SEC to Hold Miami Meeting With Crypto Startups and Developers

- The SEC is engaging directly with crypto builders, signaling a move away from enforcement-heavy regulation.

- The friendlier stance is easing market fears and supporting crypto sentiment.

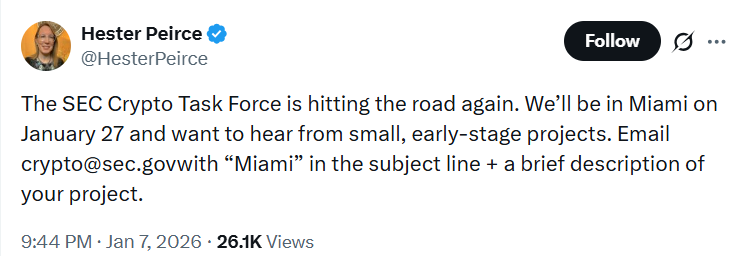

The U.S. Securities and Exchange Commission (SEC) has announced that its Crypto task force will visit Miami on January 27 to meet directly with the early-stage Crypto builders and Startups. The main goal is to listen to the Crypto community and gather feedback before finalizing new Crypto regulations.

Hester Peirce (SEC Commissioner) confirmed the visit and invited small Crypto projects to participate and share their experiences, challenges, and regulatory concerns with the SEC. Under the new SEC Chairman, Paul Atkins, the agency is moving away from “Regulations by enforcement” and focusing more on clear rules and guidance. The SEC is actively engaging in the Crypto industry instead of punishing it. This is a clear shift from the Previous approach under Gary Gensler, which relied heavily on lawsuits and enforcement actions.

SEC Listening Tour Draws Mixed Reactions, Boosts Market Confidence

During the meeting in Miami, the SEC wants to listen to the founders, developers, and startups to understand the real-world problems before writing the rules. They mainly focus on the startups instead of the big firms and discuss their policy challenges and innovations. This follows a December 2025 roundtable on financial privacy and data protection, showing a broader effort to rebuild trust with the Crypto industry.

After the announcement for this Meeting the people are in mixed reactions, like some say that listening tours slow things down and the SEC should reduce red tape faster by taking action sooner instead of talking to the startups. Some Crypto supporters say that this is the most constructive approach the SEC has taken so far and will be a great chance for the Direct conversations, which can lead to better regulations.

This approach from the SEC brings less fear and more confidence in U.S. based Crypto projects and also improved sentiment for Bitcoin and other infrastructure tokens. For the traders, it supports the bullish outlook and is especially positive for compliance-friendly and U.S. focused Crypto projects. Finally, the Startups may get the real voice in shaping future regulations.

Highlighted Crypto News:

Bybit Spot 2025 Highlights Early Listings and First-Mover Trading Gains

You May Also Like

8.18 Million Solana Committed on CME as SOL Options Prepare to Go Live

The Shocking Zero-Tolerance Policy That’s Reshaping Crypto Security