Key insights into leading projects in various fields of DeFi: overall oligopoly structure

Author: Cheeezzyyyy

Compiled by: Felix, PANews

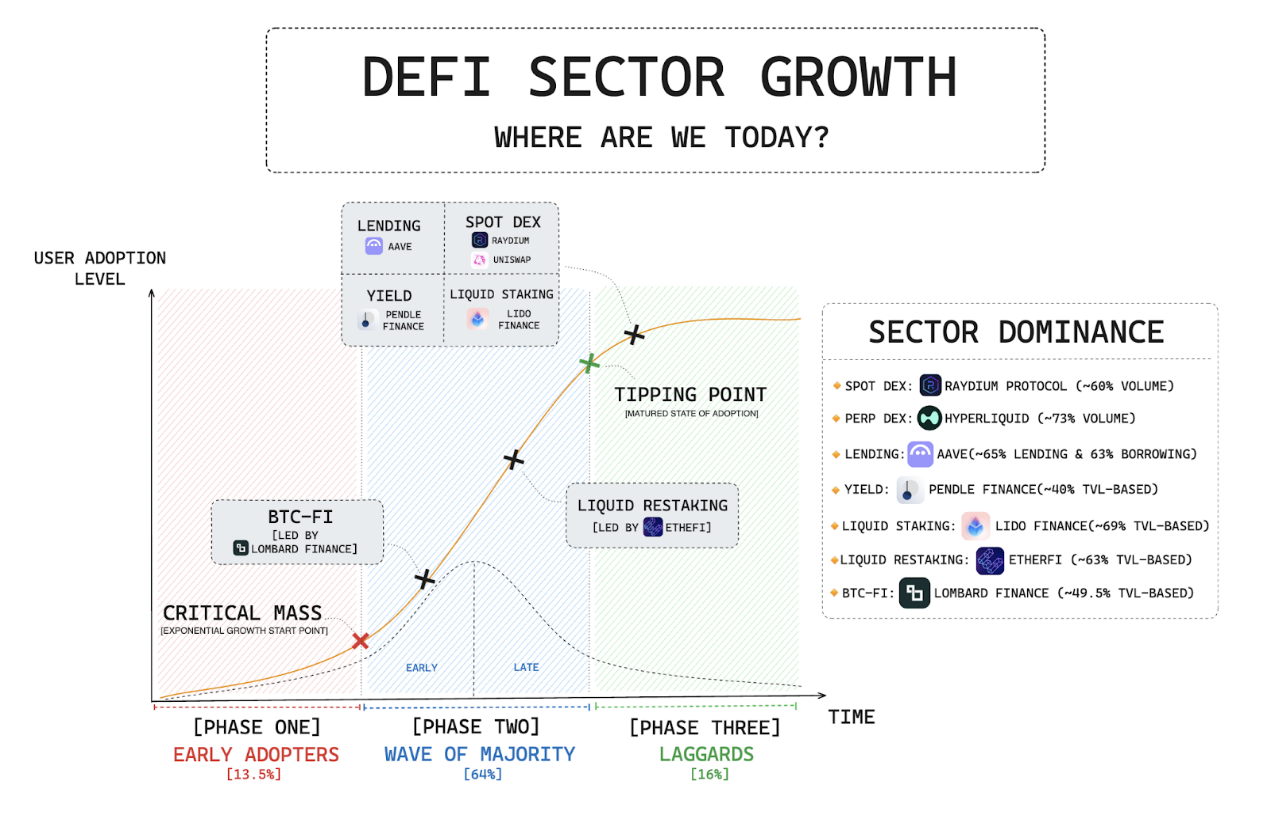

DeFi has come a long way since the “Summer of DeFi” kicked off in 2021. Today, DeFi has established multiple mature sectors, with growth and activity in each area being self-sustaining.

Even so, it’s still early days, as the cryptocurrency market cap is still around $3.3 trillion, while the TradFi market cap is $133 trillion.

