| Disclosure: This content is promotional in nature and provided by a third-party sponsor. It does not form part of the site’s editorial output or professional financial advice. |

At the start of 2026, the crypto market moved past $2.3 trillion in total value, with daily trading activity staying above $90 billion across major exchanges. Well known names such as BNB holding near long term highs and Ethereum settling after years of expansion reflect strength, but also show signs of maturity. As returns narrow and upside becomes harder to reach, many now ask whether these large assets can still deliver dramatic gains for fresh capital entering the market.

Because of this shift, attention is moving toward Zero Knowledge Proof (ZKP), a privacy focused AI and data network currently running a live presale auction. Researchers describe its structure as fundamentally different from established platforms. Built using advanced cryptography and decentralized incentives, the network focuses on rewarding users rather than centralized platforms, while keeping sensitive data protected without exposure.

Experts Link Phase Two Burns to the Next Big Crypto Narrative

Zero Knowledge Proof (ZKP) is built as a privacy focused AI and data network where users maintain control over value creation and data usage. Analysts reviewing the design point to its Substrate framework, zero knowledge cryptography, and hybrid consensus as reasons research teams see it as long term digital infrastructure with broad relevance. Some projections even outline the possibility of gains reaching several thousand multiples under early supply conditions, reinforcing discussion around the next big crypto.

Observers also highlight a capped supply close to 257 billion coins, daily presale auction based release mechanics, and proof systems that consume roughly ten watts per device. Prices have already climbed nearly three hundred percent from initial levels, and as the presale auction remains live, a growing number of analysts now describe Zero Knowledge Proof (ZKP) as the next big crypto before tightening supply places stronger pressure on availability.

This scarcity is not accidental. Phase Two introduces a rule that permanently removes all unallocated coins from each daily presale auction pool. Over time, this steadily reduces the total supply in circulation. Analysts explain this as cumulative pressure, where every cycle lowers future selling capacity and gradually raises the underlying value base tied to the network.

Researchers tracking on chain movement note that coin destruction continues to outpace distribution as demand grows. This pattern changes traditional supply calculations, leaving fewer units accessible over time. Forecast models built on this structure suggest extreme scarcity conditions once public market access expands further.

As scenarios involving four digit multiples are discussed, timing becomes central. Each burn cycle raises the cost of entry. For early participants, Zero Knowledge Proof (ZKP) brings together enforced scarcity, expanding demand, and uneven upside potential, reinforcing why analysts repeatedly label it the next big crypto in current discussions.

