Why World Liberty Financial’s New Lending Market Matters for USD1

This article was first published on The Bit Journal.

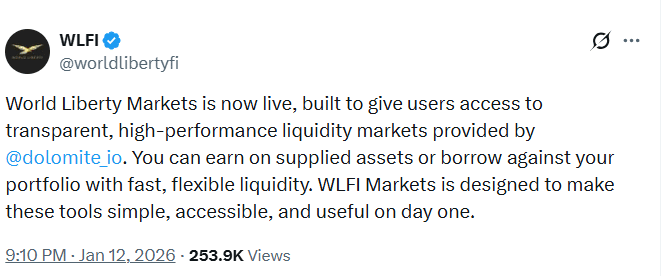

World Liberty Financial has expanded its ecosystem with a new on-chain lending and borrowing market. The Trump-affiliated crypto project confirmed the rollout on Jan. 12. The product, called World Liberty Markets, is built on top of Dolomite’s liquidity infrastructure.

The move pushes World Liberty Financial further into active DeFi services. It also strengthens the role of its stablecoin, USD1, across the platform.

World Liberty Markets Goes Live

World Liberty Financial said World Liberty Markets is now live. The platform allows users to supply assets to earn yield. It also allows borrowing against collateral through Dolomite’s established money market system.

Source: X

Source: X

Supported assets at launch include USD1, WLFI, ETH, cbBTC, USDC, and USDT. World Liberty Financial positioned USD1 as a core asset inside the platform. Users can supply USD1 for yield or use it as collateral.

The project also activated a USD1 Points Program inside World Liberty Markets. World Liberty Financial said users who supply USD1 may earn points under terms set by launch partners. It warned that conditions may change and participation involves risk.

Dolomite-Powered Infrastructure Speeds WLFI Rollout

World Liberty Financial chose a faster route to deployment by relying on Dolomite rather than building a new protocol from scratch. Dolomite supplies the lending engine and liquidity rails. World Liberty Markets functions as the front-end layer tailored for WLFI products.

Also Read: Will WLFI’s USD1 Stablecoin on Aptos Gain Traction With Trump Jr.?

The structure allows World Liberty Financial to focus on incentives and governance. It also allows the project to add more markets over time without rebuilding core infrastructure.

The project described the new market as a unified interface. It said future services are expected to be integrated into the same platform.

Dolomite Infrastructure Provides the Lending Engine

World Liberty Financial said Dolomite gives the platform execution speed and flexible liquidity across different asset pairs. Dolomite’s existing system handles deposits, borrows, and interest rates. This reduces the risks linked to early-stage protocol design.

World Liberty Markets sits on top as a WLFI-focused user interface. That means the product can evolve through governance while still using Dolomite as the backend. This model is widely used in DeFi, especially for platforms that want to scale quickly.

USD1 Becomes the Core Asset in Market Design

USD1 plays the central role in the new lending structure. World Liberty Financial said the platform is built to keep the stablecoin productive across its ecosystem. Users can deposit USD1 and earn yield. They can also borrow USD1 by supplying other assets as collateral.

This setup expands USD1 beyond simple transfers and holding. It gives it a role in lending loops and collateral strategies. That helps create stablecoin demand through actual market activity rather than passive supply.

Governance Will Guide Collateral and Incentive Changes

World Liberty Financial said WLFI token holders will influence how the platform evolves. Token holders can propose and vote on new collateral types, incentive structures, and market parameters. That includes the conditions that govern borrowing limits and yield design.

This means the system may change quickly once voting becomes active. Interest rates, collateral requirements, and token support may expand based on governance outcomes. World Liberty Financial said the market is intended to grow into a wider interface for future products.

USD1 Points Program Targets Liquidity Growth

The platform’s incentive layer launched alongside the market. World Liberty Financial said the USD1 Points Program rewards users who supply USD1. The project did not disclose full eligibility rules or long-term reward conversion.

Still, the initiative signals a liquidity-building strategy. DeFi lending markets are typically thin at launch. Programs like points systems often pull deposits early and help stabilize borrow and lend flows. World Liberty Financial said program terms can change depending on partners and evolving market conditions.

TradFi Expansion Adds Regulatory Attention

World Liberty Financial is also positioning itself closer to traditional finance. The platform recently applied for a national trust bank charter through WLTC Holdings LLC. If approved, the structure could place USD1 issuance and custody under federal supervision.

The application has drawn attention due to the project’s political ties. It also reflects a push to operate inside regulated frameworks. World Liberty Financial has repeatedly framed its long-term strategy around tokenized real-world assets.

The project said it plans to support both WLFI-issued RWAs and third-party RWAs over time. The aim is to expand USD1 into broader settlement and yield markets beyond crypto-native activity.

Early Rates Reflect Thin Activity After Launch

World Liberty Markets is still in early-stage conditions. Liquidity remains thin and rates may shift quickly. Initial figures show users may borrow USD1 by paying around 0.83%. USD1 suppliers were earning close to 0.08% at the time of early activity.

These metrics are expected to change once volume grows. Lending markets often adjust as deposits increase and demand becomes clearer.

World Liberty Financial said the rollout expands USD1’s real-world DeFi utility. It also noted USD1 recently surpassed $3.4 billion in circulating supply.

Zak Folkman, co-founder and COO, described the launch as the first of several products planned. He said more services are expected over the next 18 months.

Conclusion

World Liberty Financial is using World Liberty Markets to deepen USD1 adoption inside DeFi. By relying on Dolomite’s infrastructure, the project avoided launching a brand-new lending protocol while still gaining exposure to borrowing and yield activity.

If governance expands collateral options and incentives attract liquidity, World Liberty Financial could strengthen USD1’s position as a working stablecoin within both crypto markets and future tokenized real-world asset flows.

Also Read: World Liberty Financial Expands USD1 Supply to Record 24B with New 205M Mint

Appendix Glossary Key Terms

World Liberty Markets: WLFI’s new DeFi lending and borrowing interface.

Dolomite Infrastructure: Backend liquidity and money market engine powering the platform.

Money Market: On-chain system that matches lenders and borrowers with variable rates.

Collateral: Assets locked to secure a loan and manage risk.

USD1 Stablecoin: WLFI’s dollar-pegged token used for lending, borrowing, and yield.

WLFI Token: Governance asset used to vote on markets, incentives, and parameters.

Yield Supply: Returns earned by depositing assets into lending pools.

USD1 Points Program: Reward mechanism linked to supplying USD1 in the market.

FAQs About Liberty Financial

1- What is World Liberty Markets?

It is a lending and borrowing platform launched by World Liberty Financial. It allows users to supply assets for yield and borrow against collateral.

2- Which assets are supported at launch?

USD1, WLFI, ETH, cbBTC, USDC, and USDT are supported in the initial release.

3- What infrastructure does the market use?

It uses Dolomite’s liquidity infrastructure and money market system. World Liberty Financial provides the platform interface and ecosystem integration.

4- What is the USD1 Points Program?

It is a rewards program for users who supply USD1. Terms can change and participation carries risk.

References

CryptoNews

CoinDesk

Read More: Why World Liberty Financial’s New Lending Market Matters for USD1">Why World Liberty Financial’s New Lending Market Matters for USD1

You May Also Like

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets