Ethereum Needs Better Decentralized Stablecoins, Buterin Says

Ethereum needs “better decentralized stablecoins,” Vitalik Buterin said this weekend, arguing that the next iteration has to solve three design constraints that today’s models keep skirting. His comments landed alongside a broader claim from MetaLeX founder Gabriel Shapiro that Ethereum is increasingly a “contrarian bet” versus what much of the venture-backed crypto stack is optimizing for.

Shapiro framed the split in ideological terms, saying it is “increasingly obvious that Ethereum is a contrarian bet against most of what crypto VCs are betting on,” listing “gambling,” “CeDeFi,” “custodial stablecoins,” and “’neo-banks’” as the center of gravity. By contrast, he argued, “Ethereum is tripling down on disrupting power to enable sovereign individuals.”

Why Ethereum Lacks A Decentralized Stablecoin

Buterin’s stablecoin critique starts with what to stabilize against. He said “tracking USD is fine short term,” but suggested that a long-horizon version of “nation state resilience” points to something that is not dependent on a single fiat “price ticker.”

“Tracking USD is fine short term, but imo part of the vision of nation state resilience should be independence even from that price ticker,” Buterin wrote. “On a 20 year timeline, well, what if it hyperinflates, even moderately?” That premise shifts the stablecoin problem from simply maintaining a peg to building a reference index that can plausibly survive macro regime changes. In Buterin’s framing, that is “problem” one: identifying an index “better than USD price,” at least as a north star even if USD tracking remains expedient near term.

The second issue is governance and oracle security. Buterin argued that a decentralized oracle must be “not capturable with a large pool of money,” or the system is forced into unattractive tradeoffs that ultimately land on users.

“If you don’t have (2), then you have to ensure cost of capture > protocol token market cap, which in turn implies protocol value extraction > discount rate, which is quite bad for users,” he wrote. “This is a big part of why I constantly rail against financialized governance btw: it inherently has no defense/offense asymmetry, and so high levels of extraction are the only way to be stable.”

He tied that to a longer-running discomfort with token-holder-driven control structures that resemble markets for influence. In his view, “financialized governance” trends toward systems that must continuously extract value to defend themselves, rather than relying on a structural advantage that makes attacks meaningfully harder than normal operation.

The third problem is mechanical: staking yield competes with decentralized stablecoins for capital. If stablecoin users and collateral providers are implicitly giving up a few percentage points of return relative to staking ETH, Buterin called that “quite bad,” and suggested it becomes a persistent headwind unless the ecosystem changes how yield, collateral, and risk interact.

He laid out what he described as a map of the “solution space,” while stressing it was “not endorsement.” Those paths ranged from compressing staking yield toward “hobbyist level,” to creating a staking category with similar returns but without comparable slashing risk, to making “slashable staking compatible with usability as collateral.”

Buterin also sharpened what “slashing risk” actually means in this context. “If you’re going to try to reason through this in detail,” he wrote, “remember that the ‘slashing risk’ to guard against is both self-contradiction, and being on the wrong side of an inactivity leak, ie. engaging in a 51% censorship attack. In general, we think too much about the former and not enough about the latter.”

The constraint bleeds into liquidation dynamics as well. He noted that a stablecoin “cannot be secured with a fixed amount of ETH collateral,” because large drawdowns require active rebalancing, and any design that sources yield from staking must reckon with how that yield turns off or changes during stress.

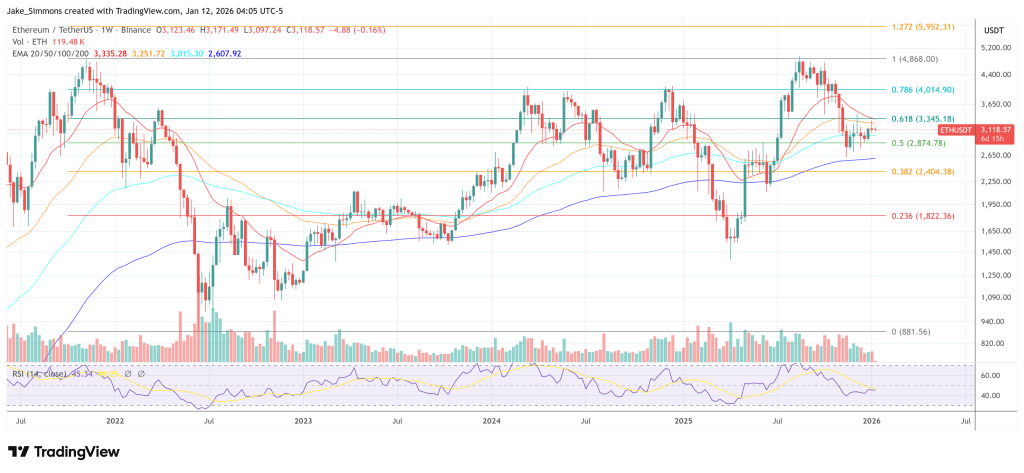

At press time, ETH traded at $3,118.

You May Also Like

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!

Wall Street’s Pivotal Shift To Digital Asset Leadership