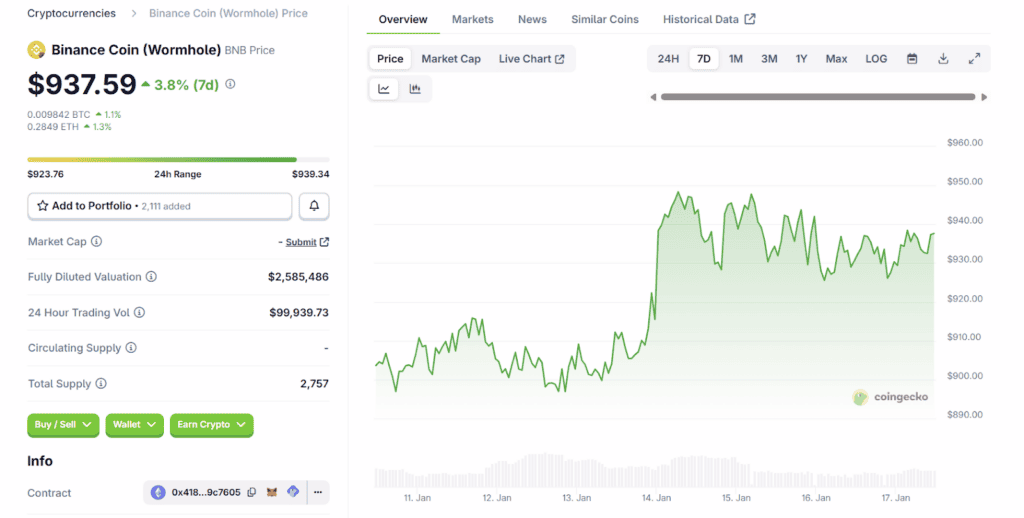

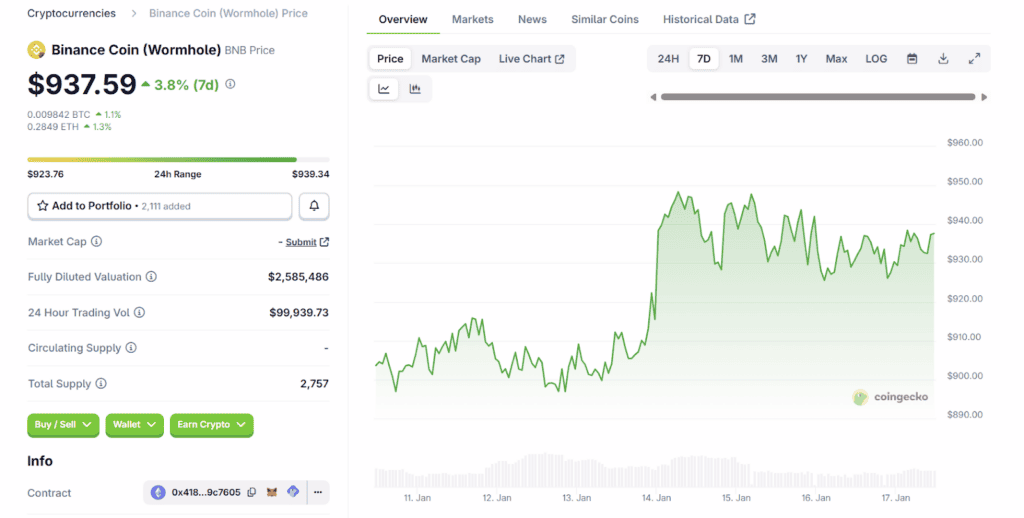

BNB Coin Price Shows Strength Through Stability

During mid January 2026, BNB remained among the largest digital assets by market value, trading between $930 and $940. The BNB coin price stayed above the $900 support zone after weeks of sideways movement, signaling steady demand despite pauses across the wider market. Market value stood near $126 to $128 billion, supported by daily trading activity ranging from $1.8 to $2 billion. This depth places BNB among the most liquid assets, with price changes closely following overall market direction rather than sharp breakouts.

Source- CoinGceko

Source- CoinGceko

Supply control also plays a role. Early in 2026, BNB completed its 34th quarterly burn, removing about 1.37 million coins from circulation. This ongoing process limits long term supply growth. Although gains may be slower, the BNB coin price reflects stability, scale, and a mature position within the crypto market. Institutions and long term holders continue to monitor its performance closely.

Ethereum Price USD Reflects Network Reliability

Ethereum continues to hold a central position, with the Ethereum price USD trading between $3,288 and $3,350 in mid January 2026. Market value remains near $396 to $397 billion, while daily trading activity averages $20 to $22 billion. Recent price movement since January 14 shows consolidation following earlier advances, with ETH staying above important support levels.

Source- CoinGceko

Source- CoinGceko

Analysts identify resistance in the $3,300 to $3,350 range, slowing short term momentum. Even so, the Ethereum price USD highlights strong network usage, consistent wallet growth, and steady demand from developers. Ethereum functions more as a reference asset than a high risk option. Its size and liquidity provide reliability, while upside potential remains measured compared to emerging projects. This role keeps it vital to overall market structure as traders search for faster growth elsewhere.

To Sum Up!

BNB and Ethereum continue to anchor the market through scale and liquidity. The BNB coin price represents controlled supply and steady volume rather than rapid upside, while the Ethereum price USD shows consolidation backed by deep capital support and strong network activity.

Although these assets remain key benchmarks, their maturity naturally limits extreme return potential. Analysts often note that as market value expands, growth rates slow, leading many to study newer models where supply mechanics and early demand still have room to influence outcomes.

For this reason, experts increasingly point to Zero Knowledge Proof (ZKP). With its live presale auction, active infra, operational network, and proof pods now delivering and shipping, analysts highlight aggressive coin removal and rising scarcity. These factors drive continued discussion of Zero Knowledge Proof (ZKP) as the next big crypto as shrinking supply steadily reshapes long term value expectations.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

| Disclaimer: The text above is an advertorial article that is not part of coinlive.me editorial content. |