Algorand Supports Environmental Certificate Adoption by Japan’s Top Corporations

- Two of Japan’s largest companies have partnered to reduce carbon emissions through environmental certificates, and it’s all being done on Algorand.

- MOL and ITOCHU will issue and trade the certificates on 123 Carbon, a Dutch company that has built its infrastructure on the Algorand blockchain.

Mitsui O.S.K. Lines (MOL) and the ITOCHU Corporation, two of the largest companies in Japan, have announced a new partnership that aims to reduce carbon emissions in the East Asian country, and they are building on the Algorand blockchain.

MOL president Takeshi Hashimoto and ITOCHU president Keta Ishii signed a memorandum of understanding to use Environmental Attribute Certificates (EACs) to push decarbonization in the transport sector. The two will partner on sales, marketing, public relations and other areas to advance the use of EACs in Japan. They aim to help Japanese firms reduce Scope 3 emissions, which are emissions that happen outside a company’s own operations, but still have a connection to its business.

MOL is one of the largest shipping groups in Japan and the world’s largest tanker operator. ITOCHU is a giant general trading house in Japan with interests across energy, natural resources, machinery, food, consumer brands and chemicals.

Decarbonizing with Algorand

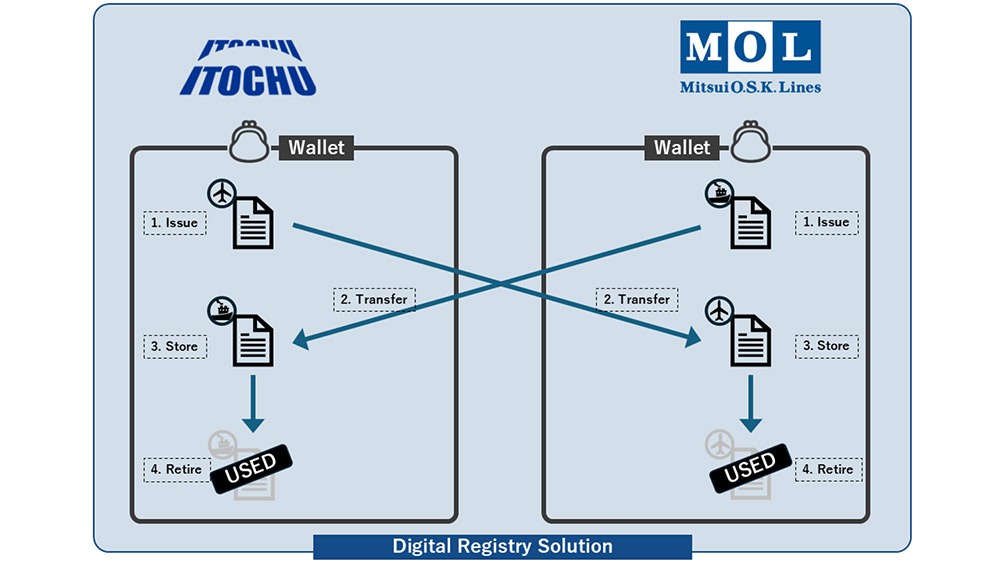

Both companies traded EACs to reduce their respective carbon footprint. MOL purchased EACs from ITOCHU to reduce its air transport emissions from its employees’ frequent travel. ITOCHU then purchased EACs issued by MOL to reduce its maritime emissions.

These transactions were executed on 123Carbon’s platform. The Dutch company facilitates net zero transportation by allowing companies to trade EACs, and has worked with some of the world’s largest companies, including Britain’s Zilch and American oil giant Chevron.

123Carbon’s platform is built on the Algorand blockchain, which solves one of the key challenges in trading EACs: traceability. As MOL noted in its announcement, the complexity of global supply chains makes tracing the EACs expensive and difficult. With Algorand, all transactions will be documented on-chain and will be transparent and immutable, making tracing easy and cost-effective.

Source: MOL

Source: MOL

“Collaboration across the entire transportation supply chain is essential to achieving net-zero,” MOL commented, adding that its partnership with the Algorand-based platform and ITOCHU “represents a concrete example of stakeholder co-creation.”

The carbon offsets and credits market is valued at over $400 billion, with one report projecting that it will hit $1.6 trillion by 2028. If Algorand can position its platforms as critical to the on-chain documentation of these credits, it stands to tap into one of the most rapidly developing segments and could attract hundreds of billions of dollars.

It would also align with the network’s 2026 roadmap which outlined sustainability as one of the key goals, as we reported. Algorand has shown it can process over 30,000 transactions per second, as CNF detailed, enabling it to handle institutional volume.

ALGO trades at $0.177, dipping 2.6% in the past day for a $1.03 billion market cap. Despite the dip, analysts say that the token could be bracing for a massive rally as the $0.1 level continues to be strong support.

Source: AltWofCrypto on X ]]>

Source: AltWofCrypto on X ]]>You May Also Like

United On Crypto: UK And US Announce Joint Regulatory Effort

BlackRock Files $12.5 Trillion Bitcoin Premium Income ETF Application