Bitcoin (BTC) Price Hits $97,000 — Here’s Why Breaking $100K May Not Be Easy

The post Bitcoin (BTC) Price Hits $97,000 — Here’s Why Breaking $100K May Not Be Easy appeared first on Coinpedia Fintech News

Bitcoin and the broader crypto market turned sharply bullish after the latest CPI print came in exactly as expected, easing near-term uncertainty for risk assets. BTC price broke out of the range it had been trapped in since mid-November, while Ethereum pushed above $3,300 and several altcoins—such as Dash, Internet Computer, Pump.fun, Monero, and Zcash—also cleared key resistance zones. Even laggards like Axie Infinity saw a strong jump, supported by a noticeable rise in trading volume, adding to the “risk-on” tone.

But while traders are already eyeing $100,000 as the next milestone, the path may not be instant. Market structure and positioning signals suggest Bitcoin could spend more time consolidating below the psychological barrier before a clean breakout attempt.

Why Is $100K Hard to Break for Bitcoin Price?

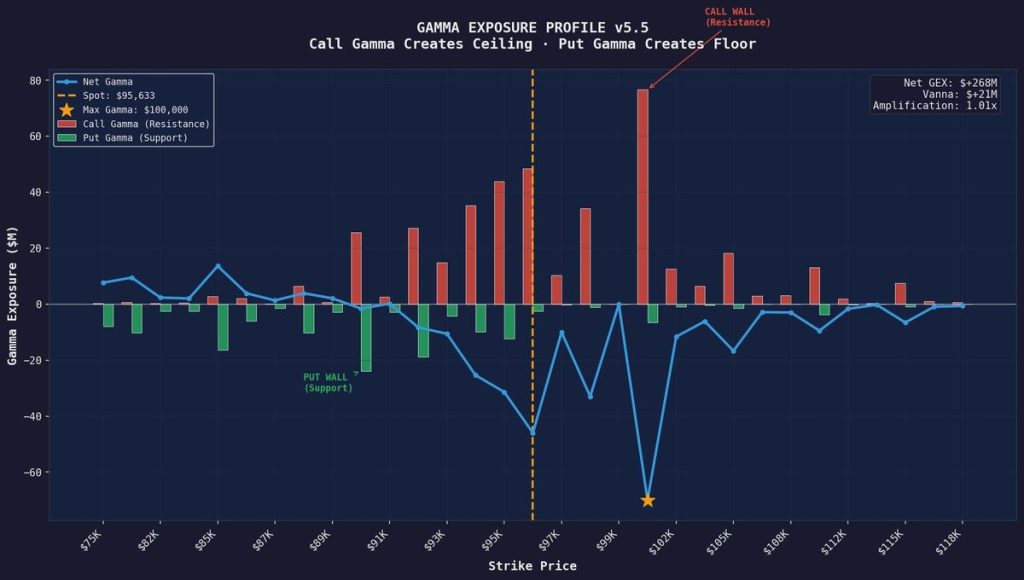

Bitcoin is struggling to break $100,000 because an options-driven “gamma wall” is capping the move. According to the Escape Velocity Model (v3.1), a large $129.9M call gamma wall sits at the $100K strike. As the BTC price pushes higher, dealers hedging these options are often forced to sell Bitcoin, which absorbs buying pressure and keeps volatility muted.

Source: X

Source: X

The model estimates the market needs around $574M in net buying (CVD) to chew through this resistance and the sell orders stacked above it. Smaller liquidation pockets near $98K ($43M) and $99K ($36M) may not provide enough fuel. Based on current liquidity, the probability of generating that “escape velocity” is 2.2% in one day, 57.4% over a week, and 80%+ over 30 days, suggesting BTC may stay range-bound until positioning resets.

What Would Actually Break $100K Cleanly?

Bitcoin may be close to $100,000, but a clean breakout usually needs more than hype. Sellers tend to stack orders near round numbers, and options hedging can add extra resistance. Here are the key triggers that could help BTC finally clear $100K and hold above it.

- Sustained Spot Buying: BTC needs steady net buying for multiple sessions, not a quick leverage-driven spike.

- Strong Close And Hold Above $100K: A clean breakout is confirmed when Bitcoin flips $100K into support instead of wicking and rejecting.

- Options Reset (Expiry/Rollover): If the $100K “wall” is driven by options positioning, it often weakens when contracts expire or get rolled to new strikes.

- Fresh Institutional/ETF-Style Flows: Larger inflows can absorb the sell orders stacked near $100K and push the price into discovery.

- Macro Catalyst Tailwind: Softer inflation or a dovish shift can add confidence and follow-through.

- Tariff Ruling Headlines Could Add Volatility: A U.S. Supreme Court tariff decision can swing risk sentiment fast—risk-on could fuel a breakout, while a risk-off shock could trigger a pullback before the next attempt.

What To Expect Next

Bitcoin is bullish, but the market is now entering the “hard part” of the move. The next phase may look less exciting than the breakout because high levels tend to slow the price down.

If BTC grinds below $100K, that’s not automatically weakness—it can be consolidation as liquidity builds. If BTC breaks and holds above $100K, the psychological barrier flips into a launchpad, and price discovery can accelerate.

For now, expect higher volatility, headline-driven swings, and a tug-of-war near $100K—until either demand overwhelms the sell wall or the market needs more time to refuel.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025