Coinbase Trading Suspension: Strategic Shift Halts ETH/DAI, FLOW/USDT, and MANA/ETH Pairs

BitcoinWorld

Coinbase Trading Suspension: Strategic Shift Halts ETH/DAI, FLOW/USDT, and MANA/ETH Pairs

In a significant move for digital asset markets, leading cryptocurrency exchange Coinbase announced on January 5, 2025, that it will suspend trading for three specific pairs: ETH/DAI, FLOW/USDT, and MANA/ETH. This strategic suspension, effective 5:00 p.m. UTC on January 7, signals a notable shift in exchange liquidity management and prompts analysis of evolving market dynamics. Consequently, traders and investors must understand the implications of this decision. Furthermore, this action reflects broader trends within the cryptocurrency industry.

Analyzing the Coinbase Trading Suspension Details

Coinbase provided clear and direct communication regarding the upcoming changes. The exchange will halt order book trading for the specified pairs at the designated time. However, users will retain the ability to cancel existing limit orders for a brief period afterward. Importantly, this suspension affects only the specific trading pairs, not the underlying assets themselves. For instance, users can still trade Ethereum (ETH), DAI, FLOW, MANA, Tether (USDT), and others via different pair combinations on the platform. This precise targeting suggests a liquidity consolidation strategy rather than an asset delisting.

Potential Rationale Behind the Pair Removal

Exchanges like Coinbase routinely evaluate market performance metrics for all listed trading pairs. Key factors influencing such decisions typically include:

- Low Trading Volume: Pairs with consistently minimal activity fail to justify the operational and technological resources required to maintain them.

- Liquidity Fragmentation: Concentrating liquidity into fewer, major pairs often creates a better trading experience with tighter spreads.

- Strategic Realignment: Exchanges periodically refine their offerings to align with current user demand and market trends.

For example, the ETH/DAI pair might see reduced activity as traders prefer the deeper liquidity of ETH/USDC or ETH/USDT. Similarly, the MANA/ETH pair’s suspension may encourage direct trading against stablecoins. This move ultimately streamlines the trading interface for most users.

Market Context and Historical Precedents

This action by Coinbase is not an isolated event. Major exchanges frequently adjust their listed pairs to optimize their markets. For instance, Binance and Kraken have executed similar pair removals throughout 2024. These decisions often follow a quarterly review cycle. Historically, such suspensions have minimal long-term impact on the price of the underlying assets, provided the assets remain listed elsewhere on the exchange. The table below compares the affected pairs with their likely primary alternatives on Coinbase.

| Suspended Pair | Primary Alternative on Coinbase | Asset Type |

|---|---|---|

| ETH/DAI | ETH/USDC, ETH/USDT | Major Crypto / Stablecoin |

| FLOW/USDT | FLOW/USD, FLOW/EUR | Layer-1 Token / Stablecoin |

| MANA/ETH | MANA/USD, MANA/USDT | Metaverse Token / Major Crypto |

This consolidation reflects a market-wide preference for trading digital assets against major fiat-pegged stablecoins or local fiat currencies. The shift enhances price discovery and reduces complexity for new investors.

Immediate Impact on Traders and Investors

The immediate effect requires action from users holding open orders on these pairs. All traders must cancel any limit orders before the deadline to avoid automatic cancellation by the system. Additionally, users seeking exposure to these asset relationships must now use alternative pairs. For example, someone wanting to trade MANA against Ethereum might first convert ETH to USDT, then trade MANA/USDT. This adds one extra step but remains fully functional. Importantly, the suspension does not affect the ability to deposit or withdraw the underlying assets. Wallet holdings remain completely secure and unchanged.

Broader Implications for the Cryptocurrency Ecosystem

This decision underscores the maturation of cryptocurrency markets. Exchanges now prioritize efficiency and user experience over offering every possible pair. This professional approach mirrors traditional financial markets. It also highlights the dominance of certain stablecoins like USDC and USDT as primary trading vehicles. The move may indirectly influence liquidity on decentralized exchanges (DEXs), where these niche pairs could see increased activity. However, the overall market structure becomes more streamlined and less fragmented as a result.