At its core, DeFi is about providing a more innovative and efficient system that solves TradFi inefficiencies through proven PMF (Point of Market Fit). DeFi also consists of multiple key areas that typically follow an oligopolistic structure.

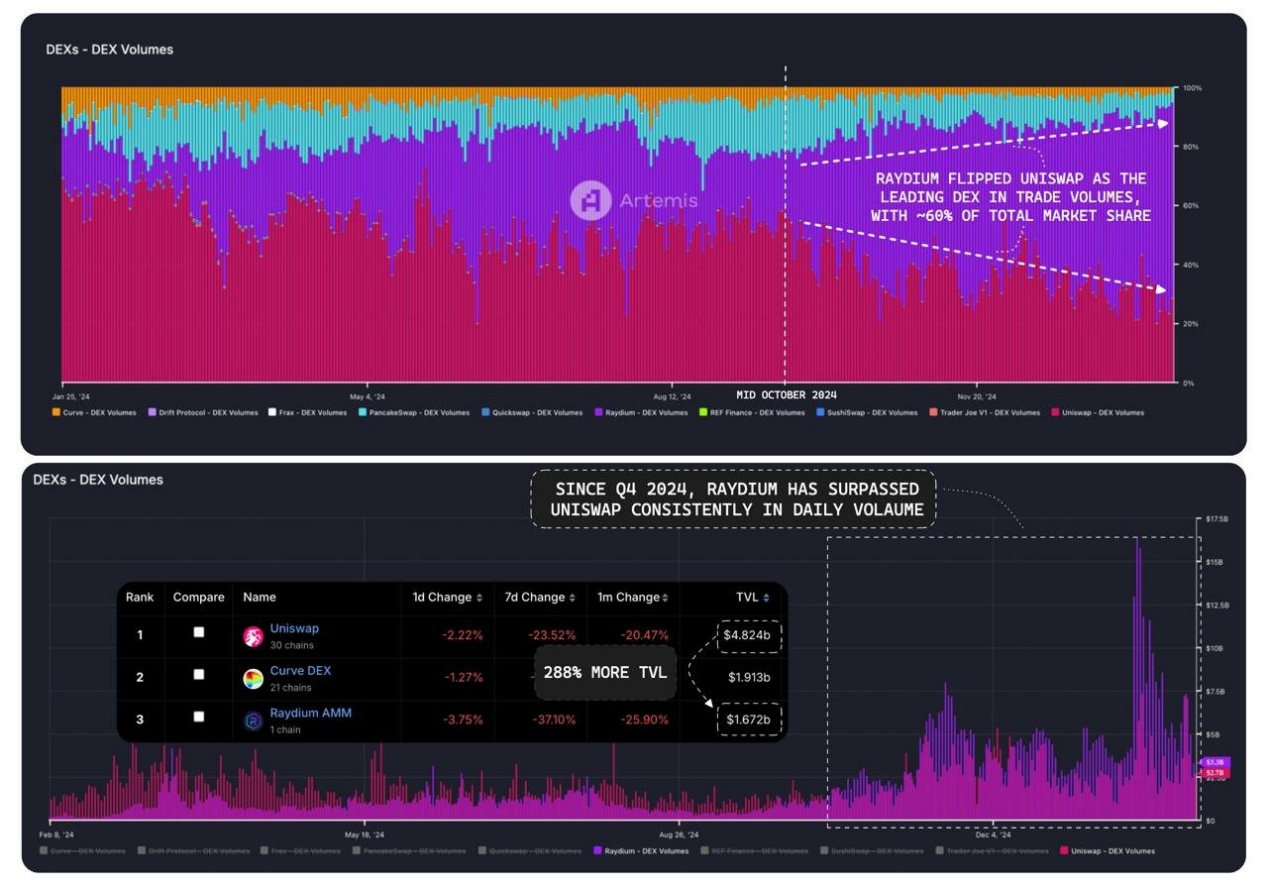

In the fourth quarter of 2024, the DEX platform Raydium (an automated market maker based on Solana) accounted for about 61% of the market share, surpassing Uniswap to become the industry leader. It is worth mentioning that Raydium's TVL is only about 39% of Uniswap's.

While Raydium’s rise may be due to the Memecoin Season of the Solana ecosystem, the durability of its LT (Note: User Life Cycle, a measure of user activity) remains uncertain.

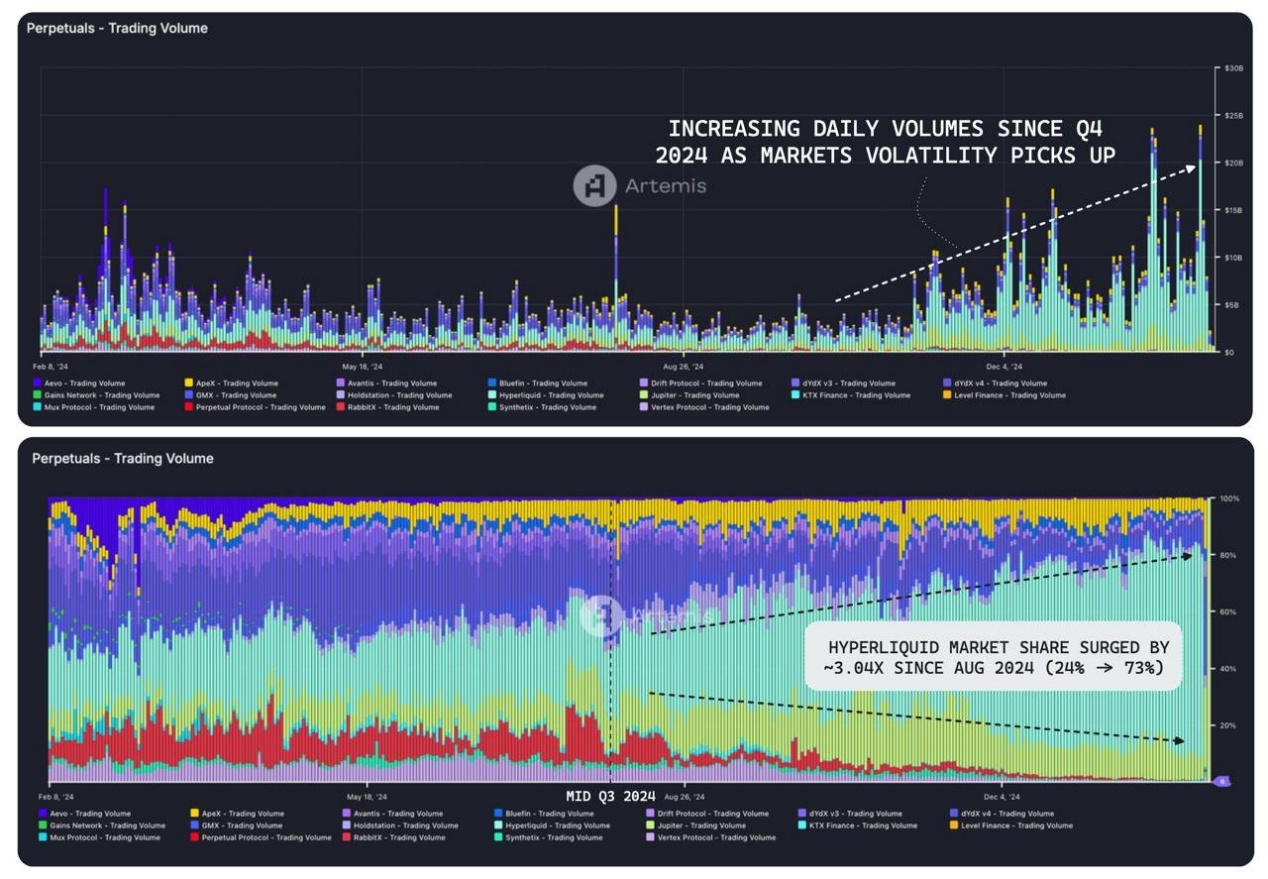

The winners in the perp DEX space stand out. Hyperliquid’s dominance has been further consolidated since Q3 2024, with its market share increasing from 24% to 73% (3x).

