Zcash Price Prediction As Developers Resign – Is ZEC Dead?

One of the top trending headlines to have come out of the crypto space today is that of Zcash.

After an impressive outing in Q4 2025, highlighted by Grayscale’s ETF filing of its native token ZEC, the project is now starting the new year against headwinds.

In particular, the core issue stems from the unexpected resignation of the entire development team behind its privacy-focused architecture, known as the Electric Coin Company (ECC) over a deep governance dispute.

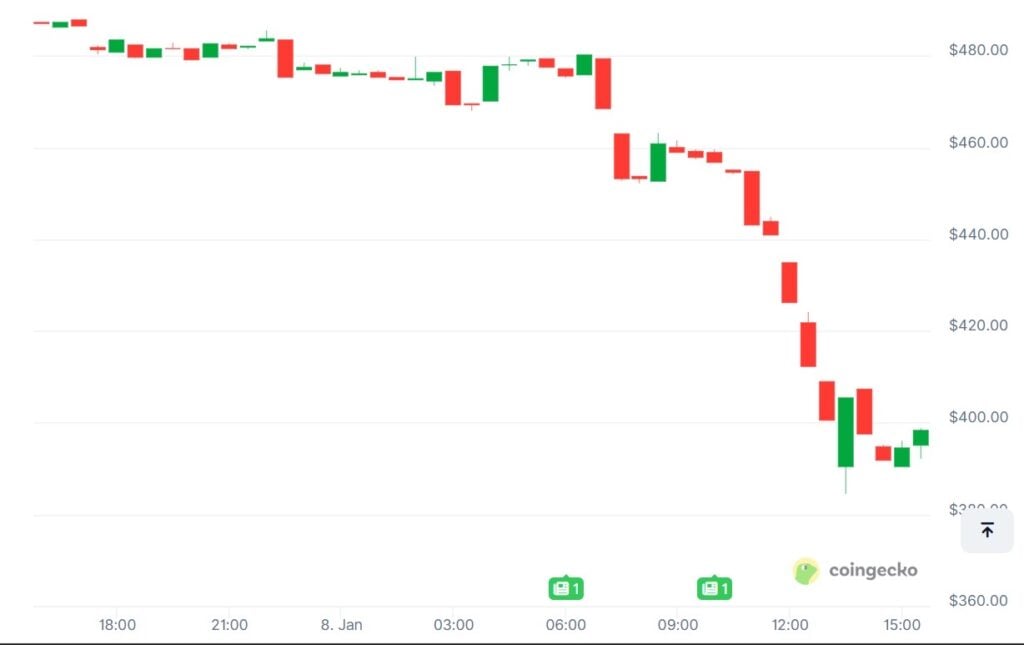

ZEC is down 20% on the news, hovering around $396 as investor sentiment deteriorates rapidly.

And as selling pressure persists, cues from technicals suggest more downward movement could be on the horizon.

Is ZEC dead?

A Dive into Zcash’s Governance Dispute

Zcash is facing one of its most consequential internal crises in recent years, following a governance dispute that led to the exit of its core development team.

The disagreement stems from decisions made by the Bootstrap board, which developers argue fundamentally altered how the Electric Coin Company could operate.

Those changes, according to public statements shared by ECC leadership, eroded trust and removed the autonomy needed to carry out long-term technical planning.

The dispute played out publicly, with developers describing the situation as untenable. Statements from the team, however, clarified that the issue was not due to financial pressure or protocol instability, but rather governance direction and accountability.

Within days, the entire engineering leadership stepped away, stating their intention to continue Zcash development under a new structure.

However, none of this has affected the network itself. Zcash continues to process transactions normally, privacy features remain intact, and there has been no disruption to block production. Still, the governance fallout has shifted market attention away from fundamentals and toward leadership uncertainty.

That being said, there are speculations that the developers might be dumping the token, owing to the magnitude of the selling pressure.

However, at the time of writing, there is no verified evidence linking the large sell-offs directly to former ECC developers. Much of the narrative appears to be sentiment-driven rather than data-confirmed.

