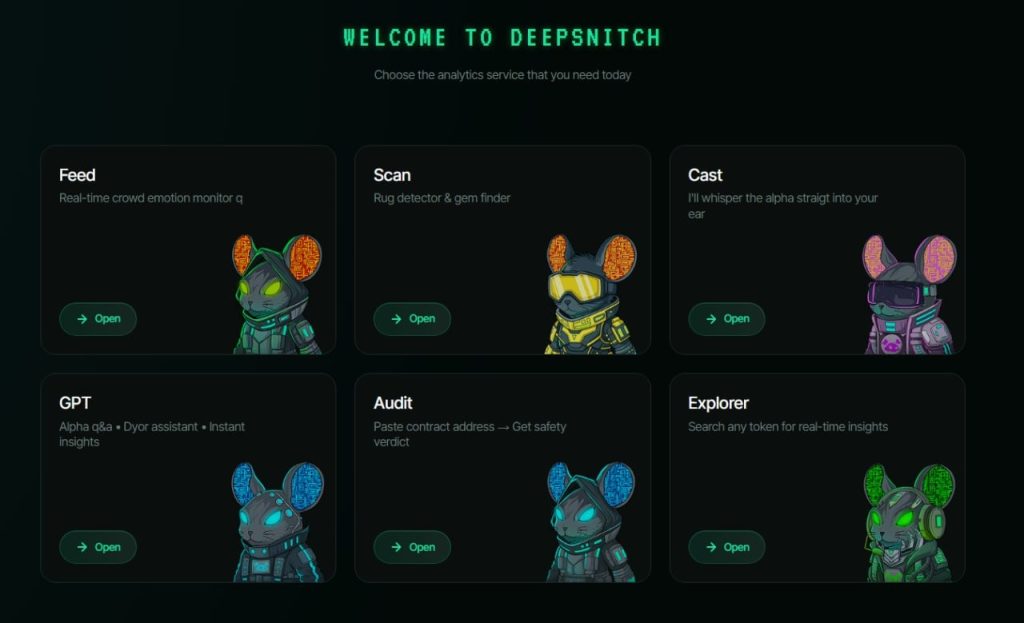

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24