Dogecoin Eyes a New Chapter as 21Shares Prepares to Launch DOGE Spot ETF this Week

- 21Shares has cleared regulatory steps to launch its spot Dogecoin ETF on Nasdaq.

- The launch puts the 21Shares product on par with existing Dogecoin ETFs.

21Shares has moved closer to launching its spot Dogecoin ETF after submitting a final prospectus to the U.S. Securities and Exchange Commission. The filing clears the product to be listed on Nasdaq under the ticker symbol TDOG, positioning it to start trading as early as this week. As a result, Dogecoin becomes one of the few digital assets to have multiple spot ETF products live in the US market.

ETF Filings Signal Growing Institutional Access to Dogecoin

The new fund joins a small but growing wave of spot Dogecoin ETFs that are already available. Products from Grayscale and Bitwise have already been launched, creating a regulated channel for exposure to the meme-based cryptocurrency.

The 21Shares product tracks the spot DOGE prices with the CF Dogecoin-Dollar US Settlement Price Index. It provides direct exposure without the need for leverage or speculative trading strategies. Shares are created and redeemed in blocks of 10,000, known as baskets, and Dogecoin only moves in or out of the trust during these times. Consequently, the structure is similar to that of other spot crypto ETFs whose aim is to provide a close reflection of underlying asset prices.

The ETF has a management fee of 0.50%, which is accrued daily and paid weekly in DOGE. No fee waiver has been revealed. Administrative duties are assigned to The Bank of New York Mellon, and custody services are divided up between Coinbase Custody Trust, Anchorage Digital Bank and BitGo. Wilmington Trust provides trustee support for governance and operational oversight.

Corporate Partnerships Expand Dogecoin’s Strategic Footprint

Alongside ETF developments, Dogecoin’s ecosystem is also advancing on the corporate front. As we reported earlier, the House of Doge, which serves as a business-focused wing of the Dogecoin Foundation, has outlined plans to collaborate with two Japanese companies. The strategy focuses on regulated tokenization, payment integrations and real-world asset initiatives focusing on the Japanese market structure.

The roadmap focuses on cooperative phases instead of introducing one product. The goal is to create safe and scalable systems in support of the use of Dogecoin in daily business. In the long run, such initiatives will help to make DOGE a useful tool of exchange, as opposed to being a highly speculative asset.

DOGE Price Holds Range

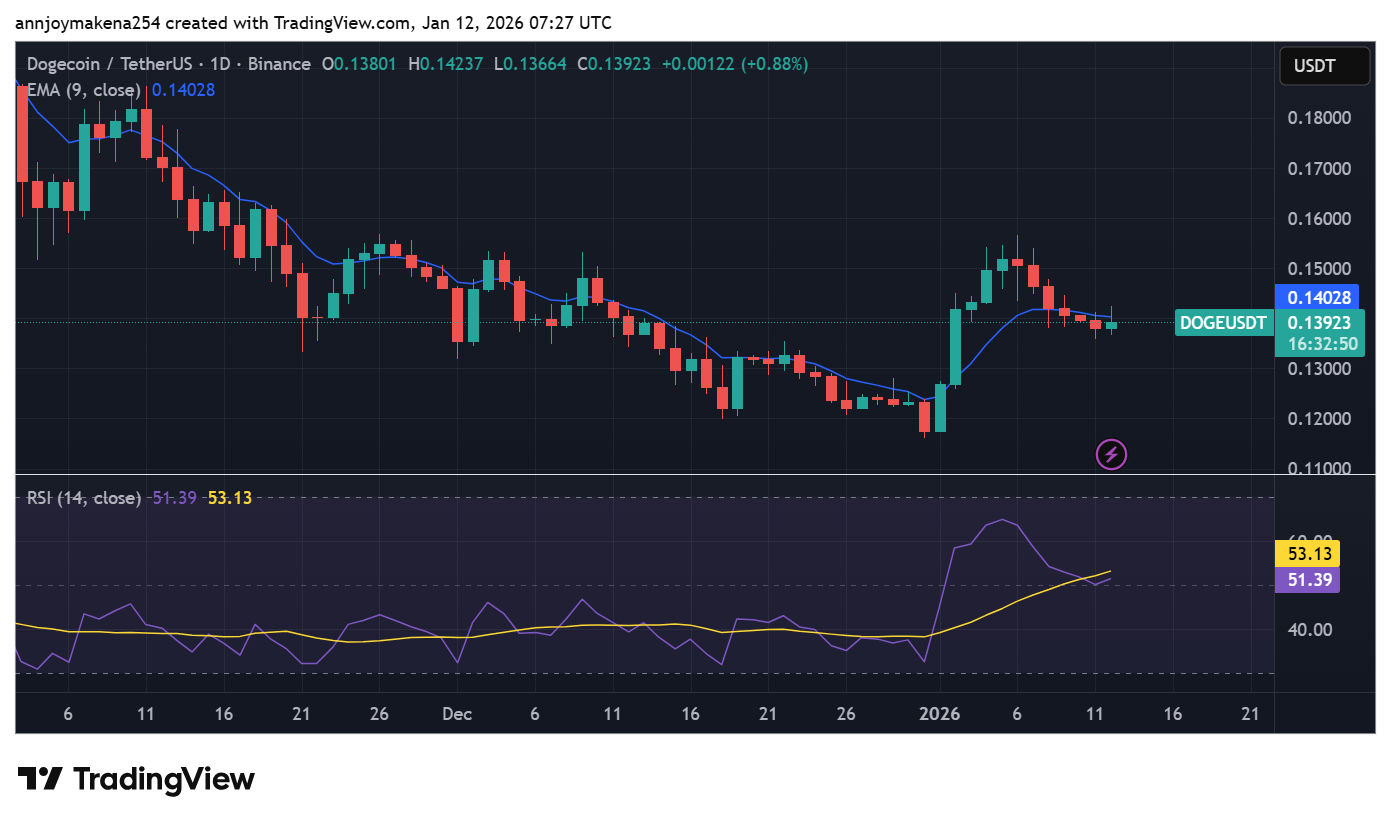

Dogecoin is trading at $0.137, registering a 1.22% decline over the past 24 hours. Price action has since stabilized from an early January rebound, which took DOGE briefly to the mid-$0.15 range. However, sellers are continuing to cap advances near previous resistance levels.

Technical indicators suggest consolidation rather than the ideal acceleration of the trend line. The 9-day exponential moving average, which is just above 0.1403, is providing a short-term resistance point. Meanwhile, the 14-day RSI is still within the low 50s, which reflects a neutral momentum compared to the earlier bearish momentum. The support is clinging to 0.135, with a superior base of about 0.120. On the positive front, a long-term action above $0.145 would open up new targets.

Source: TradingView.com ]]>

Source: TradingView.com ]]>You May Also Like

Subaru Motors Finance Reviews 2026

Shiba Inu Price Prediction: Dubai Cracks Down on KuCoin as Pepeto Outpaces DOGE and SHIB With $7.4M Raised

![[Two Pronged] Teen daughter hates father for cheating and won’t respect him](https://www.rappler.com/tachyon/2026/03/two-pronged-daughter-mad-at-father.jpg)