Fetch.ai (FET) Exits Multi-Year Downtrend Following Prior 1,400% and 2,000% Runs

Fetch.ai’s FET token is back in focus after breaking a long-standing downtrend that had capped price action for more than two years.

Market watcher Crypto Patel pointed out that this move stands out from earlier attempts, as it mirrors past breakout structures that led to explosive gains. In 2022, a similar setup resulted in a rise of around 1,410%, followed by an even stronger 2,097% run in 2023.

With the long base between $0.1243 and $0.0455 holding firm during the broader decline, this third breakout is being watched as the possible start of another extended uptrend lasting several months.

The pattern is clear on the weekly FET/USDT chart. Long drops in price are followed by quick upswings after the price moves above the downsloping trendlines.

From 2022 to early 2023, FET had been under falling resistance, creating lower highs while being squeezed near the bottom of the range. Once that pressure released, price jumped up fast.

Source: X

Also Read: Fetch.ai Leads the Agent Economy as Digital Intelligence Expands Globally

Fetch.ai Breakout Structure Signals a Shift in Long-Term Trend

After peaking at around $3.00 in 2024, FET fell into another big drop. Price has remained under the long-term downtrend in 2025, creating lower highs and trending toward the $0.27-$0.28 demand zone.

The area has supported the price in previous cycles, and the most recent weekly candle closed clearly above the trendline. The setup is similar to the 2023 reversal in that FET spent weeks forming a base prior to moving higher.

First upside targets are around $0.69–$0.70, and any bigger move could hit the previous cycle high near $3.50 if momentum continues strong. Of course, former resistance acting as support is a sign of a real trend shift rather than a short-lived bounce.

Indicators Point to Base Building, Not Euphoria

Although the setup does look positive, we should remain careful with regard to the overall trend. FET is trading around $0.28, well beneath its major moving averages. The 20-, 50-, 100-, and 200-week averages are all above the price, with the shorter ones trending down.

Source: Tradingview

It means that a rally may find resistance between $0.37 and $0.55 before an effective reversal in fortunes is achieved. The momentum indicators suggest consolidation rather than upward momentum. The RSI is rising from oversold but still below neutral, and the MACD weakness is waning but has not turned positive.

Also Read: Fetch.ai (FET) Price Could Mirror Past Cycles with Massive 600%–1,600% Expansion

You May Also Like

CME Group to launch options on XRP and SOL futures

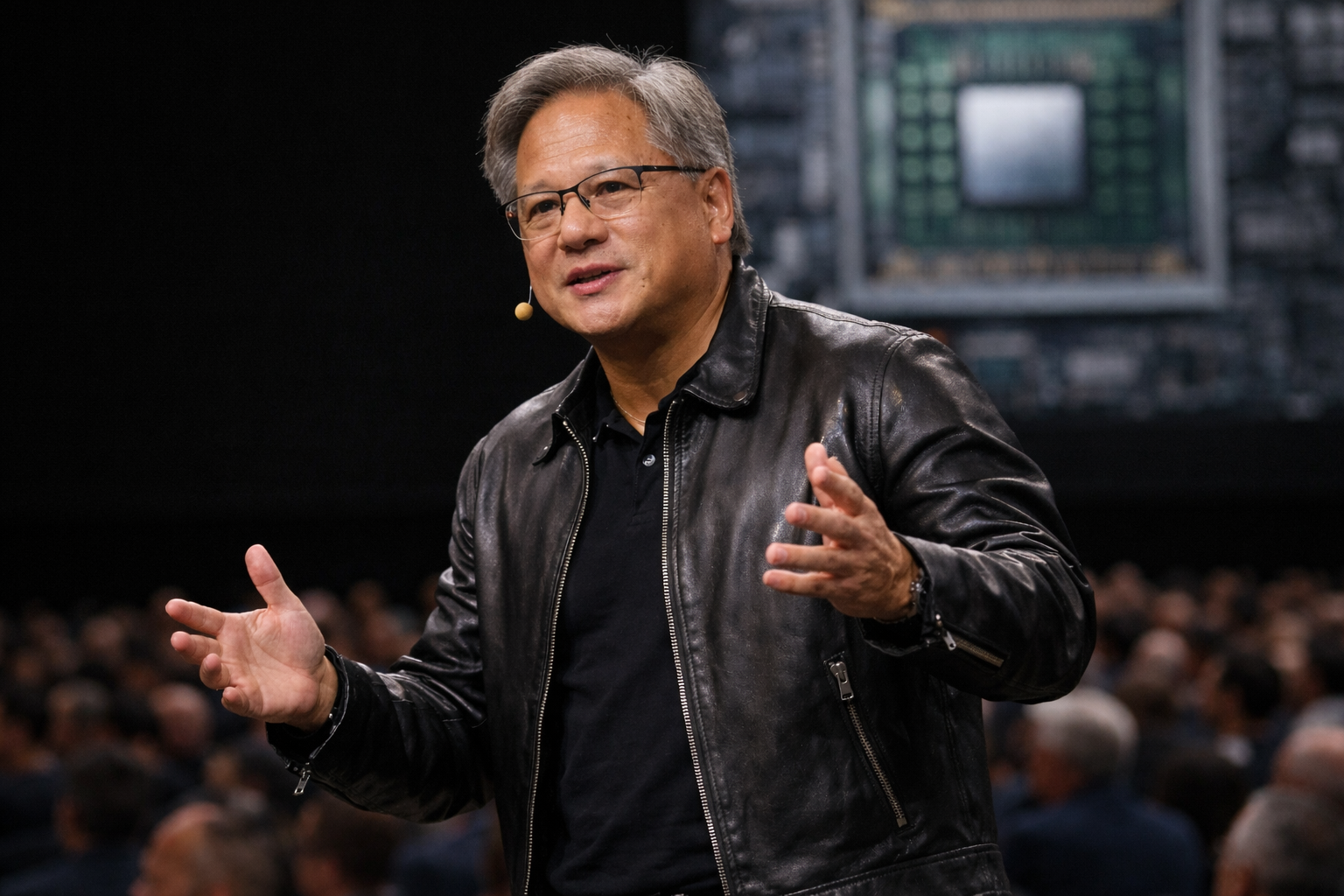

Nvidia’s Jensen Huang believes markets are wrong on software selloff