Bitcoin May Test $89,000 as Selling Pressure Intensifies—Here’s What’s Next for the BTC Price Rally

The post Bitcoin May Test $89,000 as Selling Pressure Intensifies—Here’s What’s Next for the BTC Price Rally appeared first on Coinpedia Fintech News

Bitcoin price is juggling around the crucial range at $90,000 after failing to secure acceptance above $95,000, triggering a sharp shift in short-term market structure. The rejection at higher levels has pushed BTC into consolidation mode, dragging the broader crypto market lower.

A key macro overhang is the U.S. Supreme Court ruling due Friday on the legality of tariffs imposed by former President Donald Trump. Nearly 1,000 companies have challenged the measures, warning of economic and trade disruptions. A ruling against Trump could strengthen the dollar and spark a risk-off move across global markets—pressuring Bitcoin further. In that case, BTC risks losing the $89,000 local support, opening the door to deeper downside.

BTC Price Tests the Support at 200-day MA

Bitcoin began 2026 with a strong breakout, surging from a multi-week range to nearly $95,000. However, momentum faded quickly. The price has dropped over 5% in recent sessions, with declining volume suggesting distribution rather than healthy consolidation.

Unless BTC reclaims $90,500–$91,000 swiftly, downside pressure may persist through the week, especially as macro uncertainty peaks. Holding above $89,000 remains critical to prevent a broader bearish continuation.

As seen in the above chart, the BTC price faced a rejection for the third consecutive time since December, flashing bearish signals. The MACD displays a drop in buying pressure, which may further undergo a bearish crossover. As it continues to remain within a negative range, the possibility of an extended pullback hovers over the token. However, the 200-day MA could act as a strong base and trigger a rebound, but only if the buying volume kicks in.

Momentum Cools, but the Broader Trend Remains Intact

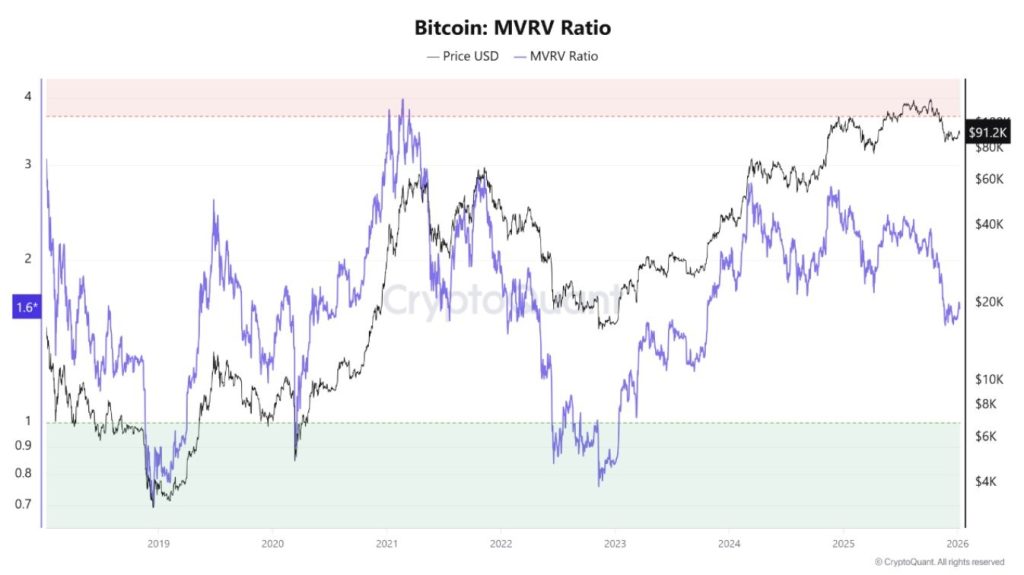

Bitcoin’s Market Value to Realised Value (MVRV) ratio is currently hovering around 1.6, offering important context for the ongoing price correction. The MVRV ratio compares Bitcoin’s market price to the average on-chain cost basis of all coins, helping assess whether the market is overheated or undervalued.

Source: X

Source: X

Historically, major cycle tops have formed when MVRV rises above the 3.5–4.0 zone, a level associated with extreme profit-taking and euphoric sentiment. At present, Bitcoin remains well below those thresholds, suggesting the market is not in an overheated state despite recent highs.

In previous bull cycles, Bitcoin often experienced pullbacks and consolidation phases while MVRV stayed between 1.3 and 2.0 before resuming its broader uptrend. The current reading fits that pattern, indicating that recent weakness is more likely a healthy reset rather than a structural breakdown. Downside risk would increase meaningfully only if MVRV trends back toward 1.0, a scenario that would imply price returning closer to the aggregate cost basis.

The Bottom Line

Bitcoin’s pullback appears more like a momentum reset than a trend reversal. With on-chain metrics such as realized cap still rising and MVRV well below historical peak levels, the market is not showing signs of broad distribution. In the near term, traders should expect continued volatility and potential tests of key support zones. Direction will depend on whether buyers defend these levels. A successful hold would keep the broader bullish structure intact, while a failure would delay upside rather than end it.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Trading bots gain traction as crypto markets move sideways: HTX 2025 recap

The cryptocurrency exchange reported sharp growth in automated trading as vol