BlockDAG, Bitcoin Hyper and Remittix Compared as Analysts Debate XRP-Style Price Potential

Market participants are increasingly comparing new crypto projects to XRP’s early price growth. Traders are questioning whether newer crypto projects can combine strong narratives, practical use cases, and institutional interest.

Bitcoin Hyper and BlockDAG are currently receiving increased attention across social media and research communities. Some investors are searching for high-growth altcoin opportunities as XRP price outlooks become more positive.

Remittix, meanwhile, is approaching the market from a utility-first angle, aiming to address payment and remittance use cases. This section examines how analysts may assess these projects looking ahead to 2026.

BlockDAG: Infrastructure Narrative Gains Traction

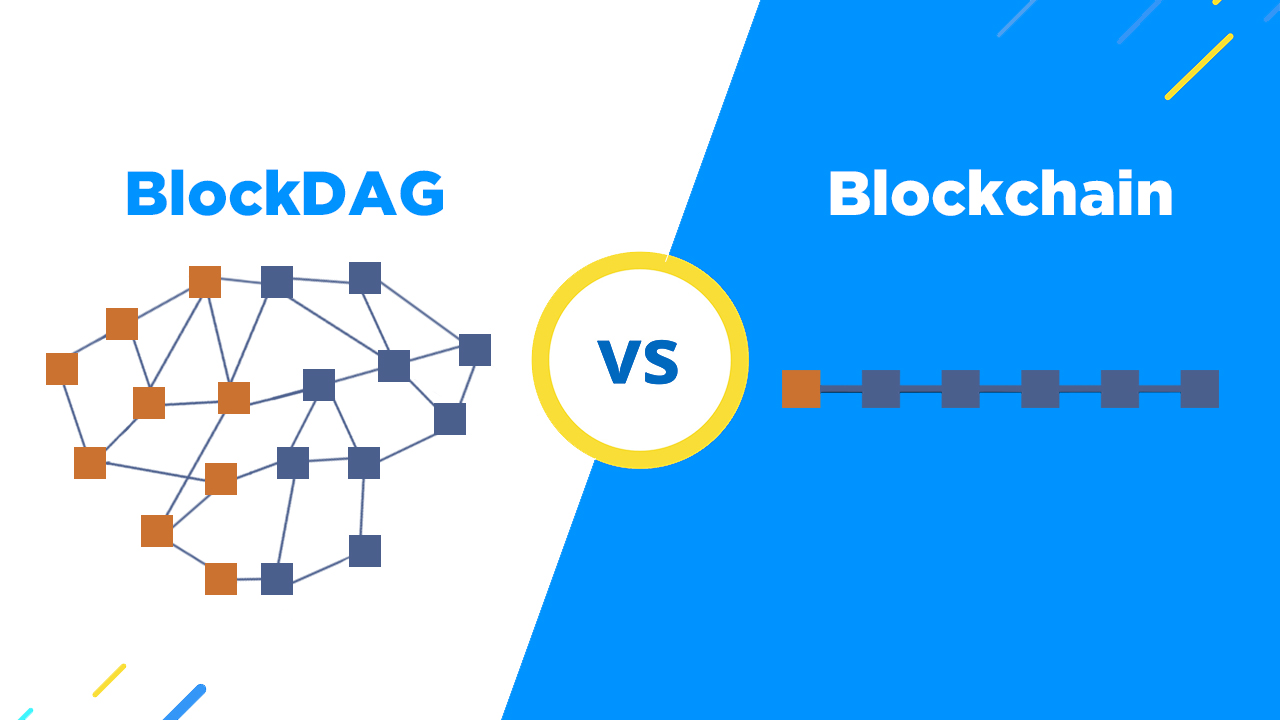

Recent commentary on BlockDAG highlights its positioning as an infrastructure-focused project designed to address scalability and throughput challenges. By moving beyond traditional linear blockchains, BlockDAG aims to support higher transaction volumes and faster confirmations—features that are often considered relevant in periods of increased on-chain activity and network usage.

Analysts following crypto trends have noted that infrastructure-focused projects can attract longer-term capital when adoption narratives gain credibility.

From a price perspective, the XRP comparison stems from BlockDAG’s early-stage positioning. Similar to XRP in its formative years, BlockDAG is still building recognition while cultivating a developer and user base. Some observers suggest that increased adoption and partnerships could influence future price dynamics.