Conclusion

The Coinbase trading suspension for the ETH/DAI, FLOW/USDT, and MANA/ETH pairs represents a strategic, data-driven decision to consolidate liquidity and improve platform efficiency. This action aligns with standard industry practices for managing exchange offerings. Traders face a short-term adjustment period but retain multiple avenues for accessing these assets. Ultimately, such routine maintenance by major exchanges like Coinbase contributes to a more robust and user-friendly digital asset ecosystem. The market continues to evolve toward greater sophistication and institutional-grade standards.

FAQs

Q1: Can I still hold ETH, DAI, FLOW, or MANA on Coinbase after the suspension?

A1: Yes. The suspension only affects the specific trading pairs. You can still hold, deposit, and withdraw all these assets individually. You can also trade them using other available pairs like ETH/USDC or MANA/USDT.

Q2: What happens to my open limit order on one of these pairs?

A2: You must cancel any open limit orders on ETH/DAI, FLOW/USDT, or MANA/ETH before 5:00 p.m. UTC on January 7. After trading halts, the system will cancel any remaining orders. Failing to cancel them yourself will result in an automatic cancellation.

Q3: Why would Coinbase suspend these particular pairs?

A3: Exchanges typically suspend pairs due to low trading volume. Concentrating liquidity into fewer, more popular pairs creates better prices and tighter spreads for the majority of users. This is a common practice for optimizing market health.

Q4: Does this mean FLOW or MANA is being delisted from Coinbase?

A4: No. This is a pair suspension, not an asset delisting. Both FLOW and MANA remain listed on Coinbase. You can still trade them against other currencies like USD, USDT, or EUR. The action only removes one specific trading route for each asset.

Q5: Where else can I trade these specific pairs after January 7?

A5: Other centralized exchanges or decentralized exchanges (DEXs) may continue to offer these pairs. However, always check for sufficient liquidity and security on alternative platforms before trading. The suspension is specific to Coinbase’s platform.

This post Coinbase Trading Suspension: Strategic Shift Halts ETH/DAI, FLOW/USDT, and MANA/ETH Pairs first appeared on BitcoinWorld.

You May Also Like

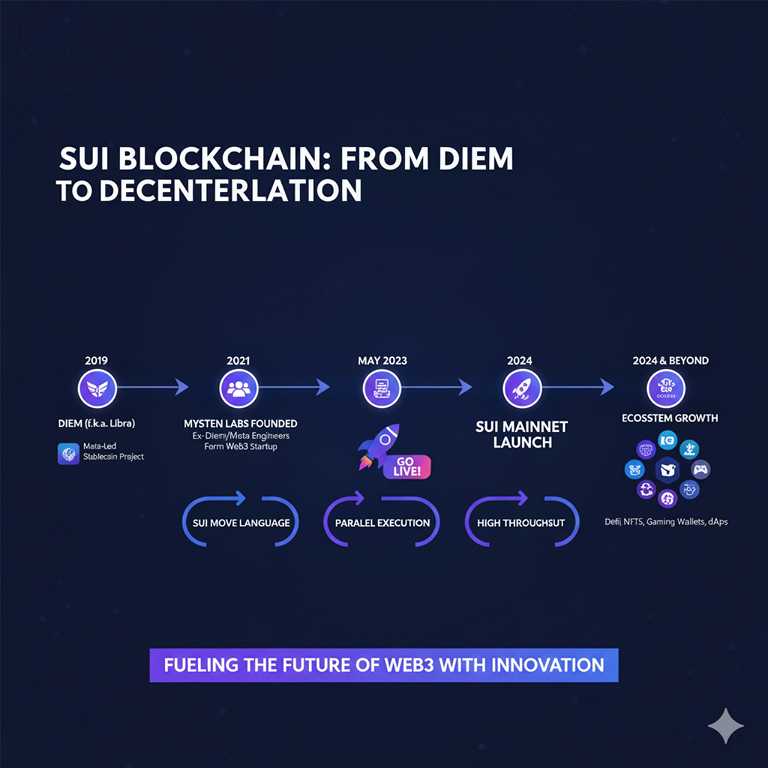

Sui Blockchain Explained (2025): Move Language, High-Speed Layer-1 & The Future of Web3

In an era of agent explosion, how should we cope with AI anxiety?