From Metaverse to Institutional Money: Why Real-World Assets Are Blockchain’s Real Breakthrough

After Bitcoin, decentralized finance (DeFi) is the most significant innovation that came out of the blockchain paradigm. DeFi’s rapid growth mirrors its ambitious goal of recreating finance, having gone from under $1 billion total value locked (TVL) in early 2020 to $174 billion by late 2021.

As FTX and other crypto bankruptcies cooled down DeFi enthusiasm from 2022 to 2025, another phenomenon was steadily rising – Real-World Asset (RWA) tokenisation. From barely noticeable ~$200 million TVL in H2 2022, RWA’s footprint enlarged to $19.4 billion by January 2026.

Let’s examine what RWA tokenisation actually means and from where does it come from?

RWA: Emerging from Metaverse

At this point in time, it is fair to say that the metaverse narrative failed to launch. To understand the scope of this failure, it bears reminding that, in early 2022, J.P.Morgan Chase forecasted over $1 trillion in yearly revenues in its 17-page “Opportunities in the metaverse” report. This was three months before the Federal Reserve started raising interest rates to curb inflation.

This macro trigger then pulled the rug under Terra (LUNA) in May 2022, which instigated a cascade of crypto bankruptcies throughout the rest of the year. But did the metaverse sector recover as DeFi did (up to the October 2025 market correction)?

Not even close. Case in point, the vanguards of the metaverse narrative – Decentraland (MANA) and Sandbox (SAND) – appear to be permanently deflated, down 71% and 80% respectively year-over-year. Likewise, the most successful NFT project ever – ApeCoin (APE) – is down 80% YoY, also showing no signs of recovery.

Of course, the metaverse narrative was tied to the hip with the non-fungible token (NFT) market, both economically and psychologically:

- Not just being a virtual land from old sci-fi movies about VR, metaverse was the promise of the virtual land’s tokenisation.

- NFTs are the ownership primitives in this narrative, without which a “metaverse” would just be another massive-multiplayer online (MMO) game.

- These NFTs came in many forms: digital land, avatars, wearables and other in-world items.

Riding the hype, the entire metaverse/NFT market assumed future demand, pushing the price of tokenised virtual land, and the demand for rare NFT avatars as future scarce social status. The demand thesis collapsed, however, when the liquidity dried up during the aforementioned cascade of crypto bankruptcies, but also when effectively free AI image generation entered the public spotlight by the end of 2022.

To put it differently, the metaverse/NFT sector required mass retail belief to function, easily pricked by macro triggers. Nonetheless, as a proof of concept, this period was successful in pushing the idea of digital-mimicry assets having value.

RWA: A Different Kind of Digital Beast

As we can see, the metaverse narrative failed for many reasons. The future demand was overpromised, likely due to the novelty of NFTs themselves. The reflexivity of mass retail culture, as the market’s engine, was too fickle as rising floor prices signaled cultural relevance, which in turn attracted more retail entrants that pushed prices even further.

Consequently, the entire metaverse model was fundamentally unsound as it relied on social proofing, meme density, influencer signaling and price charts (jpeg go up!). This is the opposite of genuine finance that accounts for discounted cash flows, user retention curves and infrastructure costs.

Real-World Asset (RWA) tokenisation is a breed apart from that model. Instead of mimicking real-world assets with fantasy assets, RWA is all about bridging traditional financial value to blockchain rails. Unlike nebulous NFTs in the metaverse that relied on memery, RWAs simply tap into existing demand:

- Both governments and corporations already raise debt by issuing bonds, which are essentially an IOU – borrowing money on different kinds of promises while making regular interest payments until maturity date.

- Real estate is already a thriving market, fundamental for every economy.

While both metaverse projects and RWA platforms rely on smart contracts, custody solutions, oracles and sometimes compliance layers, RWA value is anchored to off-chain assets under the regulated control of institutions, funds, treasuries and governments.

The question is, why is there a demand for RWA tokenisation itself?