Moreover, periods of leadership transition often create these assumptions, especially in projects historically guided by a tight development group. Traders tend to read uncertainty into every on-chain movement, which can amplify fear during already volatile conditions.

Zcash’s structure, however, limits long-term dependency on any single entity. The codebase remains open, and development does not halt simply because an organization changes form. In that context, speculation alone is unlikely to define ZEC’s longer-term trajectory.

ZEC Technical Outlook

ZEC is trading at approximately $396 at press time, reflecting sustained volatility following the governance news. The price decline unfolded quickly, with buyers stepping in repeatedly as ZEC tested lower levels.

In fact, according to Ash Crypto, not less than $1.6 billion has been wiped out from its market cap in the last 24 hours, underscoring the severity of the market reaction.

From a technical standpoint, ZEC is now trading within a critical consolidation zone after sliding to the $396 level. Short-term trend indicators have weakened, showing that sellers currently control momentum, but longer-term structure remains intact. This places the asset in a transitional phase rather than a breakdown.

Immediate support sits between $380 and $360, an area that has historically attracted buying interest during corrective moves. A sustained loss of this range would open the door to deeper retracements, while successful defense could establish a base for recovery. On the upside, resistance between $430 and $450 remains the first meaningful test for any rebound.

Nonetheless, the narrowing price range suggests pressure is building. Markets often resolve this type of compression with a decisive move, and in ZEC’s case, direction is likely to hinge on how quickly clarity emerges around development continuity and governance stability.

Zcash Price Prediction – Is ZEC dead?

While the price dump that followed the mass resignation of the ECC team wasn’t entirely surprising, the scale and speed of the move shocked many market observers.

Traders were quick to interpret the news as a structural deficiency, which in turn dampened confidence and triggered massive sell-offs.

However, in spite of the sharp market reaction, some analysts consider the resignation as short-term FUD, emphasizing that the team’s decision does not necessarily signal the abandonment of the project.

Renowned data scientist Budhil Vyas, for instance, noted that Zcash will remain fully operational and open-source despite the internal dispute, while ECC carries on building privacy-focused technology under a new structure.

The statement by the CEO of the team, Josh Swihart further reinforces this stance. He admitted that the Zcash protocol is unaffected by this event, and that the ECC team will continue to uphold the same mission, albeit under a new company.

While this signals hope for the project’s future, the magnitude of the sell-off following the resignation, coupled with the broader market pullback, makes further declines for ZEC likely in the coming days.

ZEC price prediction from several prominent analysts indicates the token could target the $290-$310 zone before finding stability near $350.

However, in the event that clarity returns regarding both the roadmap and governance of the project, the ZEC price may see some surges, which could pave the way for a return above the $400 level.

ZEC Investors Turn To High-Potential Presales Amid Short-Term Uncertainty

Despite reassurance from the ECC leadership that the Zcash architecture remains unaffected by the mass resignations, the intensifying sell-off in the ZEC market continues to fuel near-term panic. That has prompted investors to seek refuge in high-potential presales like Bitcoin Hyper.

This project, in particular, is currently among the highly watchlisted crypto presales today, thanks to its practical utility, meme fundamentals, and perfect launch timing.

It aims to launch a Layer 2 (L2) scaling solution for the Bitcoin blockchain, addressing critical challenges like low speed, high fees, and DeFi limitations without sacrificing the blockchain’s security.

In a nutshell, Bitcoin Hyper is strategically positioned to make Bitcoin fast, affordable, and flexible enough to accommodate real-world applications. That alone makes it a valuable addition to the network, as highlighted in numerous social media posts by followers.

Its native token, SOLX, is currently in its presale stage and has raised over $30 million, owing to strong demand from whales and retail investors alike.

The sheer scale of funding, its practical utility, and continuous community growth have impressed prominent influencers, many of whom are calling it the next 10x gem.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Headwind Helps Best Wallet Token

SEC Postpones Decision on Truth Social Bitcoin ETF