Since the fourth quarter of 2024, overall perp DEX trading volume has been recovering, with daily trading volume currently around $8 billion, compared to just $4 billion back then.

Hyperliquid continues to challenge CEX’s position as a price discovery platform.

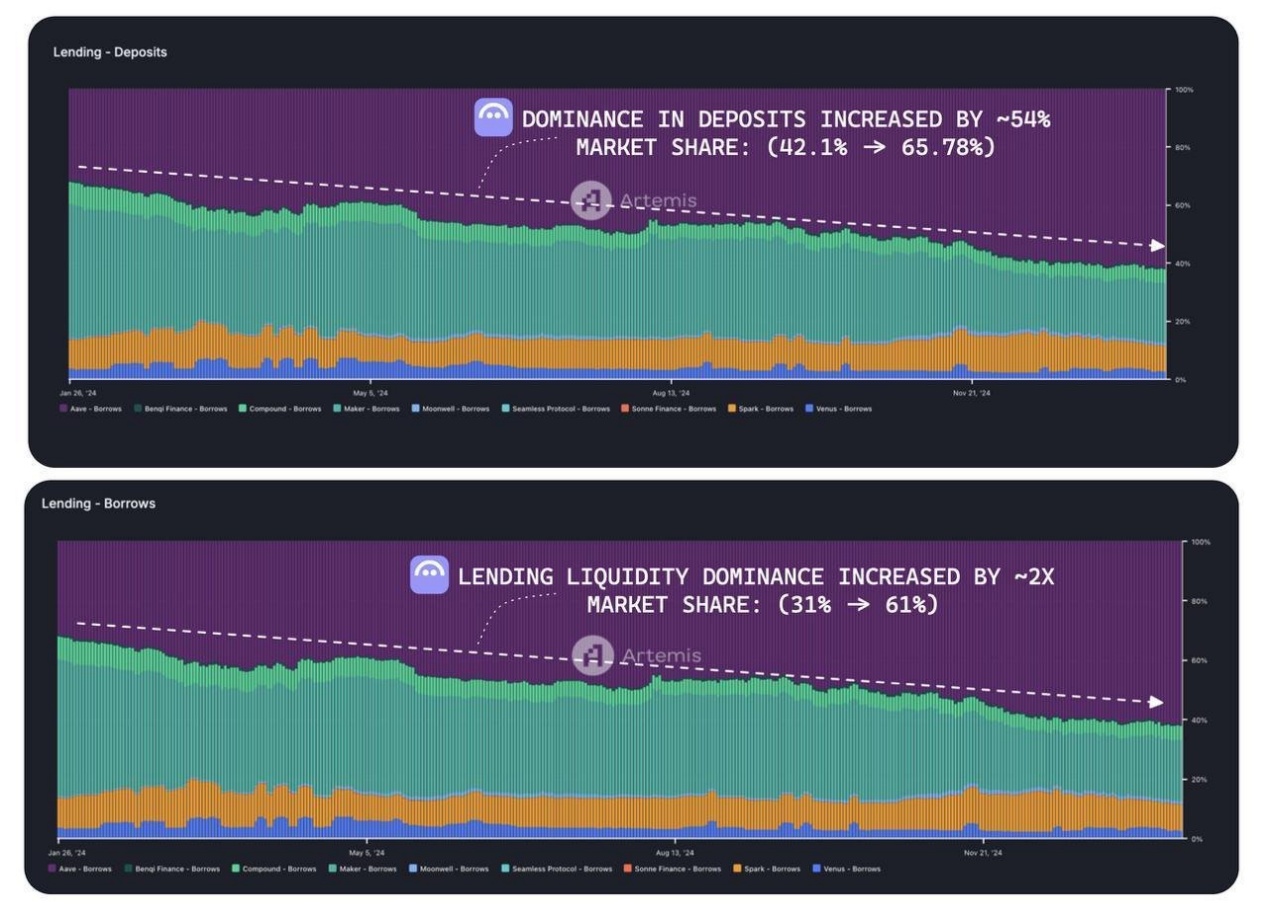

Aave’s dominance in the lending space has increased since 2024:

- Deposits: 42.1% to 65.78%

- Borrowing: 31% to 61%

Even though Aave does not have the most attractive yields, its long-standing reputation and users’ trust in the protocol make it a top choice in the lending space.

In the revenue space, the dominant player Pendle is leading the way with a market share of over 50%. Its unique value proposition is to be the preferred promoter of industry value discovery. Despite the overall slowdown in the DeFi market and low market sentiment, Pendle still holds the TVL record.

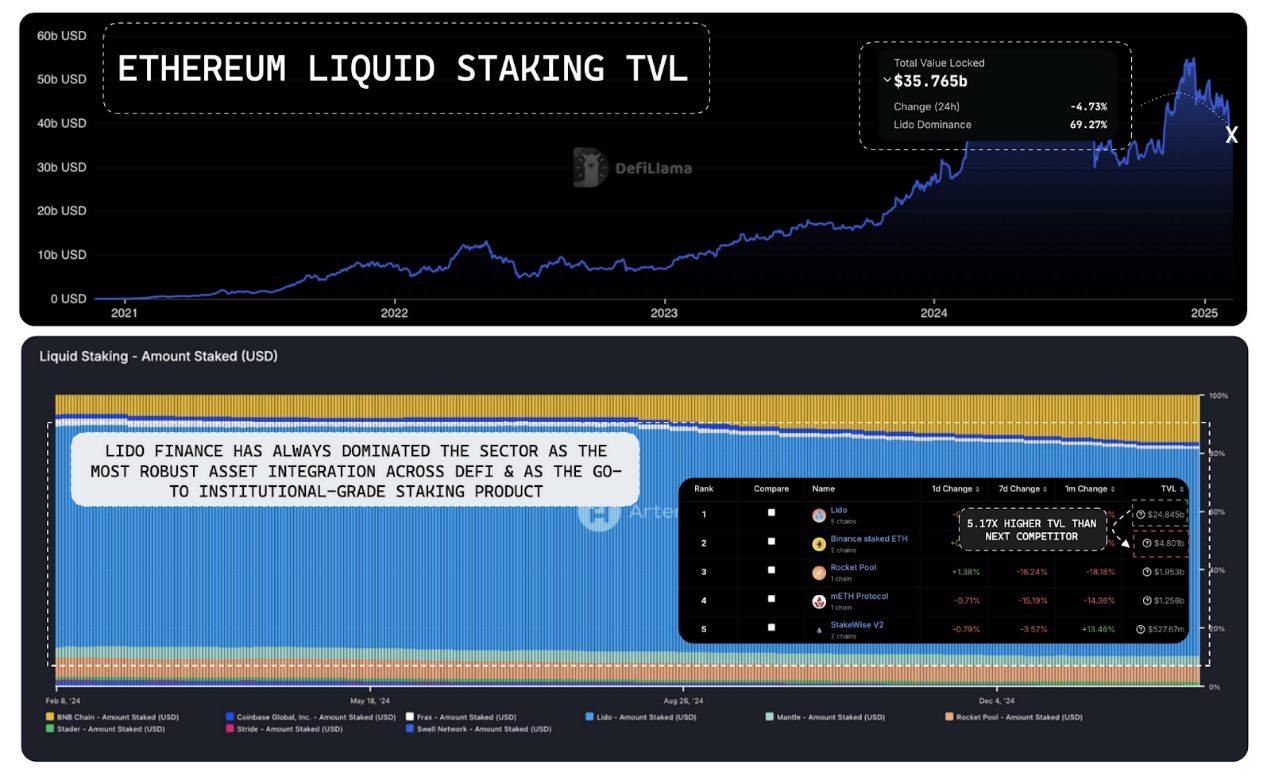

Liquidity Staking (LST) is by far the largest sector in DeFi in terms of TVL at around $35 billion.

