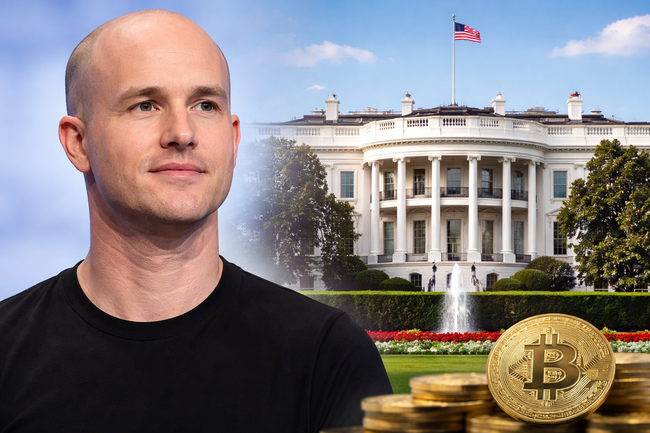

Coinbase CEO Says White House Did Not Threaten Support for CLARITY Act

Highlights:

- Coinbase CEO Brian Armstrong denied claims that the White House threatened to drop support.

- Talks with banks continue while Coinbase drafts proposals to help community banks.

- Paul Grewal said White House engagement continues and is focusing strongly on protecting retail users.

Coinbase Chief Executive Officer Brian Armstrong rejected claims about a White House threat linked to the CLARITY Act. Some online posts suggested that federal support could slow down or disappear. Armstrong said this was not true. He explained that talks are still active and positive. He added that discussions continue to solve open policy issues.

Armstrong and Grewal Confirm Ongoing White House Talks

Armstrong replied directly to journalist Eleanor Terrett in a post on X. Her message suggested that support might be pulled back. Armstrong disagreed and said the report was incorrect.

After this exchange, the topic quickly spread across crypto communities and drew broad attention. Armstrong also mentioned that White House staff asked Coinbase to collaborate with banks to reach an agreement. Discussions with banking groups are still ongoing, and policy drafts are under review. These drafts include proposals to support community banks and smaller lenders.

Paul Grewal, Coinbase Chief Legal Officer, shared a calmer message in a separate X reply. He said the White House kept clear and open communication. He added that talks are still ongoing. Therefore, optimism remains high. Protecting retail users is also a main focus in company policy planning.

After that, the discussion about banking influence grew. Investor Michael Arrington posted on X, saying banks want customer fees but avoid paying interest on deposits. He added that banks protect their own interests instead of giving fair returns to consumers. Arrington also criticized lawmakers for allowing limits on stablecoin yield. He explained that these limits exist because of strong banking lobbying. In the end, he warned that current financial rules now favor banks rather than consumers.

Arrington’s comments came after remarks from Bank of America CEO Brian Moynihan. Moynihan said yield-paying stablecoins could pull $6 trillion from traditional bank deposits. He warned that such a shift could tighten liquidity across banks. He added that this pressure might reduce lending, especially for small and mid-size companies.

CLARITY Act Timeline Uncertain as Industry Awaits Early Passage

Uncertainty remains around the bill’s timeline. Industry leaders continue to track congressional signals. Galaxy Digital CEO Mike Novogratz shared optimism after recent talks with senators. Novogratz said the passage could arrive within the next 2 weeks. A positive tone from meetings shaped his outlook. He added that compromise matters more than perfection during the early stages of regulatory work.

The CLARITY Act has sparked debate in the crypto community. Some of the leaders in the industry think that the act is a good thing, while others think that it negatively impacts the industry. One of the major concerns is the prohibition of providing stablecoin profits to customers in the current version of the bill.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Safaricom to roll out pay-as-you-go pricing for internet services in Kenya

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings