Ethereum Price Prediction: ETH Price Coils in Symmetrical Triangle Near $3,100 as $3,300 Resistance and $2,900 Support Define Breakout Risk

Currently hovering around $3,090–$3,100, ETH is exhibiting low volatility but building pressure within the triangle’s apex. Analysts note that historical triangle patterns often precede sharp price expansions or corrective moves, making confirmation essential before any directional bets.

Symmetrical Triangle Dynamics and Historical Context

The daily chart displays a classic symmetrical triangle, characterized by lower highs near $3,300–$3,350 and higher lows from $2,850–$2,900. Such formations typically reflect declining volatility and often precede sharp price expansions. Historically, Ethereum’s triangle compressions have broken in the direction of the prevailing trend about 60–70% of the time, though false breakouts are common if retest levels fail to hold.

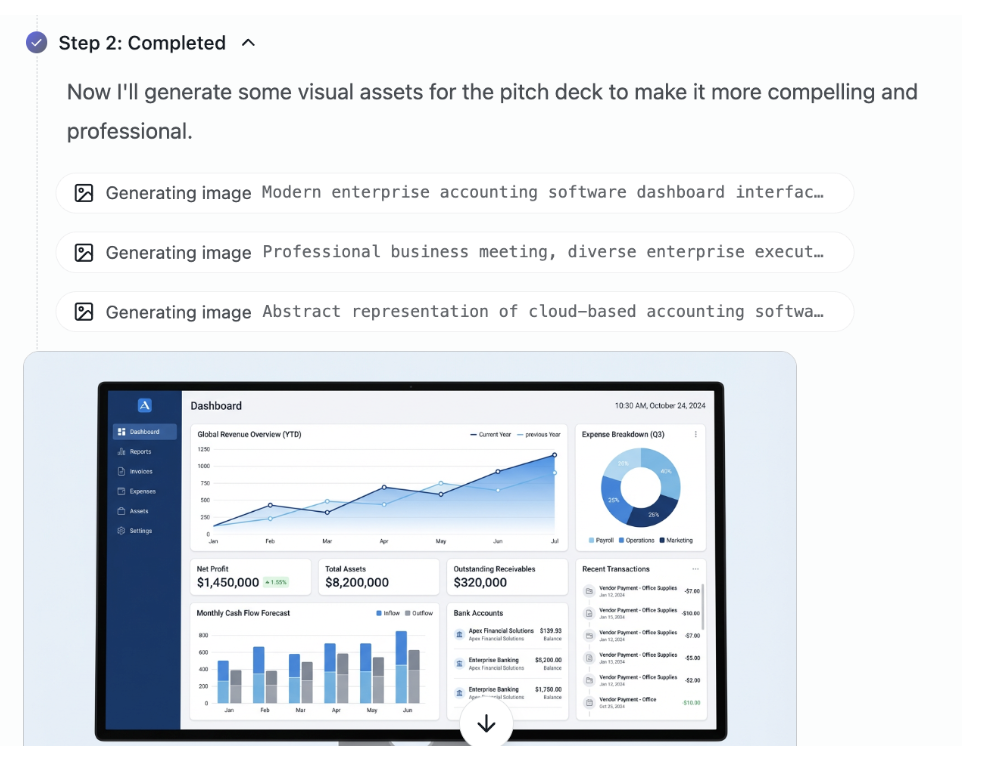

Ali Charts’ analysis shows Ethereum coiling in a daily symmetrical triangle near $3,095, indicating potential for a breakout while cautioning that false moves are common and confirmation is essential. Source: Ali Martinez via X

Market analyst Ali Martinez, known as Ali Charts, recently noted that ETH remains “trapped inside a symmetrical triangle,” emphasizing the need for a confirmed breakout rather than guessing inside the consolidation. Analysts recommend monitoring both the triangle’s upper resistance and lower support lines, alongside volume surges, for reliable signals.

Technical Structure: Support Holds and Short-Term Channels

Ethereum’s recent price action indicates support has been effective near $2,900. Observers such as The Boss (@Crypto_TheBoss) highlighted that, as long as ETH stays above this support, a retest of resistance zones remains technically plausible. Historical data support this, as ETH dipped below $3,000 in late December 2025 but rebounded to above $3,200 in early January 2026, demonstrating that the move was corrective rather than trend-breaking.

Crypto_TheBoss notes ETH bounced from $2,900 support and may retest resistance near $5,526 if the trend holds. Source: The Boss via X

On lower timeframes, ETH trades within an ascending channel. Price consolidates above moving-average support and a demand zone aligned with the channel’s lower boundary. This zone is significant for short-term traders seeking potential bounce points. The timeframe for this channel is hourly (1H), and the channel’s integrity is crucial for anticipating continuation or breakdown scenarios.

Liquidity, Leverage, and Potential Breakouts

Aggregated derivatives data shows that ETH markets carry significant leveraged positions on both sides. Across major derivatives venues, more than $1 billion in liquidations is stacked above and below the current price, suggesting that a confirmed breakout could trigger rapid moves.

Ethereum is trading in a daily symmetrical triangle ($3,300–$3,350 highs, $2,850–$2,900 lows), with over $1B in liquidations nearby, making breakouts potentially fast and volatile. Source: FlorinCharts on TradingView

- A daily close above $3,300 could pressure shorts clustered near $3,400, creating a potential short squeeze.

- Conversely, a break below $2,900 may trigger long liquidations, potentially pushing ETH toward $2,700–$2,600.

These dynamics highlight the short-term trading relevance of ETH’s triangle pattern. Market participants should size positions carefully, considering the potential for rapid volatility expansion once the structure breaks.

Ethereum Price Outlook: Short-Term vs Long-Term Considerations

From a technical perspective, Ethereum remains in consolidation rather than directional confirmation. Analysts emphasize reacting to confirmed structure breaks rather than attempting to predict moves within the triangle.

- Short-term traders should monitor for volatility expansion following a triangle breakout. Quick, intraday reactions may occur if ETH moves above $3,300 or below $2,900.

- Long-term investors may view current support and staking activity as indicators of structural integrity, signaling sustained network confidence.

Ethereum was trading at around 3,092.34, up 0.42% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

Until a decisive close outside the triangle occurs, ETH price action reflects a balance between buyers and sellers rather than market conviction. Historical patterns suggest that triangles often resolve with momentum continuation, but false breakouts are possible if retests fail.

For now, Ethereum’s price forecast remains cautiously neutral, with market participants advised to prioritize confirmation and risk management over speculation.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

CME Group to launch options on XRP and SOL futures