US Crypto Bill New Bill Offers XRP, Solana, and Other Major Altcoins ETF-level Exemption on Disclosure

Key Takeaways:

- Non-ancillary assets such as $XRP, $SOL and $LTC are now considered the primary asset of a registered exchange-traded product.

- The Digital Asset Market Clarity Act removes the cumbersome disclosure obligations of tokens listed in ETFs traded in a national securities exchange on or before January 1, 2026.

- Such a regulatory change would practically place a certain category of altcoins in the same legal position as Bitcoin and Ethereum in terms of federal disclosure obligations.

This month marked a giant change in the United States regulatory environment of digital assets. Some of the most popular cryptocurrencies have officially become covered by a new body of legislative protection under a newly signed law.

The Non-Ancillary Asset Status Shift

A key part of the new crypto-centered law has added a certain categorization of the tokens, depending on their inclusion in exchange-traded products (ETPs) as of January 1, 2026. This rule aims at distinguishing between non-ancillary assets, which are those that are straightforwardly supervised, and the so-called ancillary assets, which are often subject to severe reporting requirements.

The bill states that when a token is the main asset of an ETF that is listed in the national securities exchange and registered in the Section 6 of the Securities Exchange Act, it does not have to disclose the detailed disclosures required of other digital assets. This exception makes the process of compliance simpler on the part of issuers, and it helps to strengthen the authenticity of the underlying tokens to institutional investors.

With these requirements, $XRP, $SOL, $LTC, and $HBAR as well as $DOGE and $LINK can receive the same regulation as $BTC and $ETH. This day one equality is a big win to the industry, given that it gets rid of the doubt that always loomed over these particular altcoins.

Read More: Ethereum Whale Awakens After 10 Years: $120M ICO Wallet Stakes 40,000 ETH

Minimized Disclosure Requirements

The first advantage of this new position is that it eliminates dual-layered reporting. It is common practice that standard tokens are subject to a complicated network of disclosures to ensure that retail investors are not at risk of the principals of early-stage or decentralized projects. But the bill does recognize that in the situation where a token is already a constituent of a large, regulated ETF, the existing regulation of the ETF is sufficient to bring out transparency.

The industry has been insisting that it is unnecessary to have separate and repeat disclosures of the underlying assets of a spot ETF. The identification of these tokens as non-ancillary has facilitated the adoption of a simplified framework only by the lawmakers targeting the product level and not the individual asset level, as long as the asset has met this high standard of market integration.

Institutional Adoption and Market Impact

The legislative action will likely improve the rate of institutional capital entry into the altcoin market. In the past large funds were reluctant to hold assets that could be prone to reporting requirements or reclassification in future that could not be predicted. That risk profile is no longer as it was with $SOL, $XRP, and others now being legally bucketed with Bitcoin.

The addition of Dogecoin to the list of emerging cryptocurrencies like Dogecoin 2021 is represented as Dogecoin, and Chainlink as a representative of the wide range of assets that have effectively crossed the bridge into the ETF world. Although first mover advantage was taken by $BTC and $ETH it can be argued that the extension of this safe harbor over to a wider range of tokens is an indicator of a more mature market in digital assets.

According to the financial analysts, this transparency will result in the competitive fee structure of ETFs. Since issuers no longer have to overcome the expensive nature of making specialized disclosures on these specific assets, such savings could be transferred to the end consumer. Also, the standardization of the treatment of such assets allows banks to provide a greater number of tokens with custody and brokerage services.

Read More: First U.S. Spot ETFs for XRP & DOGE Launch Tomorrow, Tap Into $167B Altcoin Surge

Considering Section 6 Registration

This development is technically anchored in the Section 6 of the Securities Exchange Act. This part regulates registration of the national securities exchange itself. The bill seeks to make sure that only tokens that belong to the most regulated, the highest tier of the U.S. finance system get the token disclosure exemptions by attaching it to this particular pillar of the law.

This action was a successful way of legalizing the transfer of these assets to the core of the financial world. It establishes a remarkable objective standard of any subsequent tokens that may want to pursue the same status. Ultimately, when a new asset is in a position to get listed in one of the registered, exchange-traded funds, the latter can ultimately lose the label of ancillary and the administrative baggage it carries along.

To investors, the cutoff date of January 1, 2026 acts as a historical date. It entrenches the position of the First Eight, comprising BTC, ETH, XRP, SOL, LTC, HBAR, DOGE and LINK, as the core assets of the new regulated crypto economy. With the market still changing, the difference between these non-ancillary assets and the thousands of other tokens in the market will probably be a central aspect in the portfolio construction and risk management.

The post US Crypto Bill New Bill Offers XRP, Solana, and Other Major Altcoins ETF-level Exemption on Disclosure appeared first on CryptoNinjas.

You May Also Like

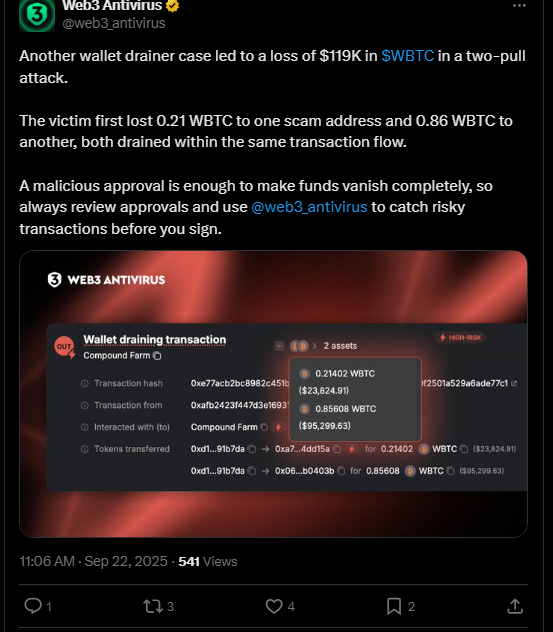

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview