Bitcoin Price Holds $90,000 as Tariff Ruling Delay Eases Some Macro Jitters

Bitcoin Magazine

Bitcoin Price Holds $90,000 as Tariff Ruling Delay Eases Some Macro Jitters

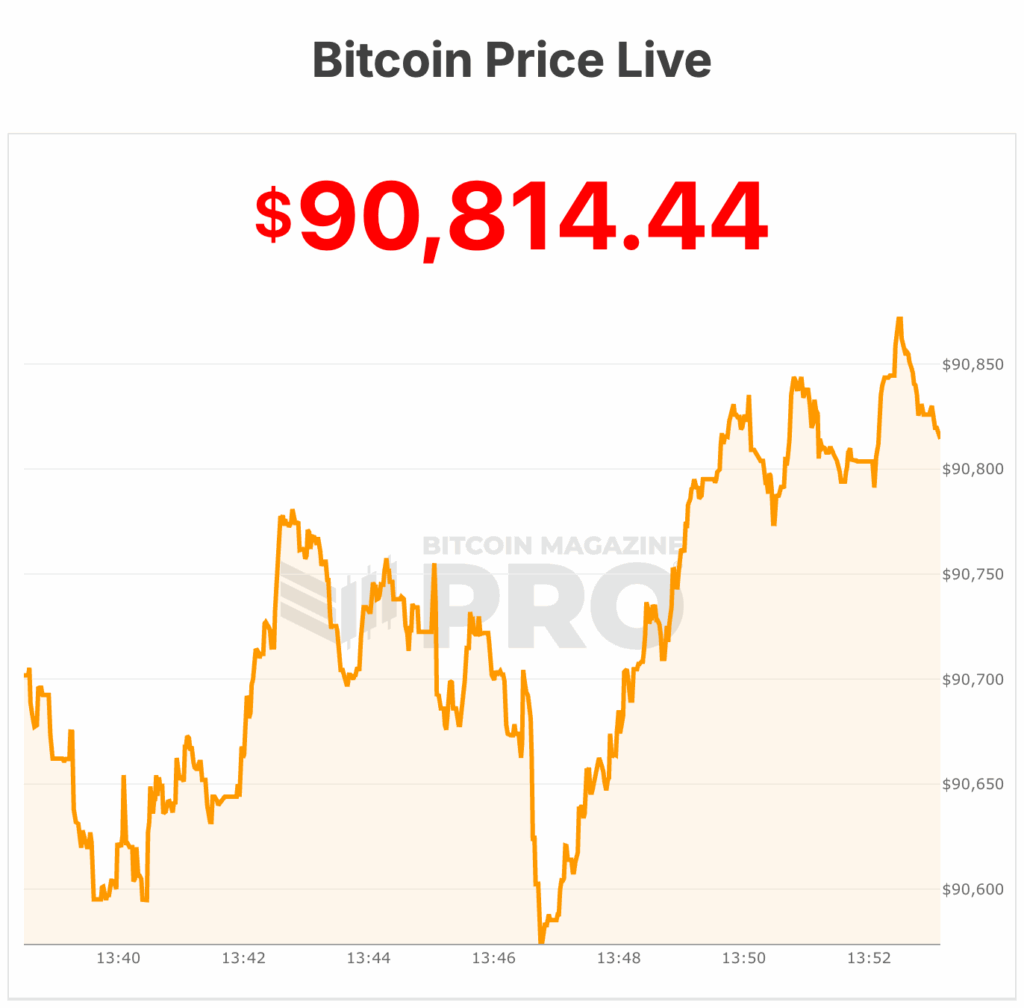

The bitcoin price was trading near the $90,000 mark on Friday as crypto markets steadied following a delay from the U.S. Supreme Court on a closely watched ruling tied to President Donald Trump’s tariff policy, temporarily easing near-term macro uncertainty.

The price of bitcoin stood at $90,443 at the time of writing, down about 1% over the past 24 hours, according to market data. Daily trading volume totaled roughly $45 billion, while bitcoin’s total market capitalization slipped to approximately $1.80 trillion, also down 1% on the day.

Despite the modest pullback, the bitcoin price remains tightly rangebound near recent highs. The asset is currently about 2% below its seven-day high of $91,839 and roughly 1% above its seven-day low of $89,671, per Bitcoin Magazine Pro data.

Bitcoin’s circulating supply now stands at 19,973,659 BTC, inching closer to its fixed cap of 21 million coins — a structural feature that continues to underpin long-term bullish narratives.

Tariff uncertainty weighs, then lifts the bitcoin price

Crypto prices initially wavered this week as traders positioned ahead of a potential Supreme Court decision on the legality of Trump-era global tariffs, widely viewed as a major macro catalyst.

However, markets moved higher on Friday after the court delayed its ruling until next week, reducing immediate downside risk across equities, bonds, and digital assets.

The bitcoin price hovered around $90,000 near the U.S. equity market open as investors reassessed risk exposure.

Analysts said the delay eased concerns about abrupt fiscal disruptions, including the possibility that the U.S. Treasury could be forced to refund more than $130 billion to importers if the tariffs were struck down.

Bitcoin has increasingly traded as a macro-sensitive asset, reacting to shifts in policy expectations, liquidity conditions, and geopolitical uncertainty.

As a result, major legal or political developments continue to influence short-term price action, even as long-term adoption trends remain intact.

Bitcoin price in consolidation following early-year rally

The current price reflects a cooling period after the bitcoin price surged in the opening days of the year, briefly pushing toward new short-term highs.

That early-January rally reignited bullish sentiment but also triggered profit-taking as momentum faded near resistance.

Technically, traders are watching the $90,000–$91,000 zone as a key support area. A sustained break lower could expose downside toward the high-$80,000 range, while a move back above $92,000 would likely reopen the path toward higher resistance levels.

For now, bitcoin remains locked in consolidation, with volatility compressed and traders awaiting a clearer catalyst.

Will the United States buy Bitcoin?

Cathie Wood of ARK Invest said in a podcast recently that politics could drive the U.S. to actively buy bitcoin in 2026. Wood argues that crypto has become a durable political issue for President Trump, potentially shaping policy ahead of the midterm elections.

While the U.S. currently holds a bitcoin reserve made up of seized assets, Trump has pledged not to sell any of the bitcoin, and the original goal was to acquire one million BTC.

Wood suggested in her conversation that the administration may move from holding only confiscated bitcoin to purchasing BTC outright for a national strategic reserve.

Crypto has also emerged as a more organized political constituency, supporting Trump and engaging with the White House through events and donations. On the policy side, executive orders have established the reserve and stockpile, with recommendations for Treasury-led expansion.

Wood sees government purchases as a potential market inflection point, reinforcing bitcoin’s scarcity as nearly 20 million of its 21 million cap have already been mined. If the United States would start buying bitcoin, its safe to assume that the bitcoin price would react positively.

At the time of writing, the bitcoin price is $90,814.

This post Bitcoin Price Holds $90,000 as Tariff Ruling Delay Eases Some Macro Jitters first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Walmart and Google Partner for In-Chat Purchases via Gemini AI

BlackRock boosts AI and US equity exposure in $185 billion models