What RWA Tokenisation Is Really About

During the stimulus-triggered retail stock trading splurge, culminating in GameStop short squeeze in early 2021, many anomalies emerged: payment-for-order-flow incentives, trading halts, T+2 settlement delays, dead capital locked in a clearing cycle. All of these revealed the opaque plumbing of intermediaries, making it clear that the mental model of owning a stock is quite different from what is actually going on.

In no uncertain terms, retail traders discovered that financial markets are not just neutral arenas but layered systems of discretionary intervention and latency. In this light, RWA tokenisation is not just a marginal improvement of access but an overhaul. Specifically, by compressing value rails – exchanges, clearinghouses, custodians, court arbitrage – into a single blockchain layer.

In practice, this translates to RWA tokenisation significantly improving the entire financial system:

- Instantly settle in seconds instead of waiting for days for trades to settle. In a traditional way, when cash is sent, a central depository has to tie it to a bond title, generating the so-called “risk window” that can last up to two days. With smart contracts, the claim is executed within a single transaction block, near- instantly (depending on particular blockchain’s throughput).

- Instant settlement itself elevates liquidity because banks and funds no longer need to contain cash to insure against settlement failure. In turn, the velocity of money is increased as freed-up capital can be immediately deployed into other trades.

- Granular, smart-contract-powered programmability allows for more dynamic value deployments. For instance, a bond can automatically pay interest into a wallet every second, rather than once every six months.

With advantages so clear, it is then also clear why the push for RWA tokenisation is not a favor to the retail traders, but streamlining monetization. It is easy to see a tokenised Treasury bill that could settle in minutes and allow for continuous collateral optimization, intraday liquidity reuse, real-time margin and automated compliance/reporting.

In the stock market and real estate, it is equally easy to see automated dividend payouts and buyback executions – bringing traditionally manual processes like cash dividends directly on-chain – alongside tokenised shareholder rights for voting and automatic distribution of rental income from tokenised real estate assets.

RWA In Practice: TradFi Dominates DeFi

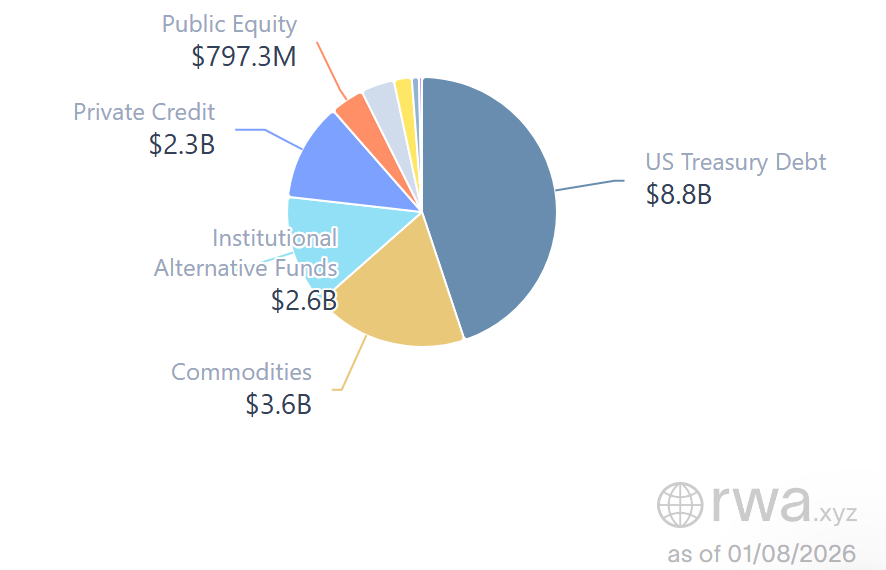

As of January 2026, the tokenised RWA market is holding at $19.38 billion, largely composed of the safest asset on the planet – US Treasury debt at $8.76 billion – given that it is backed by the world’s largest military.

Commodities rank second at $3.6 billion, followed by institutional alternative funds at $2.4 billion and private credit at $2.3 billion. All other assets – public equity, private equity, non-US government debt, actively managed strategies and corporate bonds – are under $800 million.

