Complexity to Clarity: Architecting the Next Wave of AI-Powered Monetization

If you work in software, you know the feeling. The AI wave has arrived with tremendous force, promising to reshape every industry and workflow. Yet, for those of us in the business of building and selling these technologies, a profound and universal tension has emerged. On one side, we have the volatile, unpredictable economics of delivering cutting-edge AI. On the other, our customers—business owners, finance leaders, procurement teams—demand simplicity, stability, and a clear line from cost to value. This, in my view, is the defining AI Monetization Dilemma, and it’s the critical gap our industry must bridge to move from hype to sustainable growth.

My perspective is forged at the intersection of this dilemma. Having led the transformation of pricing for major consumer software products and the build-out of a unified, AI-driven pricing and promotions engine. This journey, from introducing usage-based pricing for tax software to building a platform that has generated over $200 million in incremental revenue, has revealed a common truth: the winners in this new age won’t just have the best AI. They will have the most intelligent, adaptable, and transparent monetization architecture.

The Four Pillars of the Modern Pricing Dilemma

The challenge is combinatorial, born from several converging forces:

- The Collapse of the “Per-Seat” Proxy: AI breaks the fundamental link between users and value. A single AI agent or empowered user can now handle work that previously required a team, eroding the logic of traditional subscription models. In my own work, I saw this firsthand as AI began to automate complex tax form handling and bookkeeping tasks, forcing us to rethink the unit of value itself.

- The Predictability Problem: Customers hate bill shock. Yet, as a McKinsey analysis notes, CFOs lament, “I have no idea what we’re going to spend on AI this quarter”. Whether it’s token-based API costs or variable compute expenses, this unpredictability is a major adoption barrier.

- The Margin Squeeze: The economic model has flipped. Traditional software enjoyed 80-90% margins, with infrastructure as a rounding error. AI-driven products operate on tighter, highly variable margins where underlying model costs can swing wildly. This volatility makes cost-plus pricing risky and demands models that can adapt.

- The Value Communication Gap: There is a stark disconnect between technical metrics (tokens, API calls) and how business buyers perceive value. As one industry leader put it, a buyer’s question is simple: “I have 50 employees. How much does it cost?” If your pricing model requires a lesson in machine learning, you’ve already lost.

This dilemma isn’t theoretical; it’s operational. It lives in the frustration of marketing teams who can’t forecast their credit spend, in the boardrooms where investors seek clarity on AI ROI, and in the strategic paralysis of product leaders unsure how to package their next breakthrough.

A Framework for Future-Proof Monetization

Bridging this gap requires moving beyond a one-size-fits-all price tag. Through my work, and by observing the market, I advocate for a dynamic, layered approach built on four strategic pillars. The following table outlines this framework, which can guide leaders in structuring their monetization strategy.

| Strategic Pillar | Core Objective | Key Implementation Tactic | Industry Example |

| 1. Architect for Hybrid Flexibility | Balance predictability & upside. | Bundle a stable subscription base with metered usage for peak or premium AI features. | ServiceNow’s Now Assist: Core platform subscription + consumption-based “Assist” credits. |

| 2. Anchor on Business-Aligned Value Metrics | Translate AI output into business outcomes. | Shift pricing meters from technical units (tokens) to proxies for business value (e.g., “qualified lead,” “process automated”). | Salesforce Agentforce: Pricing moves toward pay-per-action or per-qualified opportunity, linking cost to sales results. |

| 3. Design for Ethical & Transparent Governance | Build trust and ensure fair value exchange. | Implement clear guardrails, explainability features, and audit trails to prevent algorithmic collusion or unfair discrimination. | Carnegie Mellon research highlights the need for regulatory consideration of ranking systems to promote competition. |

| 4. Build an Iterative, Data-Driven Engine | Treat pricing as a product, not a set-and-forget function. | Invest in systems that can meter usage, run pricing simulations, and implement changes rapidly without engineering re-builds. | Platforms like Orb enable companies to model, test, and operationalize new pricing strategies based on real usage data. |

Practical Steps for Leaders: Where to Start Tomorrow

This framework is only as good as its execution. For teams looking to take the first step, I recommend a focused, three-phase approach based on what we’ve learned building at scale:

Phase 1: Diagnose & Instrument (Next 30-60 Days)

Audit Your Value Chain: Map your AI feature’s output to your customer’s operational or financial KPIs. Does it save hours? Increase conversion? Reduce errors? This becomes your candidate value metric.

Instrument Reliable Metering: You cannot price what you cannot measure. Implement robust telemetry to track the usage of AI features accurately. This data is the foundation for all future models.

