Why is Bitcoin Price Up Today?

The post Why is Bitcoin Price Up Today? appeared first on Coinpedia Fintech News

Bitcoin is showing renewed strength, trading near $95,450 after breaking out of a prolonged consolidation phase. The move has reignited debate over whether the rally is merely a relief bounce or the beginning of a fresh leg toward new all-time highs.

Altcoins are starting to move alongside Bitcoin, lifting the Total crypto market cap and pushing the broader crypto market above $3.25 trillion. A bullish MACD crossover on altcoins historically followed by strong rallies suggests potential outperformance even if Bitcoin temporarily stalls below new highs.

Top Reasons Why Bitcoin Price Is Surging Today

CPI Data Eases Macro Fears

Bitcoin’s rally followed the release of the latest U.S. Consumer Price Index (CPI), which came largely in line with expectations. The absence of an inflation shock reduced fears of aggressive Federal Reserve tightening, reinforcing expectations of a controlled economic slowdown. BTC rebounded from intraday lows near $90,900 and sustained its upward momentum into the new trading session.

$6 Billion Whale and Exchange Accumulation

On-chain data shows aggressive accumulation by major exchanges and large players:

- Binance: 27,371 BTC

- Coinbase: 22,892 BTC

- Kraken: 3,508 BTC

- Bitfinex: 3,000 BTC

- Insiders and whales: 14,188 BTC

In total, nearly $6 billion worth of Bitcoin was accumulated, signaling strong conviction from deep-pocketed investors.

ETFs and Institutional Demand Stay Strong

Spot Bitcoin ETFs recorded nearly $700 million in inflows last week, providing steady downside protection. Institutional demand continues to act as a price floor during consolidations, with investors accumulating rather than chasing short-term volatility.

Long-Term Holders Reduce Selling Pressure

Glassnode data shows early Bitcoin holders slowing their selling activity. At the same time, whale wallets holding 10 BTC or more have shifted from distribution to gradual accumulation, according to Santiment, historically a bullish signal.

Corporate Bitcoin Treasuries Expand

Corporate adoption continues to strengthen confidence. Strive, backed by Vivek Ramaswamy, added 123 BTC at an average price of $91,561, bringing its total holdings to 12,797.9 BTC. The firm now ranks as the 11th-largest corporate Bitcoin holder, surpassing Tesla and Trump Media.

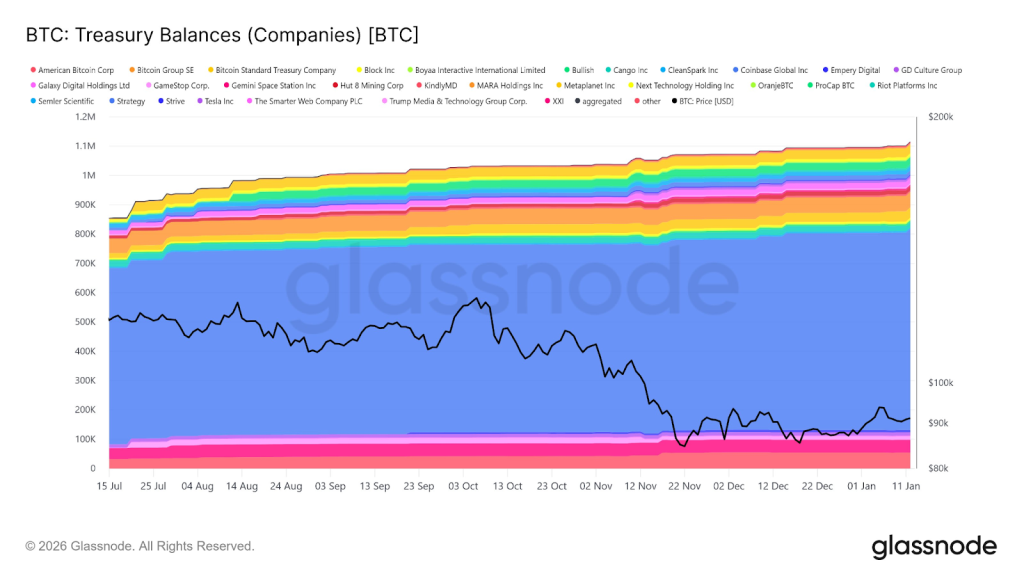

As of January 2026, companies now hold about 1.11 million BTC, up from 854K BTC six months ago—adding roughly 43K BTC per month even as Bitcoin fell from above $100K to the low $90K range.

According to Glassnode, corporate holdings kept rising almost non-stop, while the price moved lower. Long-term holders like MicroStrategy dominate, with newer buyers such as Strive and other companies steadily adding BTC. This shows strong conviction, not speculation.

Corporate buying now exceeds the monthly new supply from mining (13–14K BTC per month), effectively absorbing over three months of new coins every month and reducing available Bitcoin in the market.

- Also Read :

- Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action

- ,

What Next For BTC Price?

Bitcoin’s breakout above $94,000 shows a strong bullish shift after 54 days of sideways movement. The price recently hit $96,863, and $94K is now acting as key support.

On the 8-hour chart, BTC is forming an ascending triangle, a pattern that usually signals a potential rise. If it breaks out, the next target could be around $105,000–$106,000.

The daily RSI is near 70, which means Bitcoin could see a short pause or small pullback near $98K–$100K. Weekly indicators show bearish momentum is weakening, leaving room for more gains, while monthly charts remain cautious due to macro risks.

Short-term, Bitcoin may consolidate a little, but strong institutional inflows, whale accumulation, reduced selling, and a confirmed breakout all support further upside. If momentum continues, BTC could reach $100,000, then $105K–$106K. Longer-term targets range from $135,000 to $144,000, though economic risks could still cause some volatility.

Overall, Bitcoin’s setup favors continuation over exhaustion, suggesting this rally might be more than just a short-term bounce.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin is rising due to CPI easing inflation fears, strong whale accumulation, institutional demand, and corporate buying reducing market supply.

Stable CPI reports ease fears of aggressive interest rate hikes, boosting investor confidence and supporting Bitcoin’s upward momentum.

Altcoins often follow Bitcoin’s momentum as investor confidence grows, boosting the total crypto market and lifting smaller coins alongside BTC.

Not always, but strong BTC breakouts usually trigger altcoin gains, especially when institutional and whale activity drives overall market strength.

Track Bitcoin’s price, market cap, and momentum indicators; altcoins usually follow these cues for short- and long-term trends.

You May Also Like

Pi Network Emerges Amid Extreme Crypto Fear: Could This Be the Next Major Opportunity?

Top 5 News This Week: Bong Suntay, 18 ‘ex-marines’, China’s Filipino spies

Pi DEX: The Gateway to Web3 for Everyone, Even Crypto Beginners

Pi Network continues to redefine accessibility in the blockchain space with the launch and development of Pi DEX,