Skeptics counter that execution risk remains high, reinforcing that technical potential must translate into real usage to support optimistic forecasts.

Bitcoin Hyper: Brand Leverage Meets Speculative Ambition

Bitcoin Hyper enters the conversation with a different advantage: brand association. Analysts tracking Bitcoin Hyper’s developments note that projects associated with Bitcoin often attract early attention from retail traders, particularly during periods of improving market sentiment.

Bitcoin Hyper’s thesis centers on extending Bitcoin’s utility through Layer-2 functionality, smart contracts, and potential DeFi integrations—goals that align with broader decentralized finance narratives.

Price outlooks for Bitcoin Hyper vary widely. Some analysts suggest that successful ecosystem launches and exchange availability could attract speculative interest. More conservative perspectives emphasize that the market has matured, and without sustained adoption and measurable progress, hype-driven price movements may be shorter-lived.

Still, analysts continue to monitor Bitcoin Hyper alongside other emerging projects as 2026 approaches.

Remittix: Utility as the Differentiator From Meme Plays

While Bitcoin Hyper and BlockDAG discussions often emphasize speculative upside, Remittix presents a comparison centered more on practical application. Remittix positions itself as a project focused on payments and remittance use cases, reflecting one of XRP’s original value propositions: fast, low-cost cross-border transactions. Remittix’s progress is tied less to narrative momentum and more to reported execution milestones. According to the project team, Remittix has released a wallet application on the App Store, with Google Pay integration planned. The team also states that its crypto-to-fiat PayFi platform is scheduled to launch on February 9, 2026.

Remittix’s progress is tied less to narrative momentum and more to reported execution milestones. According to the project team, Remittix has released a wallet application on the App Store, with Google Pay integration planned. The team also states that its crypto-to-fiat PayFi platform is scheduled to launch on February 9, 2026.

Reported features highlighted by the Remittix team include:

-

Global reach: the ability to send crypto to bank accounts in more than 30 countries

-

Real-world utility: functionality aimed at converting crypto into fiat for payments and remittances

-

Security considerations: a publicly available audit by CertiK

-

Asset support: more than 40 cryptocurrencies and over 30 fiat currencies at launch

For analysts, the XRP-style comparison in this case focuses less on rapid price spikes and more on the potential for sustained growth driven by utility and trust. In that context, Remittix emphasizes a balance between functionality and usability, which some analysts view as prerequisites for longer-term adoption once the project lists.

Weighing Remittix XRP-Style Potential

Ultimately, analysts are evaluating whether conditions similar to XRP’s early breakout can realistically be replicated. XRP’s growth was shaped by timing, narrative strength, and institutional engagement—factors that are more difficult to reproduce in today’s crowded market.

BlockDAG, Bitcoin Hyper, and Remittix each reflect different elements of that earlier playbook. Infrastructure development, brand recognition, and payment-focused utility all represent potential paths forward, though none independently guarantees XRP-scale outcomes.

For investors, the takeaway remains measured: sustainable growth tends to favor projects that combine credible execution, verifiable adoption, and clearly defined use cases rather than narrative momentum alone.

FAQ’s

Are crypto presales still a viable investment?

Crypto presales can offer significant upside, though many analysts note that they remain illiquid, speculative, and high risk. Some investors view visible development teams and released products as factors that may reduce uncertainty, though presales are generally considered suitable only for high-risk allocations.

Why do some traders speculate on high-growth potential for Remittix?

Some traders point to factors such as funding disclosures, a payments-focused use case, public audit rankings, and the planned launch timeline for the Remittix platform. These elements are cited as reasons the project has attracted attention among upcoming crypto initiatives, though such expectations remain speculative.

What is the best way to discover new crypto projects?

Many analysts recommend monitoring developer repositories, audit reports, official roadmaps, and transparent community channels. Preference is often given to projects with verifiable milestones, independent audits, and clearly documented progress.

The post BlockDAG, Bitcoin Hyper and Remittix Compared as Analysts Debate XRP-Style Price Potential appeared first on CryptoNinjas.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Modernizing Legacy E-Commerce Platforms: From Oracle ATG To Cloud-Native Architectures