Monero (XMR) Plunges 12% Daily, Bitcoin (BTC) Stands Calm at $95K: Market Watch

Bitcoin’s price has remained expectedly calm over the past 12 hours or so as the weekend began, without any major moves at just over $95,000.

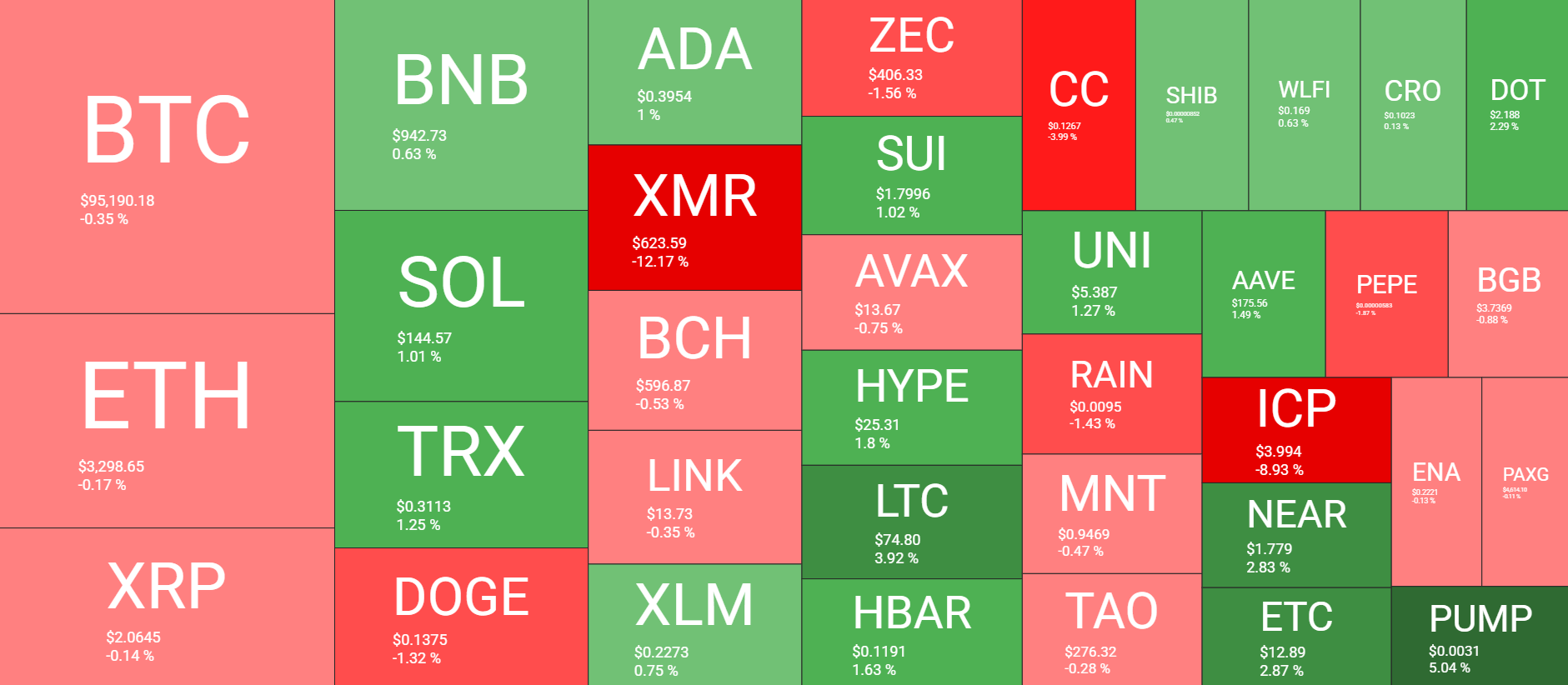

Most larger-cap alts are sluggish as well, with little to no movement from ETH, XRP, BNB, SOL, and ADA. XMR, though, has plunged hard after its recent rally.

BTC Calms at $95K

The primary cryptocurrency had a quiet previous weekend but went on the offensive on Monday, surging from $90,000 to $92,000 only to be stopped on a couple of occasions. It finally broke through that barrier on Tuesday and kept climbing to a new multi-month peak of $98,000 on Wednesday evening.

This meant that it had added $8,000 in just a few days, and roughly $10,000 since the start of the year. Following such an impressive increase, BTC was due for a pullback, which transpired on Thursday and Friday.

The culmination took place yesterday when BTC slipped below $94,500 after reports that Kevin Hessett won’t be nominated by Trump to be the next Fed Chair. Nevertheless, bitcoin bounced off and has remained above $95,000 since then.

Its market cap has stalled at $1.9 trillion, while its dominance over the altcoins stands still at 57.4%.

BTCUSD Jan 17. Source: TradingView

BTCUSD Jan 17. Source: TradingView

XMR Runs Ends

As mentioned above, the altcoins are untypically stagnant over the past 24 hours. Ethereum continues to trade sideways around $3,300, while XRP has defended the $2.05 support. DOGE, BCH, LINK, and ZEC are also slightly in the red, while BNB, TRX, and SOL have marked insignificant gains.

Monero’s token went on the run in the past week or so, surging to a new all-time high of almost $800. However, it was rejected there and now struggles at $620 after another 12% decline in the past day. ICP has also plunged hard daily, losing 9% of value.

The cumulative market capitalization of all cryptocurrency assets has remained above $3.3 trillion CoinGecko.

Cryptocurrency Market Overview Daily Jan 17. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily Jan 17. Source: QuantifyCrypto

The post Monero (XMR) Plunges 12% Daily, Bitcoin (BTC) Stands Calm at $95K: Market Watch appeared first on CryptoPotato.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure