Arthur Hayes: Dollar Liquidity Will Drive BTC Higher in 2026

BitMEX co-founder Arthur Hayes claimed that Bitcoin’s weak performance in 2025 was a direct result of tightening dollar liquidity.

Notably, Bitcoin BTC $96 972 24h volatility: 2.1% Market cap: $1.94 T Vol. 24h: $67.67 B fell 14.4% last year as liquidity declined. Gold soared 44.4% in the same period. US tech stocks also outperformed, supported by state-backed capital flows rather than free-market demand.

In a recent blog post, Hayes explained that Bitcoin only responds to one variable i.e., the rate of fiat debasement. Generally, when liquidity contracts, BTC sees downside and when liquidity expands, the prices go higher.

Hayes expects dollar liquidity to expand sharply in 2026, driven by clearer policies. He cites balance sheet expansion at the Federal Reserve, easing mortgage conditions, and increased bank lending toward government-backed strategic sectors.

BitMEX co-founder predicts that the US will continue its large-scale military production, which requires credit creation through the banking system. Such credit expansion directly affects broader liquidity conditions and boosts scarce assets like Bitcoin.

Consistent monetary expansion is required for Bitcoin to trade near or above $100,000. Hayes believes that could happen in 2026, resulting in new highs for the largest cryptocurrency.

Bitcoin Price Structure and Holder Behavior

At the time of writing, Bitcoin is trading near $96,200, up by around 11.5% in the past month. The price has recently broken above the $94,200 resistance zone and pushed to $97,600 earlier on Jan. 15.

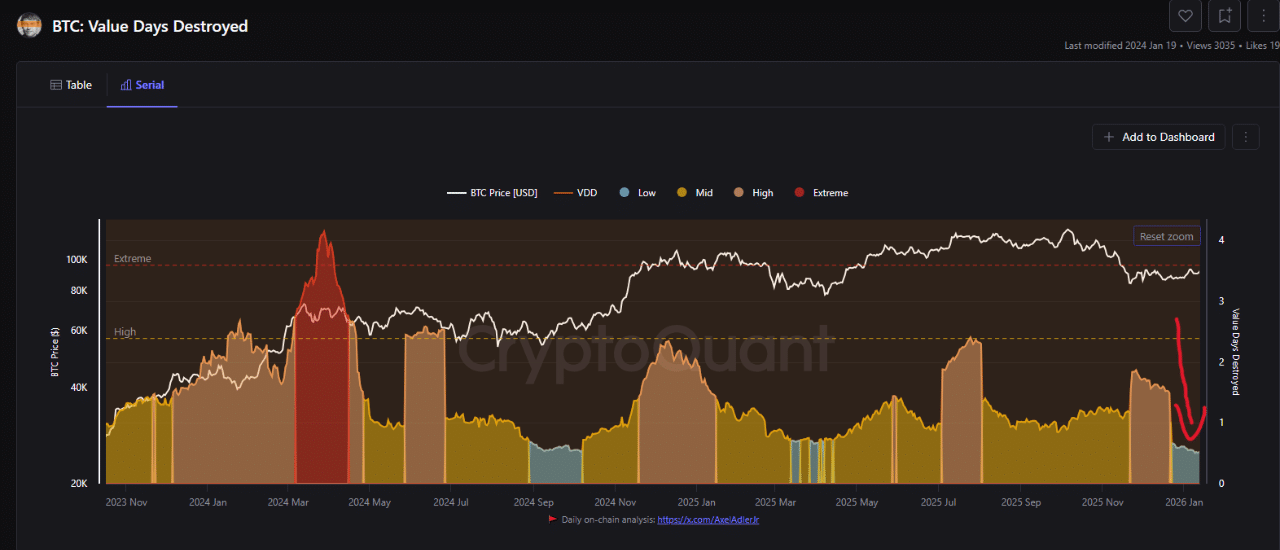

On-chain data by CryptoQuant suggests that the Value Days Destroyed indicator sits near 0.53 in early 2026, a historically low level.

