Bitcoin Price Analysis: Rally to $100K or Drop Below $90K Is Next for BTC?

Bitcoin continues to consolidate just below a major resistance cluster after a strong recovery from the December lows. The price chart shows a clear sequence of higher lows, while on-chain data indicates that the percentage of supply in profit has undergone a deep reset and is now recovering.

Technically, the market is approaching an important decision zone: either a sustained breakout above the current ceiling opens the door to a new leg higher, or a rejection here triggers a corrective phase back toward recently established support levels.

Bitcoin Price Analysis: The Daily Chart

On the daily chart, BTC is trading around the $95,000 resistance band, which coincides with the lower boundary of a broader supply area and the 100-day moving average. This zone has acted as a price cap since November and is the key level currently under test.

Below the current levels, an ascending structure has formed from the $80,000 demand zone, creating a series of higher lows. The recent advance has pushed the asset from that base into the current resistance area without any meaningful daily pullback, leaving the $90,000 short-term level as the first notable support layer in case of a rejection.

Daily RSI has also cooled from recent overbought readings, but remains above the mid-line, consistent with a market in early or mid-trend rather than at a mature top. As long as the higher-low structure from the December bottom holds, the broader bias on the daily timeframe remains constructive, even if short-term volatility emerges around resistance.

BTC/USDT 4-Hour Chart

The 4-hour chart highlights the recent breakout from an ascending triangle structure. The price spent several weeks compressing between a flat resistance around the $95,000 mark and the rising trendline of the pattern. This resistance has now been marginally exceeded, and the market is consolidating just above the former range high, potentially targeting the $100,000 region next.

Yet momentum on the 4-hour RSI points to a downtrend, reflecting waning short-term strength and raising the risk of a corrective phase or at least a period of sideways consolidation.

If such a correction unfolds, $93,000–$94,000 forms the immediate breakout-retest zone, where stability would preserve the integrity of the bullish breakout. Further below, the $90,000 region marks the prior consolidation band and mid-range support, a logical area for a deeper but still healthy pullback within the prevailing uptrend.

On-Chain Analysis

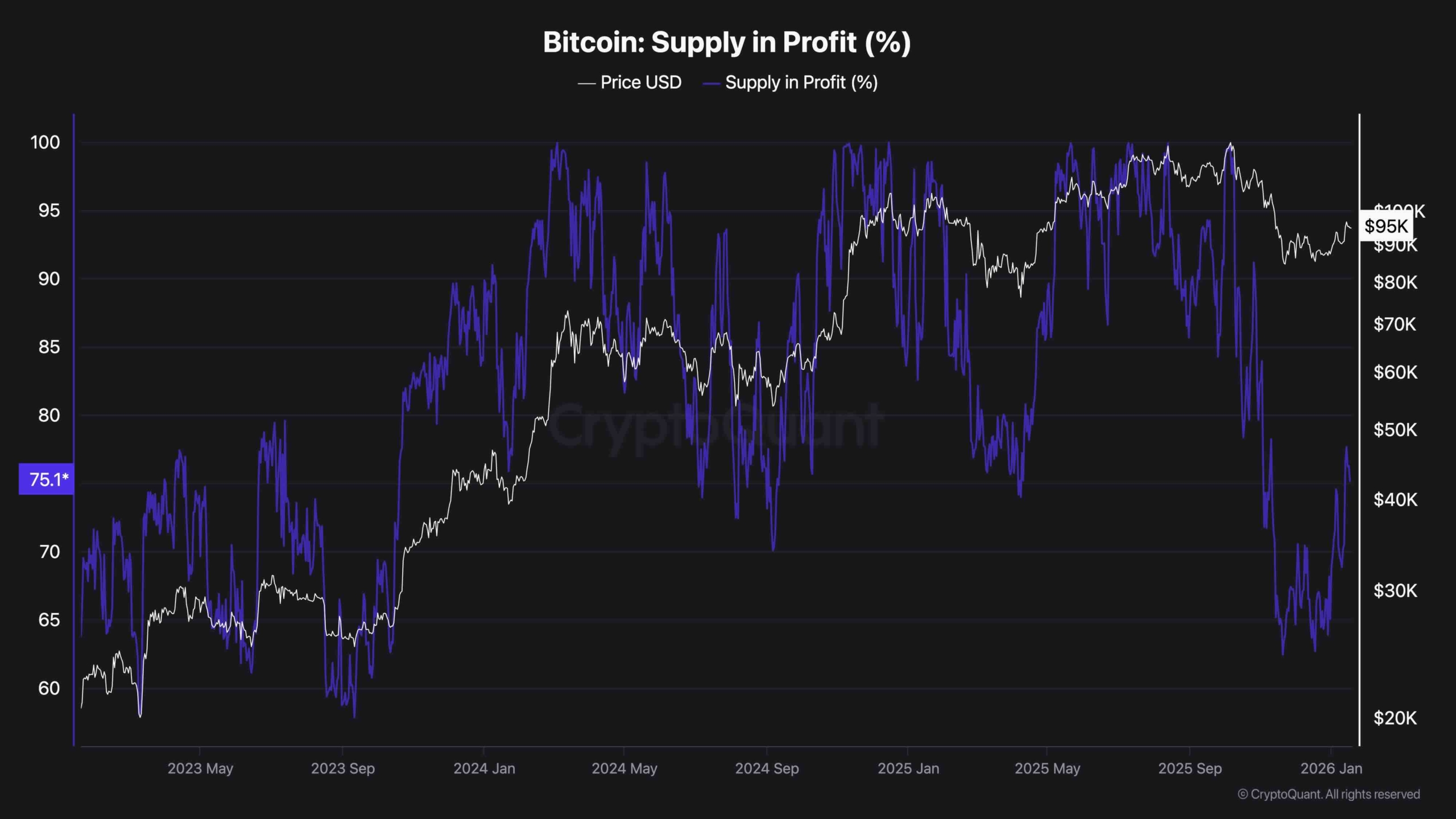

The Supply in Profit (%) metric currently provides an important cyclical signal. Recently, the percentage of circulating BTC that was in profit dropped to levels comparable to those seen when the spot price was below $30,000 earlier in the cycle. This occurred despite the current price being in the $90,000+ region.

Such a deep reset in profitability at a much higher nominal price indicates that a large portion of coins changed hands or saw unrealized gains compressed during the recent correction. Historically, similar resets have often preceded new medium-term advances, as weaker hands are flushed out and a more robust holder base emerges.

The metric is now recovering back toward the mid-70% range, suggesting that profitability is improving again but has not yet reached the extreme levels (above 95%) typically associated with late-stage euphoric phases. This combination can be interpreted as a constructive on-chain backdrop, consistent with the early stages of a potential new rally, provided that key technical resistance on the chart is eventually absorbed.

s

s

The post Bitcoin Price Analysis: Rally to $100K or Drop Below $90K Is Next for BTC? appeared first on CryptoPotato.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

MicroStrategy Eyes New Bitcoin Milestone With Another Purchase