Phase 2: Pilot & Learn

Run a Controlled Hybrid Pilot: Select a customer cohort. Offer them a new plan that combines their existing subscription with a usage-based fee for a specific, high-value AI action. For example, a base platform fee plus a cost per “automated financial report generated” or “complex support case resolved.”

Measure Everything: Track not just revenue, but adoption, churn, customer satisfaction, and support ticket volume. The goal is learning, not immediate perfection.

Phase 3: Scale & Systematize

Operationalize Your Winning Model: Integrate your chosen pricing logic with billing and finance systems to automate invoicing and revenue recognition.

Establish a Pricing Council: Form a cross-functional team (Product, Engineering, Finance, Sales, Legal) to review pricing performance quarterly. Treat your monetization strategy as a living system that evolves with your product and the market.

The Road Ahead: Monetization as a Competitive Moat

The next frontier of competition will not be fought solely on model accuracy or feature lists. It will be won by companies that can most elegantly solve the monetization dilemma—delivering awe-inspiring AI capability within a commercial package that feels simple, fair, and predictable to the buyer.

This requires a fundamental shift in mindset. We must stop viewing pricing as a static menu and start building Adaptive Monetization Engines. These are core technical and product systems that can dynamically align cost, value, and customer trust in real-time.

The path forward is complex but clear. By architecting for flexibility, anchoring on real-world value, designing with ethical transparency, and embracing continuous iteration, we can close the gap between AI’s potential and its practical, profitable reality. The companies that master this architecture won’t just sell software; they will build enduring trust and unlock the next wave of scalable, responsible growth.

You May Also Like

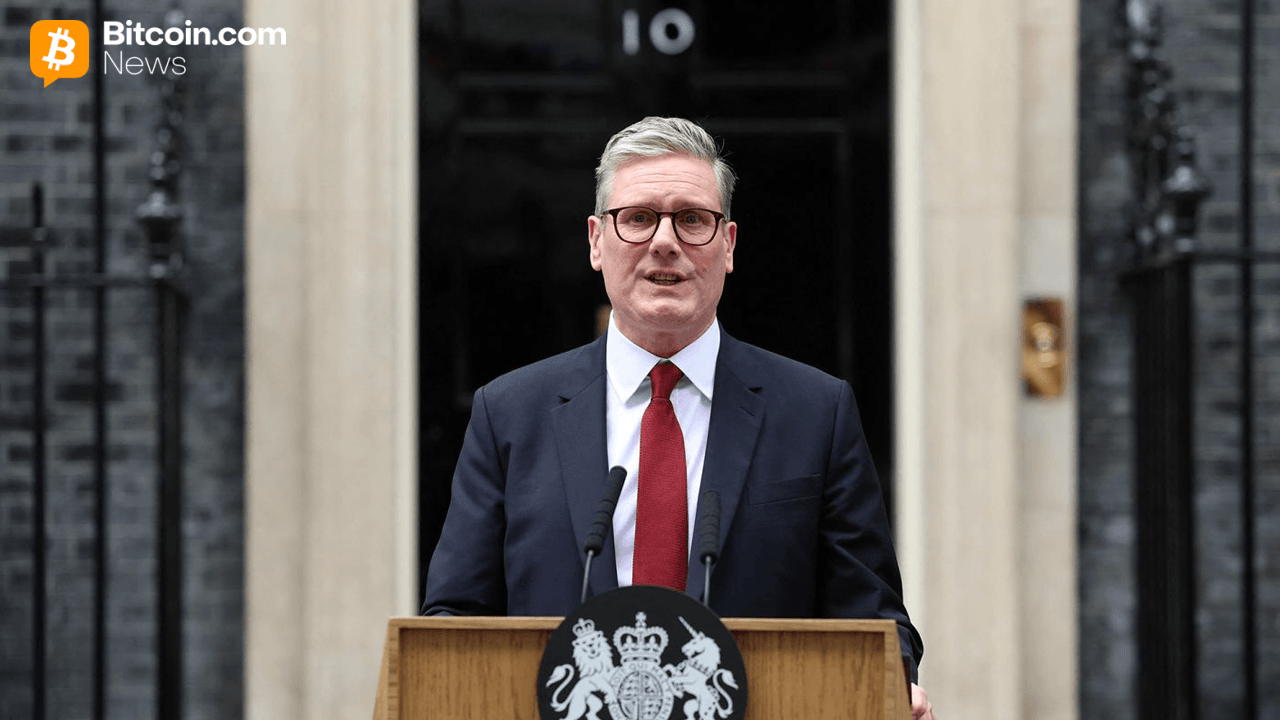

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

SEC Approves Generic Listing Standards for Crypto ETFs