Image credit: rwa.xyz

Image credit: rwa.xyz

But how does this work exactly?

Given the delicate nature of these assets, they require special permissioned blockchains. One such blockchain we covered recently – the Canton Network. This institutional blockchain network was backed by all major banks and pertinent tech/financial companies like Microsoft, Deloitte, Circle, Paxos and S&P Global.

Presently, Canton holds the bulk of the RWA market share at 95%, confirming once again that RWA tokenisation is not aimed at retail (yet). In practice, institutions that gain access to Canton operate sovereign participant nodes connected through shared Global Synchronizer, which is governed by the non-profit Canton Foundation.

Canton’s privacy is insured through Daml as the primary smart contract language that also has built-in compliance checks.

Closer to the DeFi ecosystem is Provenance blockchain, holding 3.72% RWA market share, as it is built on Cosmos SDK framework. Although Cosmos (ATOM) is not so much in the crypto spotlight these days, it inherently supports building private, permissioned networks.

As we can see, privacy/permission and regulation are tied to the hip, making the RWA market currently bound within institutions. Nonetheless, some RWAs are accessible through DeFi, which largely relies on Swarm for compliance purposes while also directly providing exposure to RWAs.

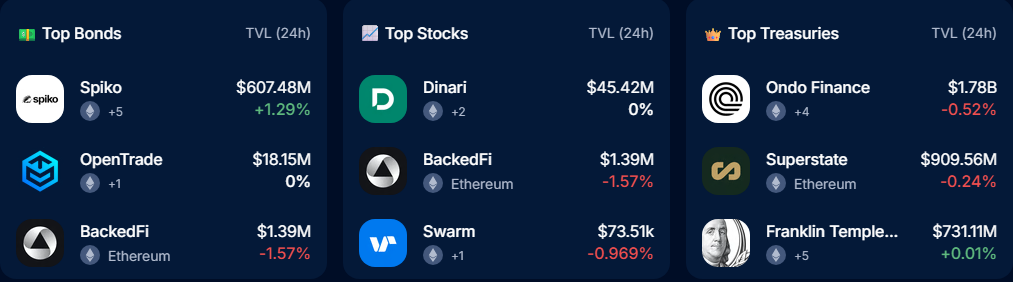

Although some, like Spiko, have blockchain presence, they are regulated FinTech firms. Therefore, access to them may vary based on region.

Roundup of top non-institutional platforms for RWAs, according to DappRadar.

Roundup of top non-institutional platforms for RWAs, according to DappRadar.

As an L2 scaling solution for Ethereum, Base (from Coinbase) hosts the largest RWA platforms – Centrifuge and Maple. Unfortunately, both require special accreditation through KYC/AML and through KYB (Know Your Business) onboarding.

However, Maple has Syrup (SYRUP) protocol that offers access to the broader DeFi audience and exposure to institutional yield streams. Due to regulatory/compliance requirements,

existing DeFi platforms like Aave and MakerDAO have moved to hybrid models.

While MakerDAO uses RWA (Treasuries) as a collateral for its DAI stablecoin, Aave launched the accredited Horizon RWA market that integrates VanEck Treasury Fund (VBILL) via Securitize.

On the other hand, access to commodities like gold is much easier owing to Paxos Gold (PAXG) and Tether Gold (XAUT).

The Bottom Line

RWA tokenization is not a revival of crypto’s retail-driven dreams but a gradual institutional re-plumbing of finance. Where the metaverse and NFTs relied on mass belief, RWAs are pushing ahead by anchoring blockchains to assets that already matter – sovereign debt, credit, commodities and cash flows.

During this process, having a compliance layer is everything, making broader retail access to RWAs primarily a function of legislative frameworks rather than technical capability.

The post From Metaverse to Institutional Money: Why Real-World Assets Are Blockchain’s Real Breakthrough appeared first on Crypto News Australia.

You May Also Like

TrendX Taps Trusta AI to Develop Safer and Smarter Web3 Network

Fed Rate Cut and Tariff Effects: Powell’s Inflation Outlook