Crypto Faces Heavy Liquidations: $864M Wiped Out in 24 Hours

This article was first published on The Bit Journal.

Crypto liquidations swept across the crypto market this week, catching traders off guard as prices dipped faster than expected. The sudden unwind raised urgent questions about leverage, timing, and how much global tension can reshape digital assets in a matter of minutes.

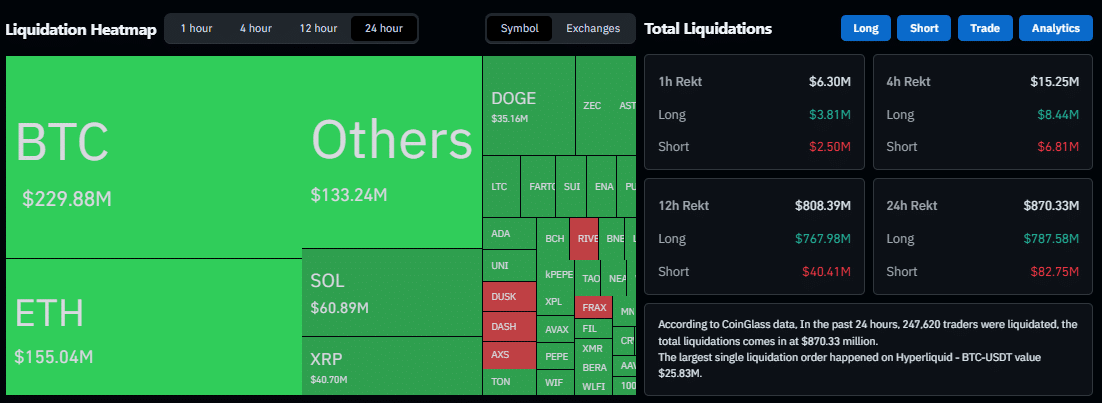

According to the source, over 241,000 traders saw their positions closed in a single day. Updated figures revealed more than $ 864 million in total liquidations within 24 hours, pushing the crypto market into deeper caution as investors reassessed risk exposure.

Leverage Unwinds That Hit Traders Hard

Fresh analysis shared in this update showed that long positions took the biggest hit, with nearly $ 782 million lost as traders expected continued gains. When prices reversed, liquidation engines across major exchanges activated at once. This chain reaction accelerated the fall.

Bitcoin dropped from above 95,000 dollars to around 92,000 dollars, triggering forced closures worth 229 million dollars. Ethereum faced 153 million dollars in liquidations as it followed a similar path. A single BTC-USDT position worth more than 25.8 million dollars on Hyperliquid became the largest wipeout of the day, showing how dangerous high leverage can be when markets turn unstable.

An analyst quoted in this report explained that crypto liquidations often behave like dominoes when markets trade near highs. Once a sharp move begins, liquidity thins and margin calls are triggered almost immediately. The crypto market then swings fast, catching even cautious traders as systems close positions to control losses.

Source: Coinglass

Source: Coinglass

Global Tension That Intensified Market Fear

Geopolitical pressure added more weight to the rapid decline. Sentiment weakened after new tariff threats surfaced between the United States and key European partners. The plan outlined a 10% tariff beginning in February, rising to 25% in June if negotiations fail. The dispute focused on Greenland and its link to the Golden Dome defense system, which stirred concerns across global markets.

The crypto market reacted fast as traders shifted into risk-off mode. Uncertainty began to spread beyond crypto news, and rising fear led to more forced closures. Updated readings showed the total crypto market cap falling to near 3.2 trillion dollars, marking about a 3% drop and signaling how quickly panic can spread through digital assets.

Why Experts See A Warning Signal Hidden In The Chaos

But even with this turbulence, experts point out that the situation provides insight rather than a collapse. The crypto market remains great in size, liquid and anchored by the long-term interests of institutional and retail groups. Yet the surge in crypto liquidations carries a clear message for traders. High leverage can magnify your profits, but when macro conditions change, it will erase weeks of progress in minutes.

Experts also pointed to a deeper reality. Digital markets no longer move only on charts. They now react to political stories, economic policy, and global disputes as fast as traditional assets. For financial students, developers, and market analysts, this event reveals how interconnected the ecosystem has become.

Conclusion

The latest wave of crypto liquidations showed how fragile high-risk positions can be when global tension meets market complacency. The crypto market may settle soon, but this event leaves a lasting lesson. Volatility rewards those who stay prepared, understand risk, and watch the signals that appear long before prices fall.

Glossary of Key Terms

Liquidation: Forced closure of a leveraged trade when losses exceed limits.

Margin: Collateral held to maintain a leveraged position.

Volatility: Speed and intensity of price changes.

Leverage: Borrowed funds used to increase trade size.

FAQs About Crypto Liquidations

Why did liquidations rise so sharply?

High leverage and sudden price drops created a cascade of forced closures.

Which assets saw the most significant hit?

Bitcoin and Ethereum recorded the most significant liquidation totals.

Did geopolitical tensions play a role?

Yes, tariff concerns increased market fear and accelerated the sell-off.

Is this a long-term problem for crypto?

Current data shows short-term volatility, not long-term weakness.

Sources

Coinglass

Coingecko

Read More: Crypto Faces Heavy Liquidations: $864M Wiped Out in 24 Hours">Crypto Faces Heavy Liquidations: $864M Wiped Out in 24 Hours

You May Also Like

Trump’s cyber strategy vows to ‘support the security’ of cryptocurrencies and blockchain

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement