114514 Price Prediction: New Japan Meme Coin Pumps, Dumps

The initial FOMO surrounding 114514, a new Japanese meme coin, appears to be slowing down, fueled by mounting selling pressure and a noticeable pullback from recent highs.

Launched on Solana a couple of days ago as a manifestation of the Japanese and Chinese internet culture, this meme coin suddenly burst out of obscurity today with nearly 10x growth on the daily chart before retracing most of the gains.

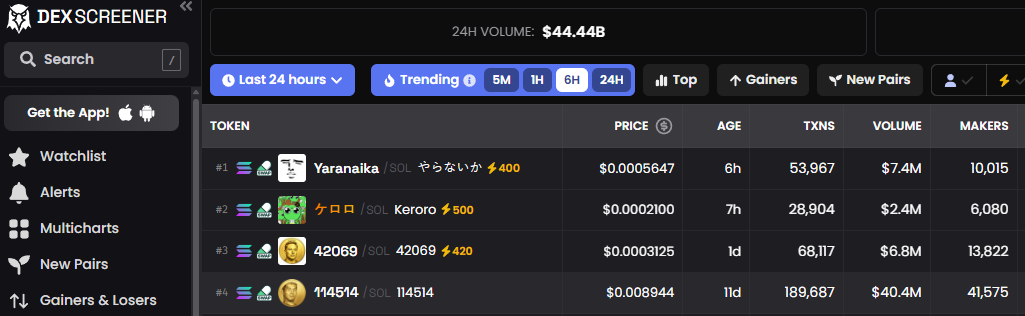

In fact, data obtained from DexScreener indicated that its market cap nearly reached $17 million during the upward trend, marking one of the most dramatic short-term rallies in the Solana meme coin market.

The scale and speed of the move not only positioned the meme coin among the top trending tokens today but also sparked insinuations that several early entrants may have captured outsized returns from it.

For instance, a particular trader identified with a wallet address starting with 8BGiMZ was said to have seen his $321 investment grow into $2.8 million at peak levels.

Surprisingly, the meme coin immediately dumped shortly thereafter, erasing most of the gains. A zoomed-out look at the four-time chart shows the market cap hovering around $8 million, with the price down 79% to trade at $0.0078, raising questions from analysts that this could be another short-lived meme coin craze.

Is 114514 a good investment?

What is 114514 Meme Coin?

114514, a new meme coin on Solana, is inspired by a Japanese cultural symbol dating back to 2001. This numeric symbol carries deep cultural foundations across Chinese and Japanese internet communities, which is why it quickly resonated with many degen investors.

In contrast to the classic crypto projects that put an emphasis on utility or long-term development plans, 114514 relies solely on speculative hype. Its rise underscores the fact that internet culture still dictates market behavior, particularly in meme-driven ecosystems like Solana. And as attention intensified, the token transitioned from obscurity into a high-volume trading instrument almost overnight.

This sudden visibility attracted both seasoned traders and newcomers searching for asymmetric opportunities. Stories of rapid capital growth circulated widely, driving in a wave of new buyers before a coordinated profit-taking event sent the price tumbling.

114514 Broke Key Resistance During Sudden Uptrend

Before its initial rally, 114514 traded within a tight range between $0.0015 and $0.0025. That structure broke decisively following a market-wide relief rally that lifted the Bitcoin price above $94,000, even amid escalating geopolitical tensions.

As soon as more buyers stepped into the 114514 market, the price surged above the $0.0030 resistance level. The move marked a clear shift in momentum as fresh demand entered the market. What followed was a rapid transition from low-volume trading into an active uptrend.

As momentum accelerated, 114514 climbed swiftly into the $0.0070-$0.0100 range. What stood out was the speed of the move rather than its duration. Within a short span, the token evolved from a lightly monitored token into a focal point for speculative traders. The rapid surge in attention and price set the tone for the heightened downside volatility that followed.

Is This Meme Coin a Short-Term Trade or Long-Term Gamble?

Evaluating 114514 through a market-analysis lens places it firmly within the category of short-duration speculative assets. Its price behavior is driven less by intrinsic metrics and more by attention cycles, liquidity surges, and trader psychology. For many participants, this structure favors tactical engagement over long-term conviction.

The experience of a few traders who reportedly turned their small positions into significant profits within days, further underscores this dynamic.

His approach centered on early positioning and disciplined execution rather than prolonged exposure. Such outcomes, while not universal, illustrate how timing plays a central role in meme coin performance.

However, this same structure brings elevated risk once momentum slows. And in the absence of lasting catalysts, price often responds sharply to shifts in sentiment, which helps explain why ongoing profit-taking in the 114514 market has triggered a repeated downward spiral.

114514 Price Prediction – Can This Meme Coin Recover?

At the moment, 114514 is currently consolidating near $0.0090, a level that has become a temporary pivot point amid growing volatility. The range presents a provisional equilibrium between buyers and sellers, making it a critical area for gauging renewed interest.

Stability above this zone would support a recovery attempt. On the downside, immediate support sits around $0.0070-$0.0075, with a deeper buffer near $0.0055-$0.0060 if selling pressure continues. Holding above these levels would help preserve the broader structure established during the rally, while a break below them could weaken near-term sentiment.

Per data from DexScreener, the 114514/SOL trading pair has witnessed not less than 100,000 sell orders over the past 24 hours, compared to only 55,000 buy orders. Analysts see this this as a signal of bearish momentum, suggesting that more downward movement could be on the horizon if sellers persist.

In this case, one of the most important addresses to watch is the one starting with 8BGiMZ, owing to its association with one of the earliest investors in the token. If the investor dumps all his 114514 holdings, it might totally change the token’s market dynamics, forcing more holders to engage in sell-offs – a development that can possibly plunge the token below the $0.0009 level.

To the upside, resistance is forming near $0.0105-$0.0115, while a stronger breakout could open the path toward $0.0130-$0.0150. Such a move would likely depend on renewed volume and sustained participation. In meme-driven markets, liquidity remains the decisive factor.

Is 114514 a Good Investment?

Considering the continuous selling pressure around 114514 and the eventual price crash, it could be considered among the riskiest meme coins to buy now. As such, those seeking a more promising alternative with both short and long-term potential may check out Bitcoin Hyper.

Bitcoin Hyper has become a highly watchlisted project among retail investors and whales, thanks to its bold Bitcoin branding and revolutionary Layer-2 architecture. The project aims to launch a Layer-2 scaling solution that will deliver unmatched speed and DeFi functionally for the Bitcoin blockchain.

It addresses critical challenges that have limited Bitcoin to being just a store of value. With the integration of the Solana Virtual Machine (SVM), it elevates the performance of the Bitcoin blockchain for both developers and investors.

The timing couldn’t be better as Bitcoin is already lagging behind newer blockchains like Solana and Ethereum in terms of speed and smart contract compatibility. By solving key pain points within the blockchain space, Bitcoin Hyper is poised to become a valuable addition to the network.

Developers will now be able to create innovative projects across NFT, gaming, and DeFi niches, all while taking advantage of faster transaction speeds. Its native token, HYPER, is currently on presale and has raised close to $30 million, which is impressive for a project still in its early stage.

Considering the share scale of its funding, its practical utility, and strong community support, experts believe Bitcoin Hyper is in a good place for growth, making it a worthwhile investment this year.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Artificial Intelligence Does Not Replace Work — It Multiplies It

Adoption Leads Traders to Snorter Token