New Tariff Data Shows Why the Crypto Market Has Been Stuck for Months

New research cited by The Wall Street Journal suggests US tariffs are quietly weighing on the domestic economy. That drag may help explain why crypto markets have struggled to gain momentum since the October sell-off.

A study by Germany’s Kiel Institute for the World Economy found that for tariffs imposed between January 2024 and November 2025, 96% of the costs were absorbed by US consumers and importers, while foreign exporters bore just 4%.

Nearly $200 billion in tariff revenue was paid almost entirely inside the US economy.

Tariffs are Acting Like a Domestic Consumption Tax

The research challenges a core political claim that tariffs are paid by foreign producers. In practice, US importers pay tariffs at the border, then absorb or pass on the costs.

Foreign exporters largely kept prices steady. Instead, they shipped fewer goods or redirected supply to other markets. The result was lower trade volumes, not cheaper imports.

Economists describe this effect as a slow-moving consumption tax. Prices do not jump immediately. Costs seep into supply chains over time.

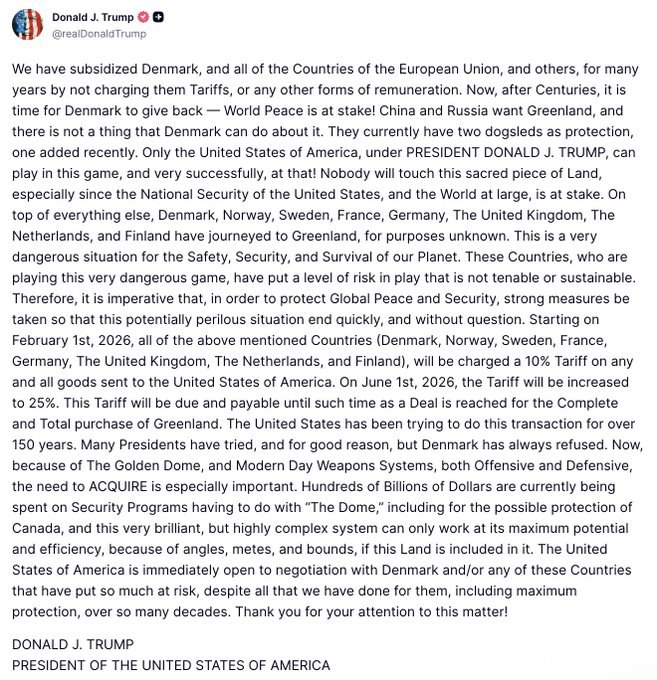

US President Trump Imposes New Tariffs on Several European Countries For Opposing His Greenland Purchase Offer. Source: Truth Social

US President Trump Imposes New Tariffs on Several European Countries For Opposing His Greenland Purchase Offer. Source: Truth Social

US Inflation Stayed Moderate, but Pressure Built

US inflation remained relatively contained through 2025. That led some to conclude tariffs had little impact.

However, studies cited by the WSJ show only about 20% of tariff costs reached consumer prices within six months. The rest sat with importers and retailers, squeezing margins.

This delayed pass-through explains why inflation stayed moderate while purchasing power eroded quietly. The pressure accumulated rather than exploded.

How This Links to Crypto Market Stagnation

Crypto markets depend on discretionary liquidity. They rise when households and businesses feel confident deploying excess capital.

Tariffs drained that excess slowly. Consumers paid more. Businesses absorbed costs. Cash became less available for speculative assets.

This helps explain why crypto did not collapse after October, but also failed to trend higher. The market entered a liquidity plateau, not a bear market.

The October downturn flushed leverage and stalled ETF inflows. Under normal conditions, easing inflation might have restarted risk appetite.

Instead, tariffs kept financial conditions quietly tight. Inflation stayed above target. The Federal Reserve remained cautious. Liquidity did not expand.

Crypto prices moved sideways as a result. There was no panic, but also no fuel for sustained upside.

Overall, the new tariff data does not explain crypto’s volatility on its own. But it helps explain why the market stayed stuck.

Tariffs quietly tightened the system, drained discretionary capital, and delayed the return of risk appetite.

You May Also Like

Trade War Headlines Trigger $800M In Liquidations Overnight: Longs Get Wiped Out Across Crypto Markets

Rokid Ai Glasses Style Now Available Globally