- NYSE plans tokenized platform for securities trading, pending regulatory approval.

- The platform promises 24/7 operation with instant settlement.

- No official statements or additional details have been confirmed by leadership.

The New York Stock Exchange is planning to launch a tokenized securities trading platform, pending regulatory approval, offering continuous operations and instant, stablecoin-based settlements, according to Businesswire.

This development signifies a crucial step toward mainstream integration of blockchain technology into traditional financial markets, potentially reshaping the securities trading landscape profoundly.

NYSE’s 24/7 Trading Platform: Blockchain and Stablecoin Integration

NYSE’s new initiative involves building a platform for tokenized securities trading, combining traditional finance with digital innovations. The plan includes features such as 24/7 operation, instant settlement, and stablecoin-backed funding. Important details, including the expected launch date and specific regulations, remain undisclosed.

The anticipated platform aims to revolutionize how securities are traded by offering continuous operations and reducing settlement times. The focus on USD orders and stablecoin interaction underlines a commitment to accessible liquidity and modern financial solutions. Despite the enthusiasm, the lack of official statements from leadership has sparked questions about feasibility and timeline.

Potential Market Shifts If NYSE’s Plan Receives Approval

Did you know? The potential for 24/7 trading and instant settlement in tokenized securities represents a significant departure from traditional markets, which typically operate for limited hours on weekdays.

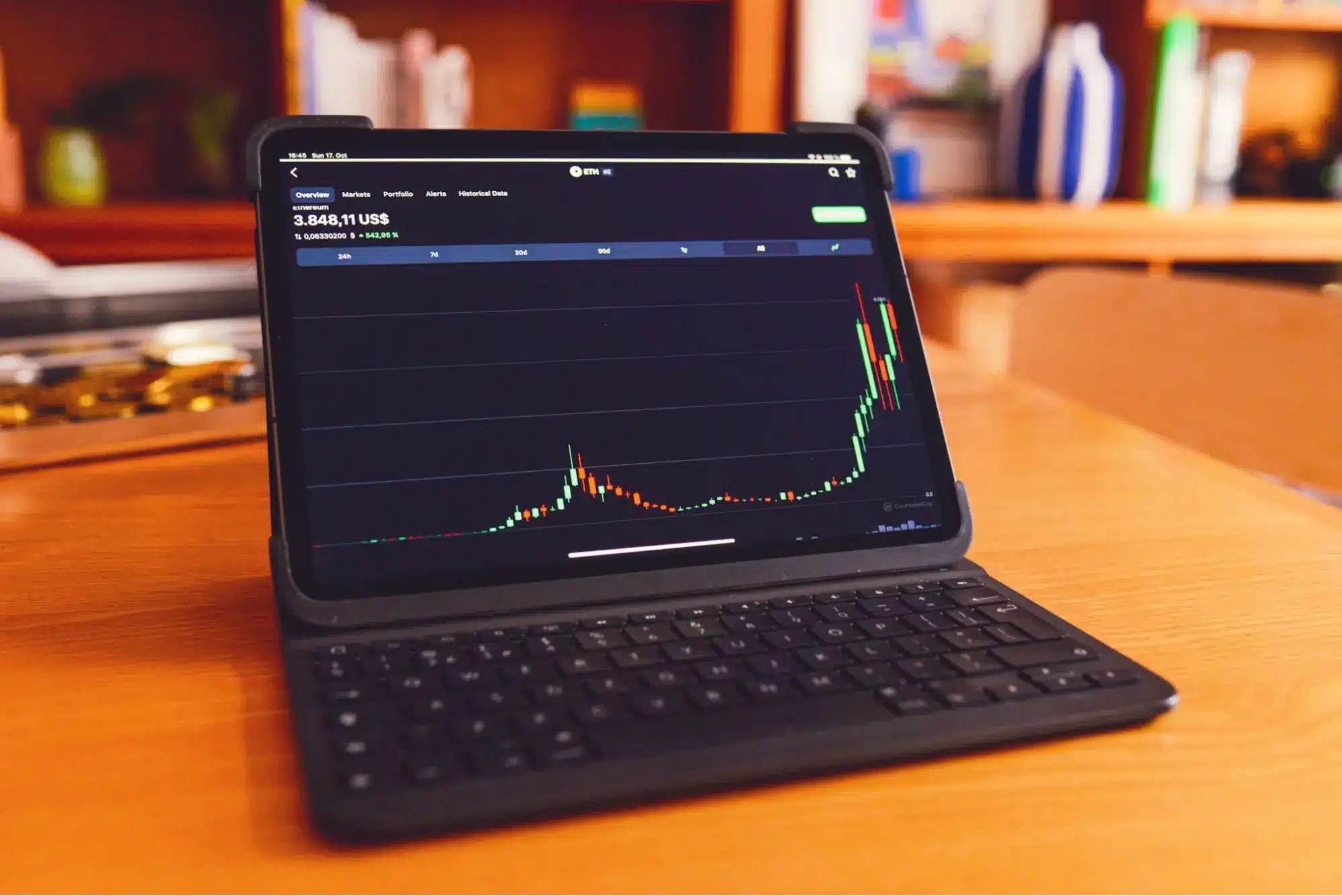

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $92,543.37, reflecting a 0.06% rise over 24 hours. With a market cap of formatNumber(1848847316641, 2) and a 59.08% market dominance, Bitcoin has shown a 5.20% increase over the past 30 days, despite a 14.64% drop over 90 days.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:38 UTC on January 20, 2026. Source: CoinMarketCapInsights from Coincu research point to possible financial shifts, especially in trading efficiency and liquidity management, should NYSE’s platform gain approval. Future technological developments are anticipated, but regulatory barriers could pose challenges. The integration of a stablecoin funding mechanism could attract wider participation from institutional investors exploring blockchain solutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/nyse-tokenized-securities-platform-3/