4,000,000 PI in 24 Hours: Is Pi Network’s Price Ready to Rebound?

The downfall of Pi Network’s native token has only intensified as of late, prompting many community members to question the project’s legitimacy and to outline bearish forecasts.

However, one indicator suggests that a short-term rally might be knocking on the door.

Abandoning Exchanges

Earlier this week, Pi Network’s PI slipped to approximately $0.18, quite close to the all-time low of $0.17 witnessed in October last year. There was a minor resurgence, but it currently trades around that level, representing a 9% decline on a weekly basis and a massive 94% collapse since the historical peak of $3 recorded in February 2025.

It is important to note that PI’s retreat isn’t an isolated case, as the broader crypto market headed south following increased geopolitical tension between the USA and the European Union stemming from the Greenland saga.

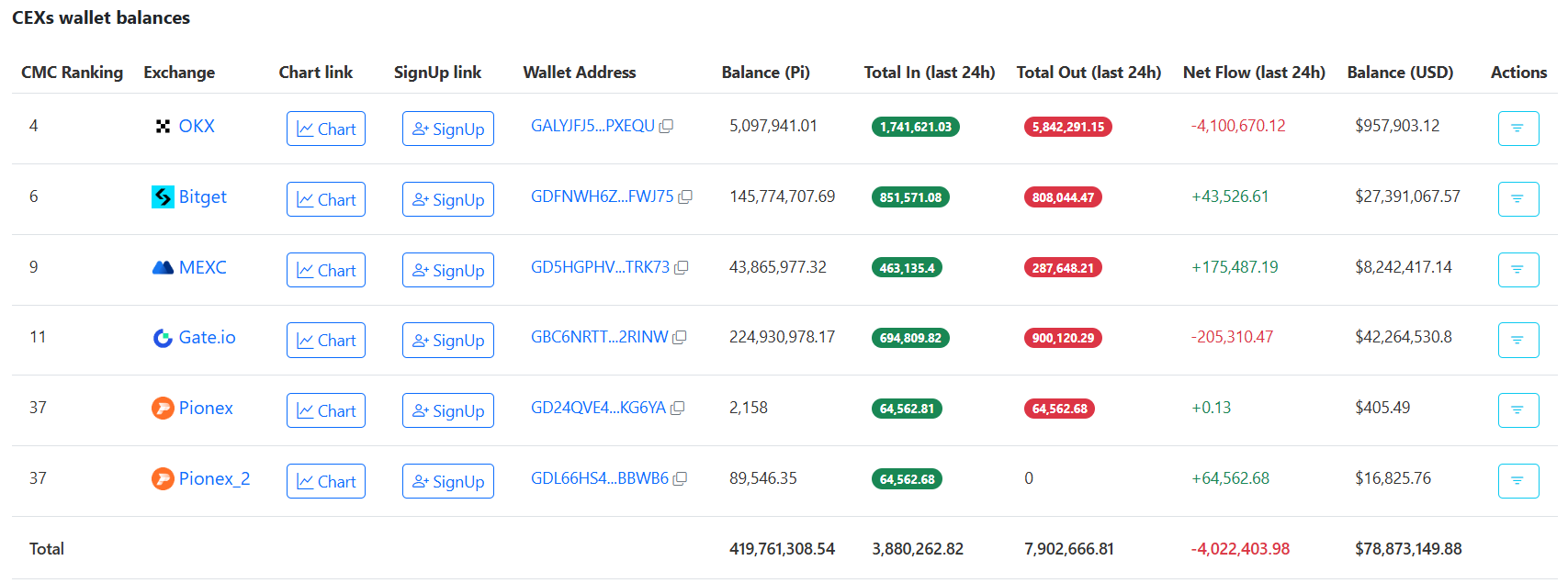

While the ongoing environment seems heavily in favor of the bears, the exodus from exchanges hints that not everything is lost for Pi Network’s token. More than four million coins have been transferred from such platforms to self-custody methods in the past 24 hours alone, reducing the immediate selling pressure.

As of this writing, the total amount of PI stored on exchanges equals roughly 419.7 million. Over 50% of those are situated on Gate.io, whereas Bitget comes in second with 145.7 million.

PI Exchange Supply, Source: piscan.io

PI Exchange Supply, Source: piscan.io

Are the Bears Here to Stay?

Pi Network boasts a vast and devoted community base, yet its persistent downtrend and ecosystem issues have fueled mounting backlash from some members. Not long ago, X user Pi Update described the project as “the longest-running crypto cope” and criticized “the endless KYC queues, frozen balances, forced lockups, and still no real open mainnet.”

They further noted the lack of major exchange listings, arguing that “at some point you have to admit this isn’t early – it’s late and still unfinished.”

X user pinetworkmembers also recently chipped in, claiming it’s “hard to stay bullish” on PI at the moment. They noted that the coin has failed to follow the overall market resurgence in the opening days of the year and pointed to unclear supply, “no real open mainnet,” centralized control, and locked balances as main hurdles.

The post 4,000,000 PI in 24 Hours: Is Pi Network’s Price Ready to Rebound? appeared first on CryptoPotato.

You May Also Like

CME Group to launch options on XRP and SOL futures

Trump Family Adds $1.4B in Crypto While Media Shares Decline