Chainlink and the $867 Trillion Opportunity to Bring Global Finance Onchain

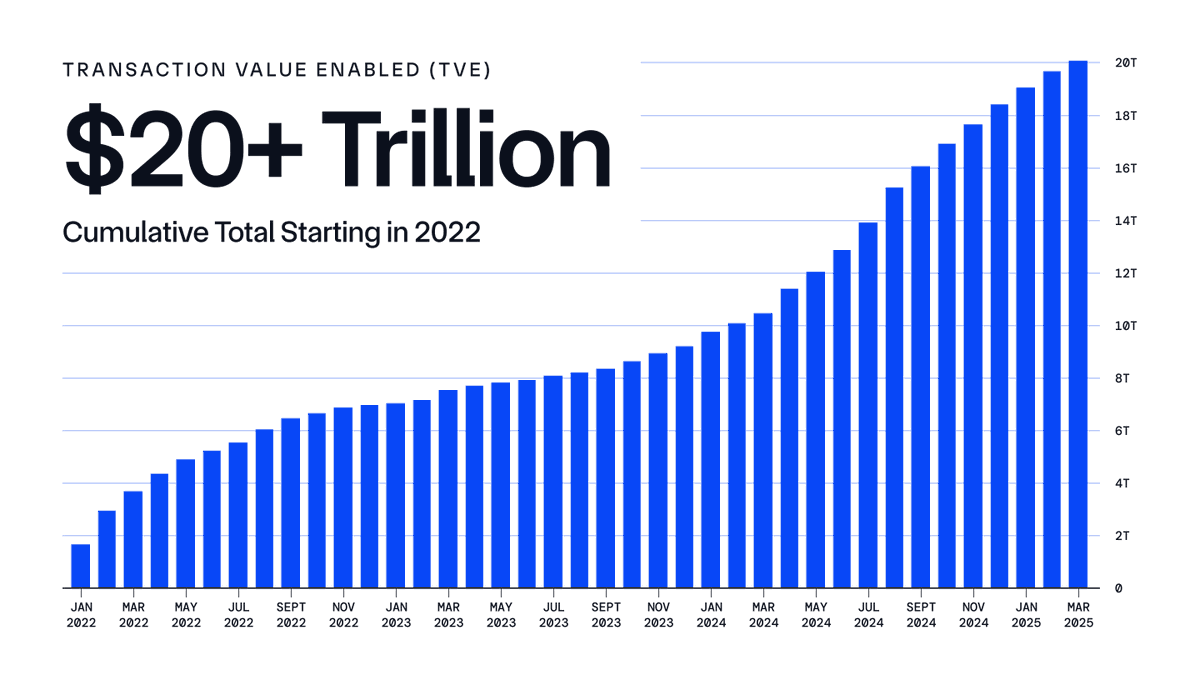

- Chainlink has now enabled over $27 trillion in total transaction value, with over 19 billion messages verified and serving over 2,500 projects.

- Experts have backed the network to be the main infrastructure provider connecting on-chain value to real-world assets, with an addressable market spanning $867 trillion.

Chainlink has become the backbone of the crypto industry and the main infrastructure provider connecting on-chain value to the real world. According to new data, the network has enabled the processing of $27.6 trillion in transaction value, and it’s now targeting an $867 trillion market.

As one expert shared Sunday, Chainlink has processed more value than the GDP of all countries globally, except the U.S., “proving the network’s capacity to handle the world’s most critical economic data.”

Source: Lawrence CCIP on X

Source: Lawrence CCIP on X

Beyond the TVE, the network has verified over 19 billion messages transmitted to hundreds of blockchain networks. With each message, users got a cryptographic truth reference that they used to underpin their smart contracts. This has become one of Chainlink’s most significant uses in the digital age where AI and other next-gen technologies have made it easier than ever to duplicate data. With Chainlink, users can now have immutable verification.

As we have reported, Chainlink continues to be the underlying infrastructure powering some of the industry’s most innovative projects. This has earned it new partnerships with some of the world’s largest corporations, from JPMorgan to Mastercard, and has made LINK one of the hottest tokens on Wall Street, as we have covered.

Chainlink Targets $867 Trillion Market

While its achievements so far have been impressive, the best lies ahead for the oracle network. As the expert pointed out, Chainlink has an addressable $867 trillion market that will rely on its infrastructure as everything goes on-chain in the near future.

According to the World Economic Forum, the size of traditional markets poised for disruption by tokenization stands at $867 trillion. A separate study by BNY Mellon found that 97% of institutional investors that tokenize will change asset management, while Citi expects tokenization to grow at a rate of 8,000% by 2030.

All these point to a burgeoning market that will rely on Chainlink’s oracles to connect off-chain assets and data to on-chain value.

Currently, all the leading players in the tokenization of real-world assets rely on the network’s infrastructure to secure and verify their assets. These include Paxos, 21Shares, BitGo, Fireblocks and Ondo.

Beyond tokenization, the entire decentralized finance ecosystem relies on Chainlink’s technology as well. DeFi holds $130 billion today in locked value according to DeFiLlama.

As the ecosystem balloons, Chainlink continues to innovate and improve. The network is working on DECO, its novel oracle technology that preserves privacy, and confidential compute. It’s also developing the Chainlink Runtime Environment and OCR 3.0, a next-generation standard for off-chain reporting.

LINK trades at $12.75 at press time, dipping 7.3% as the entire market started the week with a $300 billion dip amid fears about a US-EU trade war, as we reported.

]]>You May Also Like

Stocks and Crypto Market Face Volatility From U.S. Tariffs

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon