Uniswap Brings Zero-Fee Swaps to OKX’s X Layer

This article was first published on The Bit Journal.

Uniswap enters a new phase of its multi-chain growth through its launch on OKX X Layer, a move analysts say could reshape how traders approach low-cost decentralized markets. The change arrives at a time when users want cheaper, cleaner, and faster on-chain transactions.

According to the source, the integration now allows token swaps, liquidity provision, and direct Layer 2 access through the Uniswap app, wallet, and API. Zero interface fees and near-cent transaction costs have already gained traction among developers, financial students, and crypto researchers tracking new blockchain environments. Swaps on X Layer can cost as little as $0.01, making quick, small trades much more practical for everyday users.

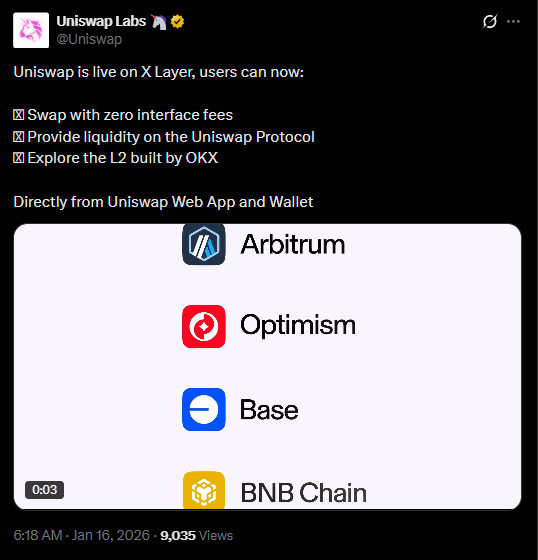

According to a Jan. 16 announcement shared on X (formerly Twitter), Uniswap confirmed that users can now access OKX X Layer directly through the Uniswap web app, wallet, and API. The post emphasized that the rollout is designed to streamline activity across low-cost blockchain environments.

Source: X

Source: X

A Breakout Moment: How Uniswap Opens New Doors Inside OKX X Layer

The arrival of Uniswap on OKX X Layer gives users a cleaner, faster entry into Ethereum-compatible markets without the usual bridging hassles. Early reactions on X have been strongly positive, with traders noting quicker swaps, smoother confirmations, and an easier onboarding flow than many other Layer 2 networks.

Many users say the update finally offers OKX traders a direct and reliable path into DeFi without cross-chain friction. A recent network review also shows that OKX X Layer aims to keep fees low while delivering stable, fast settlement.

Independent assessments confirm that zkEVM technology provides strong execution speed and high verification security, giving analysts confidence that the integration can support rising liquidity over time.

Analysts point to two early signals shaping market behavior:

• Stablecoin pairs show strong movement on OKX X Layer because traders want predictable pricing and lower swap fees, conditions that support steadier long-term liquidity activity across DeFi markets.

• On-chain explorers report increased activity since the integration, suggesting traders view Uniswap on OKX X Layer as a safer and more efficient access point for active decentralized trading.

These early markers indicate a rising comfort level among new users and long-term market watchers.

Why OKX X Layer Gains Ground as Uniswap Expands Its Reach

OKX says the integration brings deeper liquidity, lower costs, and a more professional trading experience to X Layer. The network’s zkEVM design improves efficiency, reduces load, and gives traders faster, cheaper execution. Developers note that this setup keeps verification secure and liquidity moving smoothly.

Analytics platforms show that zkEVM systems help stabilize gas costs, drawing interest from both retail and institutional users. Market watchers also say Uniswap’s arrival strengthens OKX X Layer in the Layer 2 race by offering easier access to stablecoins, new tokens, and cleaner liquidity routes.

With interface fees removed, smaller trades are now more practical, appealing to students, researchers, and active traders who want predictable and transparent costs.

Uniswap Expands Reach After OKX X Layer Unlocks New Access

Uniswap Expands Reach After OKX X Layer Unlocks New Access

Uniswap Strengthens Its Multi-Network Strategy with New Integrations

The OKX X Layer expansion fits into Uniswap’s wider strategy of connecting with global networks. Recent updates include support for Revolut onramps, Ledger devices, and partnerships with new chains such as Monad.

Governance also approved the burn of 100 million UNI tokens in late 2025, a move analysts believe supports economic efficiency. With OKX X Layer now added to the lineup, Uniswap continues its goal of pushing decentralized trading into faster and more accessible environments.

Conclusion

The collaboration between Uniswap and OKX X Layer marks a meaningful shift in decentralized trading, delivering lower fees, deeper liquidity, and cleaner market access.

As analysts, developers, and students watch these trends unfold, the integration may stand as an important signal of where DeFi is heading: toward shared liquidity networks built around speed, affordability, and secure cross-chain trading.

Glossary

Layer 2: A faster secondary network built on a main blockchain.

zkEVM: A system that verifies transactions using zero-knowledge proofs.

DEX: A decentralized exchange for peer-to-peer trading.

Liquidity Pool: A smart-contract pool of tokens used for trading.

FAQs About Uniswap

What does the integration offer?

It offers cheaper swaps, stable access, and deeper liquidity.

Why are zero fees useful?

They reduce trading barriers and support smaller trades.

Which tokens benefit?

xBTC, USDT, USDG, and new OKX X Layer assets.

Is the network secure?

Yes, independent zkEVM research confirms strong security.

References

Coindesk

Theblock

Read More: Uniswap Brings Zero-Fee Swaps to OKX’s X Layer">Uniswap Brings Zero-Fee Swaps to OKX’s X Layer

You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future