Bitcoin Value Days Destroyed | Source: CryptoQuant

This indicates that mostly younger coins are being moved, while long-term holders remain inactive. Such behavior suggests strong confidence among smart investors.

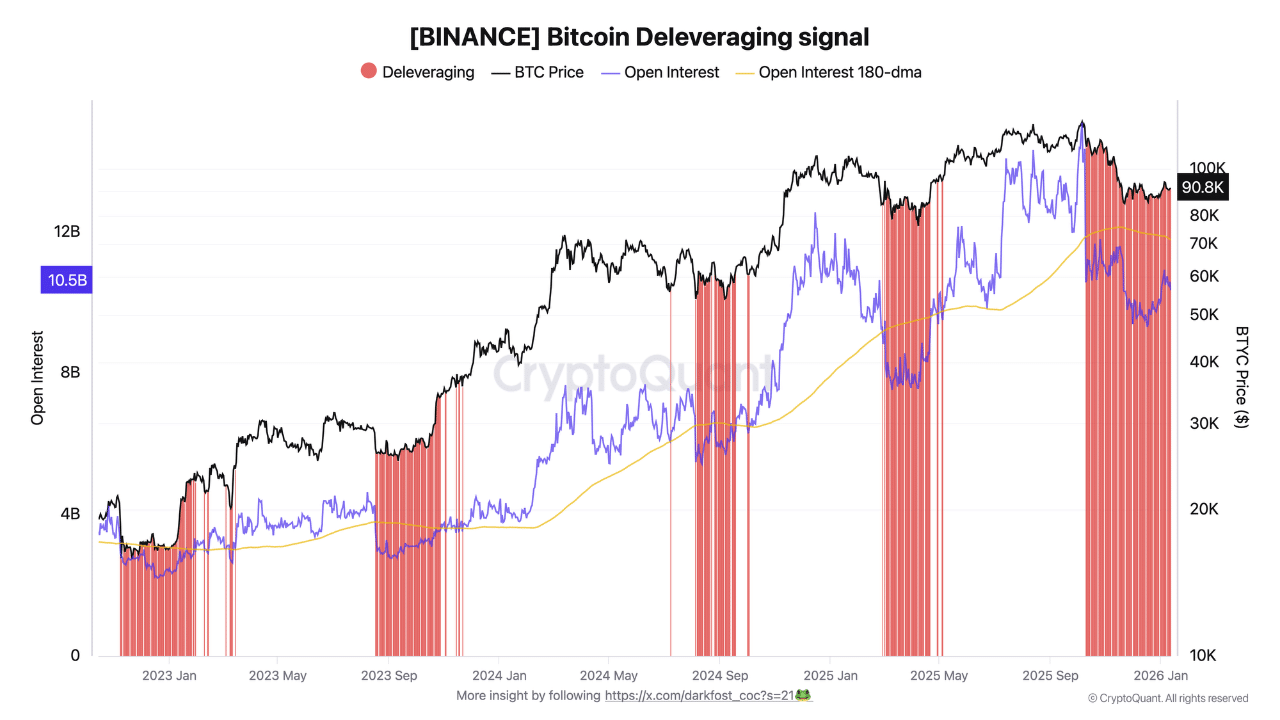

Meanwhile, Bitcoin derivatives markets have undergone a notable deleveraging phase. The open interest has declined more than 31% from its October 2025 peak of over $15 billion to around $10 billion, according to CryptoQuant.

This follows a speculative year, during which Binance futures volumes alone exceeded $25 trillion.

Bitcoin Deleveraging on Binance | Source: CryptoQuant

Historically, such reductions in leverage have helped reset market conditions along with major bottoms. Many analysts predict BTC to reach $150,000 in the first quarter of 2026.

nextThe post Arthur Hayes: Dollar Liquidity Will Drive BTC Higher in 2026 appeared first on Coinspeaker.

You May Also Like

Spanish Banking Powerhouse Santander Opens Doors To Crypto For The Public

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think