XRP Loses $2: Is More Downside Coming?

This article was first published on The Bit Journal.

XRP price extended its decline on Monday as bears defended the $2 psychological level. The token traded below $2 and slipped toward the $1.92 area. Market data showed a drop of more than 4% on the day.

The move marked the sharpest daily fall in nearly two months. Traders linked the decline to profit-taking after recent ETF-driven optimism. XRP price now sits in a zone where buyers and sellers often fight for direction.

XRP price broke below the $2 level during heavy intraday selling. The decline triggered a reset in leveraged positions. Analysts highlighted support between $1.78 and $2.03.

XRP Price Stays Defensive as Risk Sentiment Turns Cautious

Analysts also highlighted near-term levels around $1.93 and $1.91. Resistance remains clustered around $1.95, then $2.05. A wider ceiling sits between $2.10 and $2.35. Traders are watching for a reclaim of $2.07 as a momentum signal.

XRP price remains under pressure in the broader crypto market. The weakness came as large-cap assets traded defensively. Bitcoin’s late-session decline also added stress to risk sentiment. XRP price failed to sustain a prior move above $2.25.

Also Read: 2026 Altcoin Outlook: Perplexity Ai Predicts XRP, SUI and Shiba Inu Prices

It also pulled back after briefly pushing above $2.40 earlier in the cycle. The drop placed XRP back into a familiar consolidation band. That band has shaped price action through multiple sessions. Market participants now want confirmation of demand before adding risk.

XRP Price Breaks $2 Psychological Barrier

The $2 level is a major marker for XRP traders. It often acts as a pivot during volatile weeks. XRP price rejected the level and moved lower. That rejection increased bearish conviction. It also pushed price into lower liquidity pockets.

Short-term traders now focus on whether XRP can reclaim the level fast. A quick reclaim can reduce downside pressure. A failure can keep sellers active near resistance.

Analysts Flag Bearish Daily Close

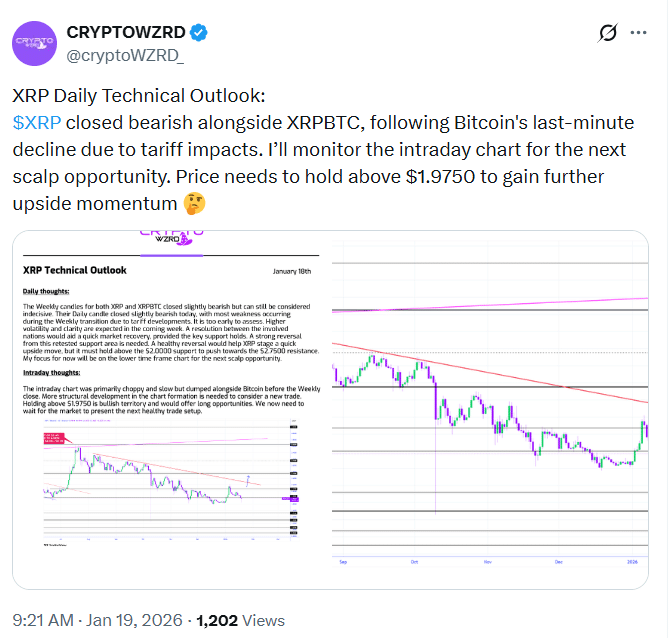

Analyst CRYPTOWZRD discussed XRP in a recent X post. The analyst said XRP closed in bearish territory. The post also mentioned weakness in XRP/BTC. The analyst linked the move to Bitcoin’s late-session decline.

Source: X

Source: X

The analyst added that XRP price needs to hold above $1.9750 to build upside momentum. They also said they will watch the intraday chart for the next scalp setup. This view reflects standard trend behavior. Sellers usually control the tape below broken pivots.

