Top 10 Cryptos by Developer Activity: MetaMask, Filecoin, and StarkNet Lead the Pack

- MetaMask, Filecoin, and StarkNet outshine other top blockchains in developer activity.

- mUSD, FIL, and STRK prices rally with rising development activity and protocol integrations.

MetaMask, Filecoin, and StarkNet have emerged as the leading cryptocurrencies in the top 10 list by development activity over the past 30 days. Their position on the list is a sign that core teams are still focused on improving their platforms.

MetaMask, Filecoin, and StarkNet Shine in Developer Activity

Santiment data revealed that there are still active developments going on in MetaMask, Filecoin, and the StarkNet blockchains.

However, MetaMask (mUSD) outranked Filecoin (FIL), StarkNet (STRK), and the other top layer-1 blockchain networks in GitHub Commits.

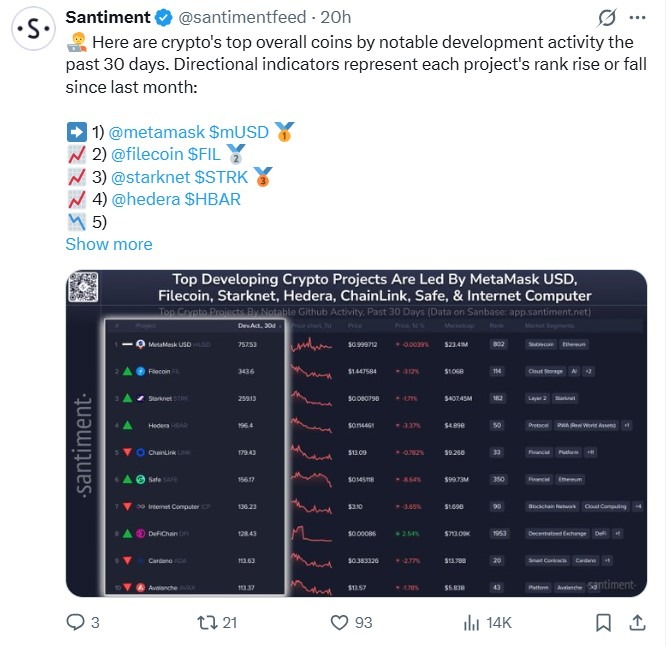

Over the past 30 days, MetaMask has recorded a total of 757.53 commits on GitHub. This figure places it above its major rivals, Filecoin and StarNet, whose collated data come in at 343.6 and 259.13, respectively.

Crypto Coin Development Outlook | Source: Santiment on X

Crypto Coin Development Outlook | Source: Santiment on X

Other featured protocols in the top 10 developer activity list include Hedera (HBAR), Chainlink (LINK), and Safe (SAFE). While they have also received substantial developer commits over the past week, they still lag behind MetaMask.

According to the Santiment data, commit counts for HBAR, LINK, and SAFE came in at 196.4, 179.43, and 156.17, respectively.

Some market experts explain developer activity as a direct reflection of the prospects of the protocol. While this is not always correct, more commits might imply projects are launching more decentralized applications (dApps).

Also, developer activity implies updates and upgrades to existing applications. Overall, it can help to solidify the resilience of the protocols.

Price Implications for mUSD, FIL, and STRK

The general expectation is that more robust developer activities will translate into a positive uptick in volume and price. The high developer impetus can make more institutional investors trust the platform. Usually, this scenario plays out where transparency and consistent development are required.

As summarized in our earlier news story, MetaMask recently expanded cross-chain swaps using Rango’s multi-network routing infrastructure. Alongside this, the team said they are already working on integrations with the Tron blockchain.

Furthermore, MetaMask Mobile integrates directly with Polymarket, allowing users to place predictions without leaving the app.

FIL has surged over 2% in the past 24 hours to $1.48, with a market cap of $1.09 billion. The FIL price rally coincides with the increasing use of AI-based data storage on the Filecoin network, as we discussed.

Accordingly, Filecoin recently topped artificial intelligence (AI) and big data development rankings at the beginning of the year.

Following the positive trend, STRK jumped 2.24% over the previous day to $0.082. In a recent study we reported on, analysts predicted that STRK could rally 300% in the long term.

]]>You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

When to Hire Land Clearing Services for Property Development