BonkFun Slashes Creator Fees to 0% to Revive ‘2024 Glory’ — Are Meme Coin Launchpad Wars Back?

BonkFun has moved to reset the economics of meme coin launches on Solana, announcing a sharp cut to creator fees that signals a renewed fight for relevance in an increasingly crowded launchpad market.

In a post on X, the team behind BonkFun said it is introducing “BONK Classic” launches with zero creator fees and a reduced 0.30% swap fee, with most of that fee routed back into liquidity.

The structure mirrors the setup that dominated meme coin trading in 2024, a period many traders associate with explosive runs on Raydium-based tokens that reached multi-billion-dollar market capitalizations.

BonkFun Shifts Fee Model as Meme Coin Activity Fragments

The change comes at a time when meme coin activity remains high but fragmented, with traders showing clear sensitivity to fees and incentives.

BonkFun framed the update as a response to widespread frustration that creator fees have become too expensive and misaligned with trader interests.

Under the new Classic model, creators earn nothing from trading activity, while liquidity depth is prioritized to support smoother price action.

Alongside this, BonkFun is keeping an alternative path open through its “BONKERS” launches, where swap fees are reduced by as much as 50% while creator fees can be increased significantly for communities that want long-term revenue streams.

In those cases, rewards will now be paid entirely in a single quote asset, such as USD-denominated tokens, rather than split between assets.

BonkFun, also known as LetsBONK.fun, launched in April 2025 as a joint effort between the BONK community and Raydium. It quickly became a central venue for no-code meme coin creation on Solana.

Within three days of launch, more than 2,700 tokens were created, and roughly $800,000 in fees were generated, helping push BONK’s price more than 50% higher in its first week.

By July 2025, the platform had overtaken Pump.fun in market share, capturing over 55% of Solana’s token issuance during peak periods.

A defining feature of its early success was its creator fee model, which offered developers a share of trading fees while routing a large portion of platform revenue into BONK buybacks and burns.

Meme Coin Wars: Did a Fee Shake-Up Just Reshape the Launch Race

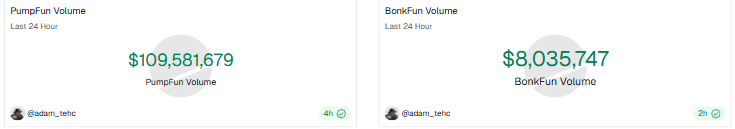

That model, however, has come under pressure as market conditions shifted. Data from the past 24 hours shows Pump.fun firmly back in the lead, with nearly 30,000 new tokens launched, over $109 million in trading volume, and more than $1.27 million in daily fees.

Source: Dune/adamhec

Source: Dune/adamhec

BonkFun, by comparison, recorded under 2,000 new tokens, about $8 million in volume, and just under $100,000 in fees.

Graduated tokens and active addresses tell a similar story, highlighting how quickly momentum can move between platforms.

The fee reset also lands days after Pump.fun announced its overhaul of creator incentives, introducing tools that allow fees to be split across multiple wallets.

Pump.fun said the goal was to correct incentives that had made coin creation low risk while leaving traders exposed, a problem that has long defined meme coin markets.

BonkFun’s shift back toward zero creator fees for certain launches reflects that same tension between fair launches and developer rewards.

Before creator fees became common, meme coins relied almost entirely on hype, fair distribution, and trading volume, often producing sharp rallies followed by brutal reversals.

Fees were later introduced to reduce rug pulls and encourage longer-term engagement, but they also raised costs for traders and changed behavior.

Market reaction has been cautiously positive so far, with the BONK token trading around $0.000012, up more than 8% over the past 24 hours, with trading volume jumping nearly 86% to over $300 million.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025