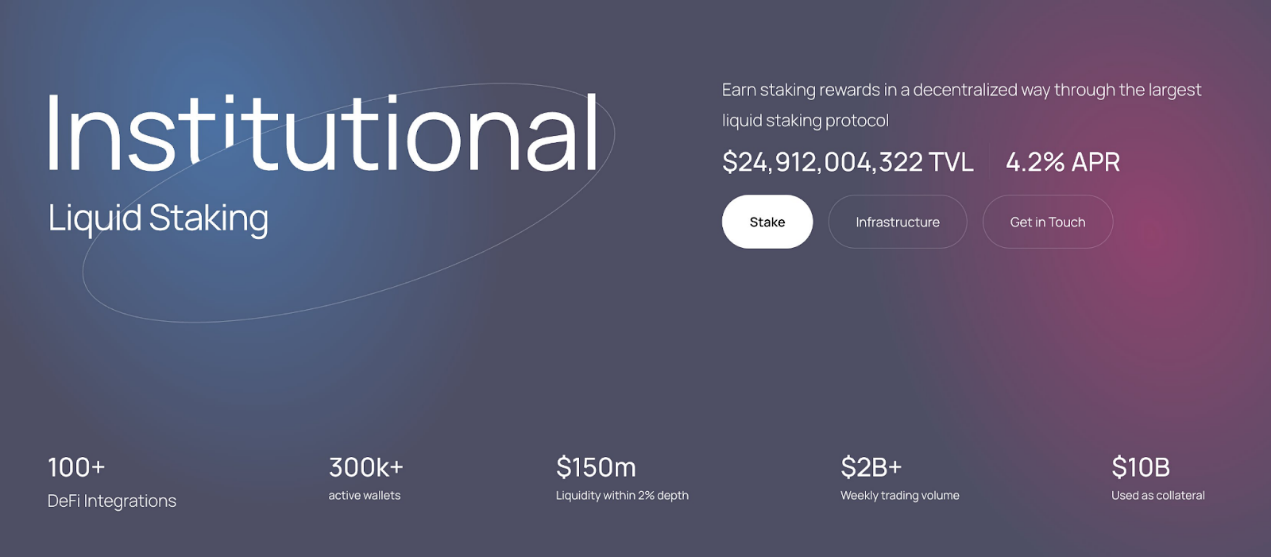

Lido Finance is the undisputed leader with a market share of about 70%, almost monopolizing the LST field, and its TVL ($24.8 billion) is 5.17 times that of its competitor Binance bETH ($4.8 billion).

This dominance is not driven by staking yield, but rather by the asset value of stETH:

- Best Asset Utilization: The Most Integrated Assets in DeFi

- The most trusted service: the preferred institutional-grade staking solution for funds and entities

Credibility and trust are key to adoption.

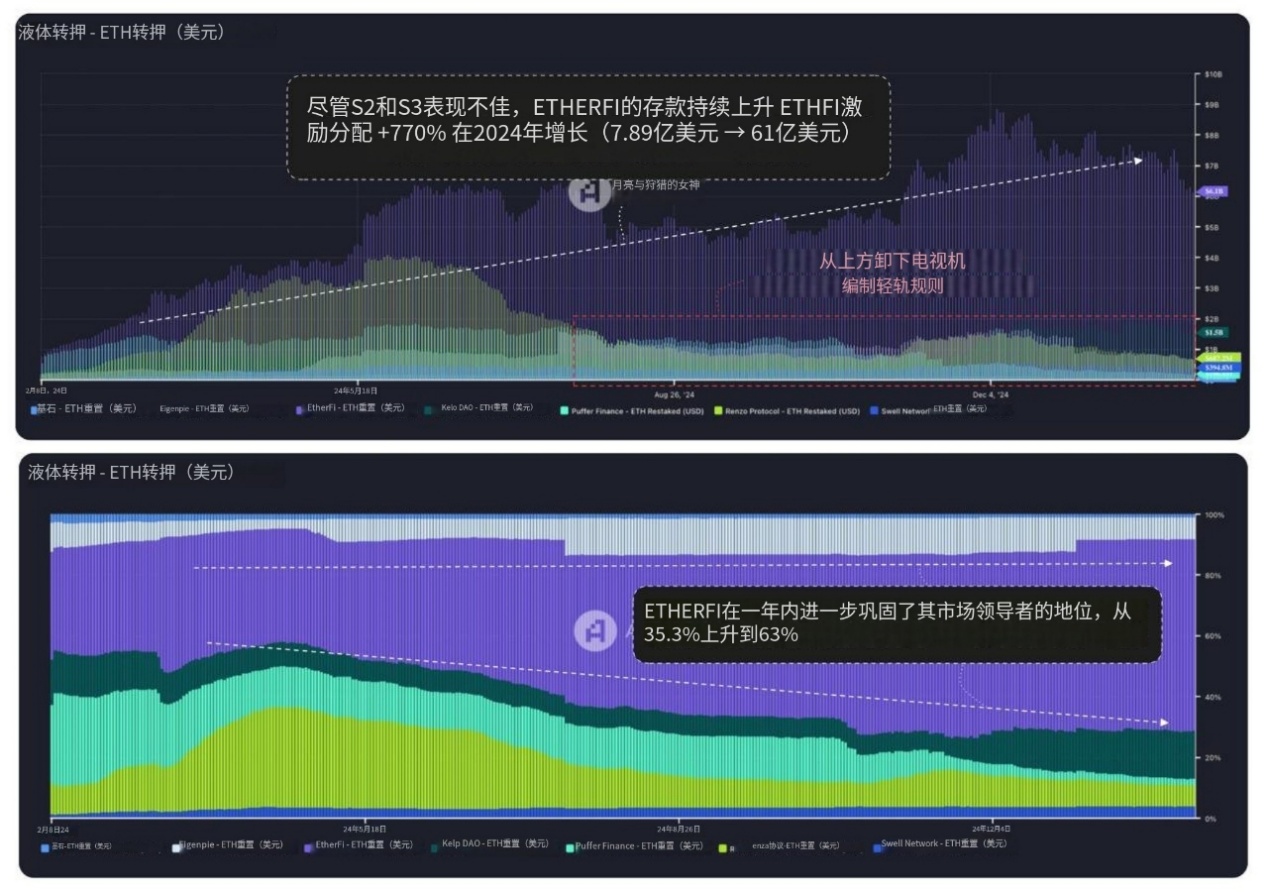

As for liquidity re-staking, the market trend is roughly the same. It is worth noting that ether.fi's market share has increased from 35.3% to 63%. Because even though ether.fi's staking volume in S1 and S2 has decreased, its TVL has increased by about 770% in 2024.

This growth is driven by the following factors:

