BNB Price Prediction: BNB Eyes $1010 as the Funding Rate Flips Positive

Highlights:

- BNB price could break out toward $1,010 as it stabilizes above support levels.

- The derivatives market shows a rise in open interest and a positive funding rate, reinforcing the bullish grip.

- The technical outlook indicates a bullish trend, as a break above $930 could see BNB eye $1010.

Binance Coin(BNB) price is slowly stabilizing, trading at $908, marking a 1% increase over the past 24 hours, as the coin approaches the upper limit of its consolidation range. Sideways price action may halt as the derivatives market indicates positive sentiment. Notably, the technical outlook indicates a potential upside of $1,010 in the BNB price. Meanwhile, Grayscale has listed more than 30 digital assets under consideration, including BNB.

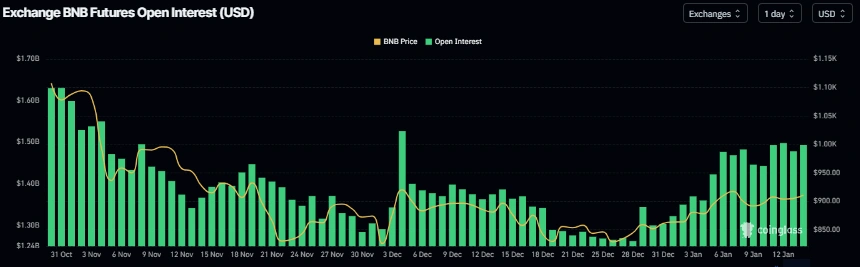

According to CoinGlass data, the OI of BNB-based futures on exchanges has reached $1.50 billion on Tuesday. This marks the highest level since December 31, which was approximately $1.30 billion. The rising OI indicates new entrants, increased capital inflows into the market, and purchase growth, which may contribute to a breakout in BNB’s price soon.

BNB Open Interest: CoinGlass

BNB Open Interest: CoinGlass

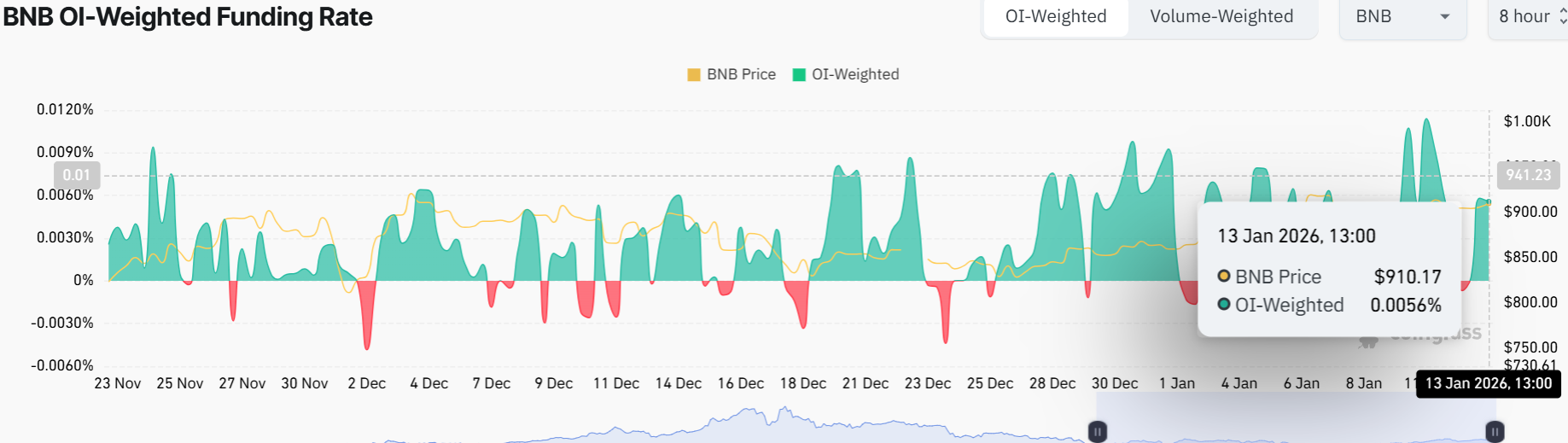

Additionally, the bullish bias is evident in BNB, as its funding-rate data have turned positive. According to CoinGlass data, the OI-Weighted Funding rate indicates that the trading community is betting on an increase in the BNB price.

BNB OI-Weighted Funding Rate: Coinglass

BNB OI-Weighted Funding Rate: Coinglass

The metric has reversed to positive, with a value of 0.0056% on Tuesday, indicating that longs are paying shorts. In most cases, when funding rates shift from negative to positive, as indicated in the chart, the price of BNB surges.

BNB Eyes $1010 as Bullish Momentum Builds

Turning to the technical analysis of BNB, the price is currently above key support levels at $908. The key moving averages include the 50-day SMA at $876 and the 200-day SMA at $901, which serve as immediate support levels in the market.

BNB has been in a sideways movement recently, making higher highs and higher lows over the past few weeks. Currently, the token is testing the upper line of the consolidation channel, as the bulls are building momentum for a breakout. The Relative Strength Index (RSI) is at 59.15, indicating positive momentum but remaining below overbought levels, leaving room for the price to continue rising.

BNB/USD 1-day chart: TradingView

BNB/USD 1-day chart: TradingView

The MACD supports this view, with the MACD line above the signal line and the histogram displaying more green bars, indicating increasing bullish momentum. Key support levels to watch include a break above the consolidation pattern at $930. A break above this zone could open the door to the $1010- $1087 resistance zones soon. This will only be reinforced majorly if the key support zones hold steady and the volume spikes.

On the downside, if early profiteering commences, bulls may find support around the $901 zone. A breach below that may see the price dwindle towards $876, where the bulls may gather again for an upside movement.

Overall, the BNB price appears poised for a strong upward path, driven by both positive funding rate and positive technical indicators. If the price rises above $930, it could yield gains of approximately $1,010 to $1,087. If it pulls back, those earlier support levels should hold well and keep the price stable.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon