Bitcoin Flirts With $110K but Ends the Week Lower Amid Geopolitical Concerns

Bitcoin ( BTC) ended the week just below $105,000, having briefly approached the $110,000 mark, but faced downward pressure from escalating geopolitical tensions in the Middle East.

BTC Ends Topsy-Turvy Week Largely Unchanged

Having twice flirted with the $110,000 mark, bitcoin ( BTC) ultimately concluded the week largely unchanged, settling just below $105,000. Its upward trajectory was significantly curbed by a confluence of escalating geopolitical tensions in the Middle East, marked by direct exchanges between Israel and Iran, alongside “disappointing” Consumer Price Index (CPI) data.

Latest data revealed that despite briefly soaring to a weekly high of $110,266 on June 10, BTC registered a modest 0.8% decline over the seven-day period, ending more than $5,000 below its mid-week peak.

Like BTC, several other top 20 digital assets ended the week marginally lower, with XRP and Solana dropping 2.1% and 4.2%, respectively. Only hyperliquid (HYPE) and bitcoin cash ( BCH) among the 20 leading digital assets ended the week in the green, rising 16.7% and 4%, respectively.

Although many of the top digital assets by market capitalization closed the week marginally lower, a few less liquid tokens registered double-digit gains. Aura topped the gainers after it surged more than 21,000% in just seven days, followed by the Useless Coin, which went up more than 570%. Kaia, which ranked No. 102 on Coingecko on June 14, was up 36%.

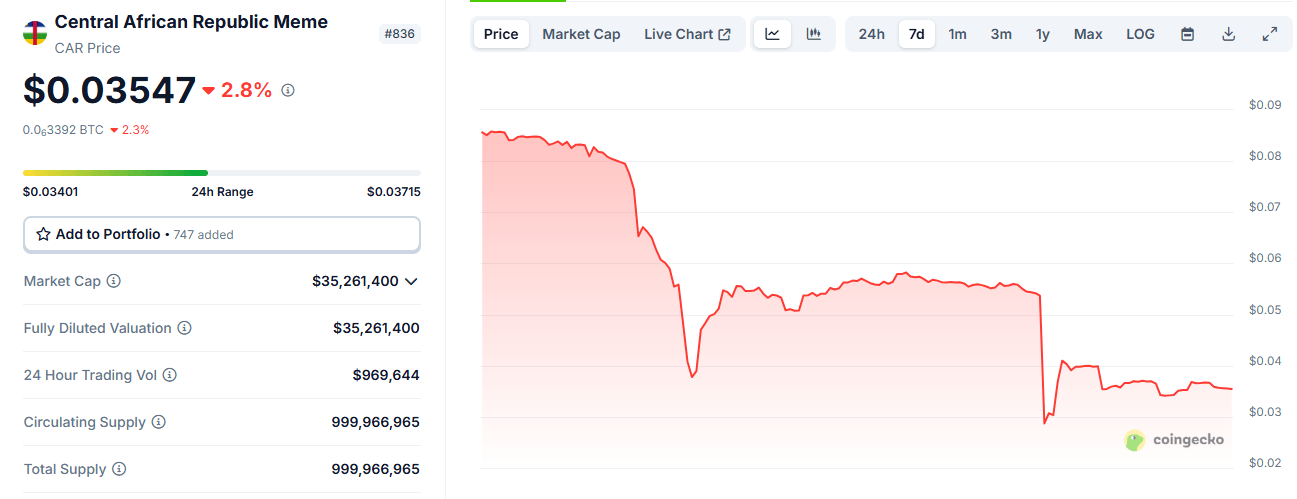

Meanwhile, the Central African Republic (CAR) token led the top losers of the week, dropping 59.4% to $0.03601. On June 6, the memecoin peaked at $0.095, an all-time high, after the country’s leader Faustin-Archange Touadéra announced plans to launch a platform enabling investors to purchase tokenized land concessions using the CAR token on Solana.

However, the token regressed in the two days that followed, dropping to $0.0377 on June 9 before reversing some of the losses. On June 13, CAR, in tandem with the rest of the crypto market, dropped to a weekly low of $0.0287. At the time of writing (June 14, 1:30 p.m. EDT), CAR traded above $0.035.

Other notable losers in the week included SUI, which dropped 11.4%; AVAX (8.7%) and ADA (6.2%).

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Michael Saylor Pushes Digital Capital Narrative At Bitcoin Treasuries Unconference