- First-mover advantage in the ecosystem

- Extensive DeFi Integration

- Trust in product suite

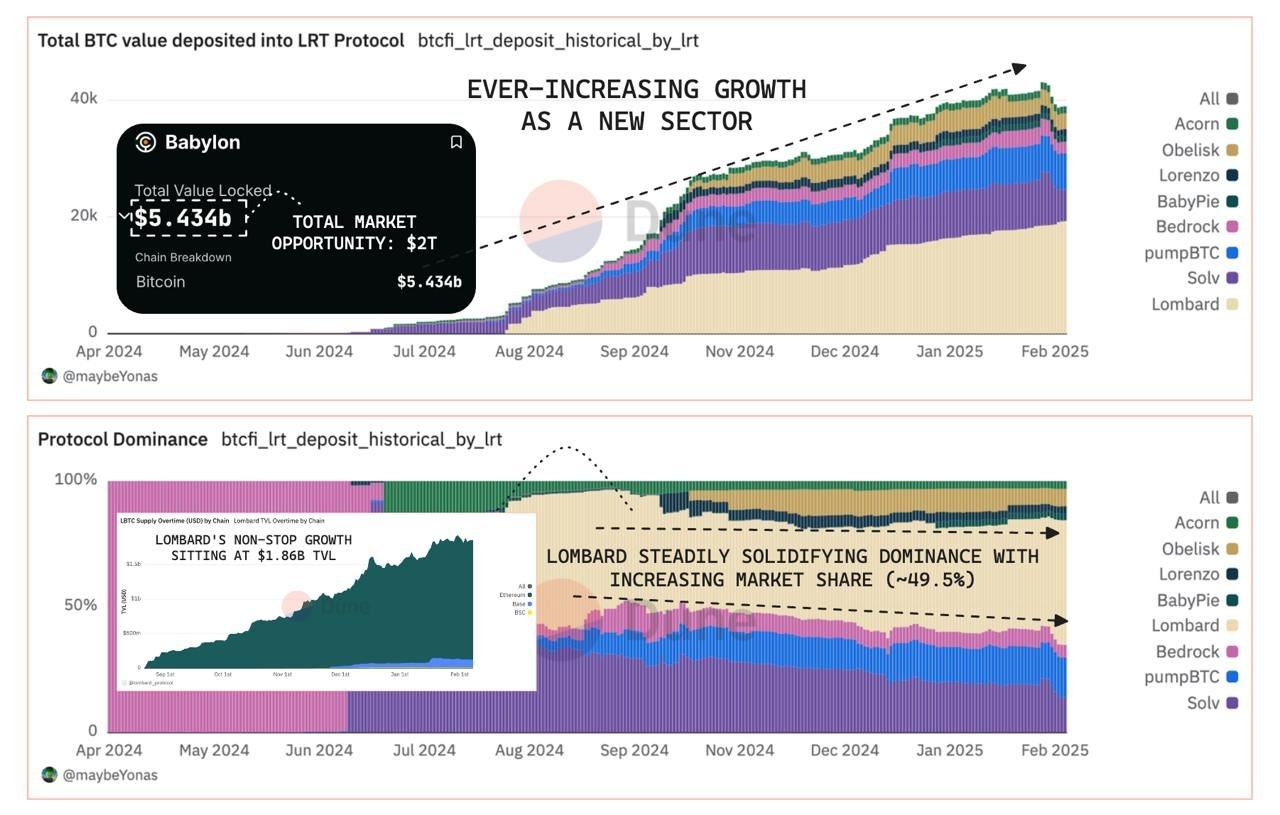

Lombard’s performance in the BTC-Fi space closely mirrors trends in the LST/LRT space, with market share steadily increasing to 49.5%.

As Babylon matures, demand for BTC as the premier safe haven asset will grow exponentially, creating a $2 trillion market opportunity.

Since LBTC is the most integrated, widely used, and security-focused LRT in DeFi, Lombard will become the first asset to gain institutional trust and widespread adoption like stETH. Lombard will dominate the industry.

In summary, each DeFi field has obviously found its own PMF, forming an overall ecosystem that complements each other. This is the rise of a new primitive set that subverts CeFi.

As DeFi enters its next phase of expansion, we will see more new verticals introduced into untapped markets and even integrated into CeFi:

- Ethena Labs: Plans to integrate TradFi payments

- Mantle: Mantle Index Fund and Mantle Banking Integrate Crypto with TradFi

As more and more institutions become interested in DeFi, such as BlackRock's participation in DeFi through BUIDL, WLFI's DeFi portfolio and spot ETF, they are optimistic about the future development of DeFi.

Related reading: A preliminary study of DeFAI: Deep integration of DeFi and AI, three core scenarios promote large-scale application of DeFi

You May Also Like

Trump goes on early morning Truth Social spree reposting calls for Obama's arrest

SEC Clears the Way for Spot Crypto ETFs with New Generic Rules