JPMorgan’s Kinexys Expands Digital Payments Push With Canton Network Partnership

JPMorgan Chase’s blockchain unit Kinexys has announced on Tuesday it plans to bring its deposit token JPM Coin (JPMD) natively onto the Canton Network.

The collaboration, unveiled in early 2026 alongside Digital Asset aims to allow the issuance, transfer and redemption of JPM Coin directly on Canton’s blockchain infrastructure.

The move reflects growing institutional demand for faster, more secure money movement on public blockchain rails without sacrificing compliance or confidentiality.

Regulated Digital Cash for Institutions

JPM Coin is the first bank-issued U.S. dollar–denominated deposit token, providing institutional clients with a digital representation of U.S. dollar deposits held at JPMorgan.

Unlike stablecoins issued by non-bank entities, JPM Coin represents a direct claim on bank deposits, combining traditional banking safeguards with blockchain-based settlement.

By issuing JPM Coin natively on Canton, institutions operating within the network will be able to move digital cash near-instantly across markets, supporting payments, settlement, and liquidity management within a regulated framework.

The integration is designed to appeal to both digitally native firms and traditional financial institutions seeking to modernize payment infrastructure while maintaining trust and regulatory oversight.

Bridging Traditional Finance and Blockchain Infrastructure

Executives from both sides framed the partnership as a foundational step toward interoperable digital money. Yuval Rooz co-founder and CEO of Digital Asset, said the collaboration brings the concept of regulated digital cash “to the speed of markets,” helping modernize existing financial rails.

Naveen Mallela, global co-head of Kinexys by J.P. Morgan explains that JPM Coin combines the security of bank-issued deposits with the continuous availability of blockchain-based transactions.

Mallela added that bringing JPM Coin onto Canton has the potential to unlock liquidity and improve capital efficiency across financial markets.

A Phased Rollout Through 2026

The integration will follow a phased approach throughout 2026. Initial efforts will focus on establishing the technical and commercial foundations required to support native issuance, transfer, and near-instant redemption of JPM Coin on Canton. Once live participating institutions will be able to use JPM Coin directly within the Canton ecosystem.

Beyond JPM Coin, the partners will explore integrating additional Kinexys Digital Payments products, including JPMorgan’s Blockchain Deposit Accounts.

Expanding the range of bank-backed digital payment instruments available on Canton could further enhance its role as a hub for synchronized, cross-market financial activity.

JPMorgan to Launch Tokenized Money-Market Fund on Ethereum

In December reports emerged JPMorgan Chase’s $4 trillion asset-management division is launching its first tokenized money-market fund on the Ethereum blockchain.

The bank will initially seed the vehicle with $100 million of its own capital before opening it to external investors. The private fund called the My OnChain Net Yield Fund or “MONY” is built on JPMorgan’s in-house tokenization platform, Kinexys Digital Assets.

You May Also Like

Ripple acquires UK approvals to expand payments business

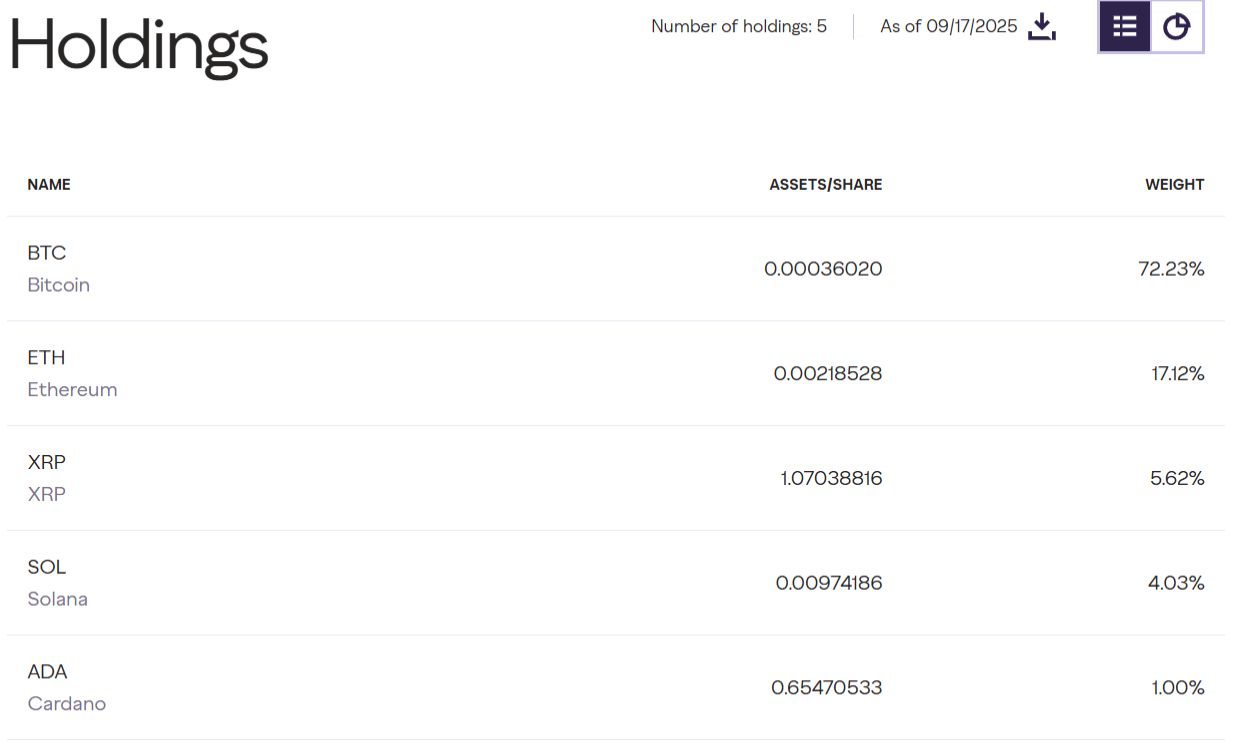

Grayscale’s Crypto Large Cap Fund, Including BTC, ETH, XRP, ADA, Gets SEC Approval