Whales and Profit-Taking Add Pressure

XRP price also faced selling tied to profit-taking. Traders said some positions were closed after the prior rally attempt. ETF-related optimism had supported earlier bids. That narrative can cool when momentum fades. Whale-linked flows can also amplify volatility.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Jan 2026 | $ 1.91 | $ 2.02 | $ 2.21 |

11.84%

|

| Feb 2026 | $ 1.92 | $ 2.02 | $ 2.19 |

10.60%

|

| Mar 2026 | $ 2.04 | $ 2.20 | $ 2.32 |

17.64%

|

| Apr 2026 | $ 2.06 | $ 2.20 | $ 2.30 |

16.33%

|

| May 2026 | $ 1.99 | $ 2.05 | $ 2.15 |

8.94%

|

| Jun 2026 | $ 2.03 | $ 2.50 | $ 2.94 |

48.61%

|

| Jul 2026 | $ 2.68 | $ 2.86 | $ 3.07 |

55.16%

|

| Aug 2026 | $ 2.59 | $ 2.75 | $ 2.92 |

48.01%

|

| Sep 2026 | $ 2.11 | $ 2.27 | $ 2.42 |

22.50%

|

| Oct 2026 | $ 2.27 | $ 2.34 | $ 2.41 |

22.05%

|

| Nov 2026 | $ 2.06 | $ 2.12 | $ 2.23 |

13.03%

|

| Dec 2026 | $ 2.06 | $ 2.09 | $ 2.13 |

7.76%

|

Large moves around round numbers often trigger stops. That can add to sharp candles on short timeframes. XRP price moved quickly as liquidations likely increased. This is common during leverage resets.

Support Levels: Where Buyers May Step In

Analyst Crypto Reality posted another view on X. The analyst said XRP fell from around $2.05 toward $1.95. They added that leveraged positioning reset during the drop. The post said XRP later stabilized near $1.9517. Support was seen around $1.93.

Resistance was seen near $1.95 first. A second resistance zone was placed at $2.05. Market structure also points to deeper demand near $1.80. That area matters due to prior reactions. XRP price can attract bids there if selling continues.

Source: X

Source: X

Resistance Levels: What Bulls Must Reclaim

Bulls now face clear resistance barriers. XRP price must first clear $1.95 with volume. It then needs to flip $2.05 into support. Traders also watch $2.07 as a directional trigger.

A sustained move above that zone can shift the bias. Upside targets then sit at $2.35 to $2.54. That region has acted as supply in recent sessions. Buyers must prove strength to break it.

Ripple’s 2026 Strategy Supports Longer View

Traders are also tracking Ripple’s broader strategy. The firm continues to expand partnerships and product work in 2026. Long-term forecasts still mention a $3 psychological target. Some projections even point to higher levels if catalysts align.

Institutional momentum is also part of the narrative. ETF performance and market flows could matter later. Still, XRP price remains driven by short-term technicals for now. Traders want stability before chasing higher targets.

Conclusion

XRP price remains bearish after losing the $2 level. The token traded near $1.92 during the drop. Support sits near $1.93 and $1.91. Deeper demand sits near $1.80 and $1.78.

Resistance stands at $1.95, then $2.05. Bulls need a reclaim above $2.07 to change momentum. Until then, XRP price may stay volatile inside the support band.

Also Read: $18B in XRP ETF Inflows: Can the Price Climb to $8?

Appendix: Glossary of Key Terms

Support Zone: A price range where investors usually step in to prevent it from decreasing further.

Supply Area: A level where it becomes easier for the price to fall, more selling pressure is present.

Leverage Reset: A cleaning out of overleveraged positions due to liquidations.

Whale Activity: Big holders making big trades that can cause the market to move quickly.

Consolidation Band: A narrow trading range where price runs over before breaking out.

Reclaim: when the price breaks back up above a key level and uses it as support.

Momentum Signal: Technical trigger for trend change or strength.

Frequently Asked Questions About XRP Price

1- Why did XRP price drop today?

XRP price fell due to profit-taking, leverage reset activity, and technical weakness below $2.

2- What is the key support for XRP right now?

Support is seen near $1.93 and $1.91. A deeper zone sits near $1.80 to $1.78.

3- What is the key resistance for XRP?

Resistance starts near $1.95, then $2.05. Stronger resistance sits at $2.10 to $2.35.

4- Can XRP price recover above $2 soon?

A recovery is possible if price reclaims $2.05 and holds above $2.07 with volume support.

Reference

CoinDesk

Read More: XRP Loses $2: Is More Downside Coming?">XRP Loses $2: Is More Downside Coming?

You May Also Like

Disney Pockets $2.2 Billion For Filming Outside America

Crypto Investors Install Golden Trump Bitcoin Statue Outside US Capitol