Bitcoin price prediction: Is $90k the line in the sand?

Bitcoin is slipping as risk-off sentiment, fading momentum and a chorus of bearish chart signals put the market on edge, with traders zeroing in on $90,000 as the make-or-break level that could decide whether the pullback stabilizes—or deepens.

Table of Contents

- Current market scenario

- Brandt is bearish

- On-chain data signals cooling momentum

- Bitcoin price prediction: Key levels to watch

Without exaggeration, the risk does exist — but it is far from guaranteed.

- Bitcoin is trading around $90,658, struggling to reclaim key resistance amid macro uncertainty and market weakness.

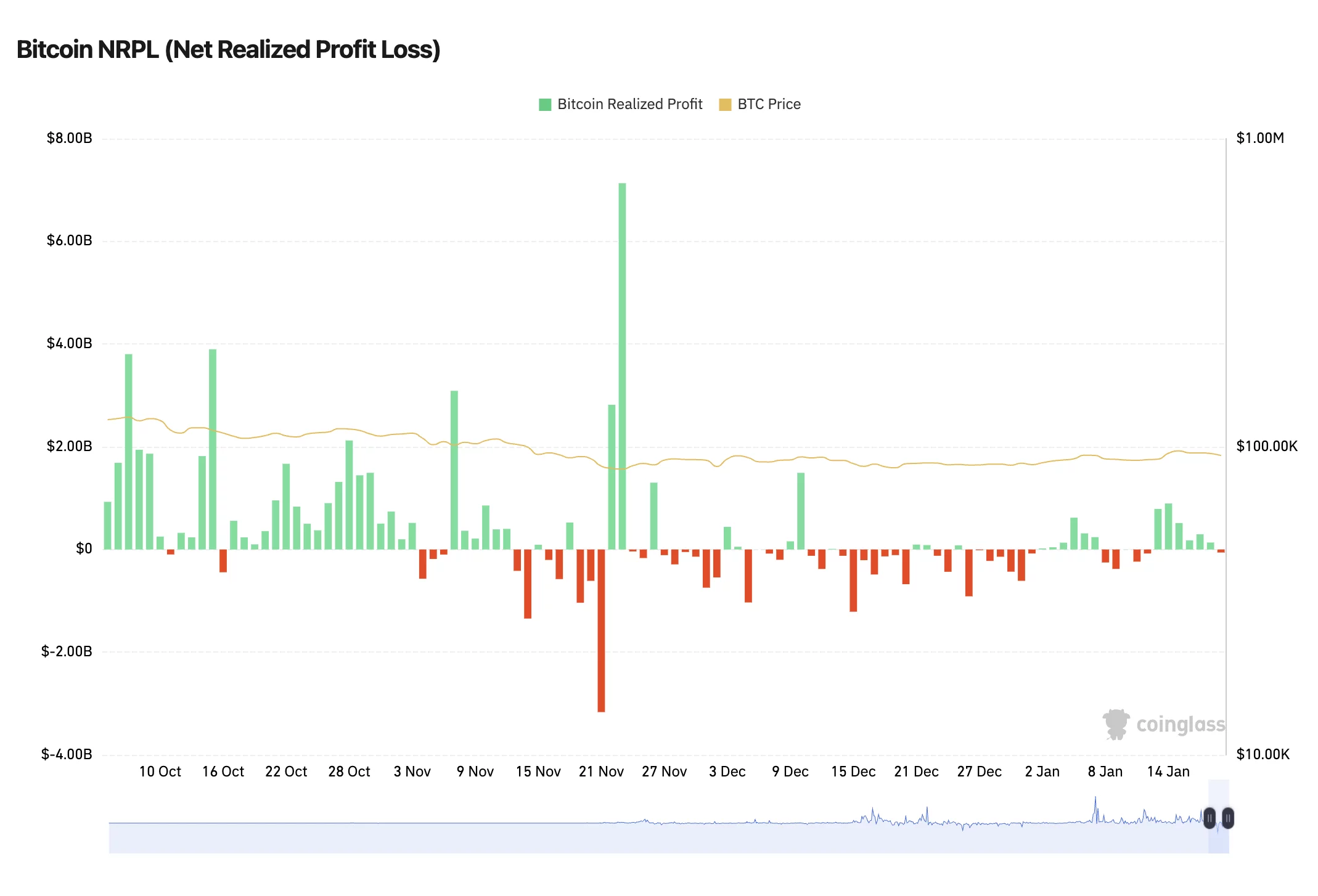

- On-chain data, including CoinGlass’ NRPL metric, shows cooling momentum and slower profit-taking, signaling cautious market sentiment.

- A push above $97K–$98K could restore bullish control, while losing $90K–$91K support increases the risk of a deeper pullback; next moves will shape the short- to medium-term BTC outlook.

Current market scenario

Bitcoin (BTC) is down about 2%, dropping below $92,000, it’s now under $91,000, and traders are keeping a close eye on this level — it could either hold and stabilize the price, or if it cracks, BTC might head lower.

The pullback comes amid risk-off vibes, worries about President Trump’s tariffs, and general market weakness. Short-term support levels are giving way, signaling the bulls are losing strength.

On-chain data also shows profit-taking has slowed, which adds to the cautious mood.

Brandt is bearish

Peter Brandt, a trader with over 850,000 followers on X, added fuel to the Bitcoin debate on X, suggesting it could slide down to around $58,000–$62,000.

He points to a rising wedge that’s been building for months — a classic bearish setup signaling the bulls might be losing steam.

He was quick to say he’s not always right, noting he’s “wrong about 50% of the time” and that this is just a possibility. Even so, his warning has traders on edge, especially short-term ones.

Bitcoin still can’t reclaim major resistance, keeping the BTC forecast on the cautious side.

On-chain data signals cooling momentum

Some on-chain data suggests Bitcoin’s upward push is losing steam. CoinGlass’ NRPL metric — which tracks trader profits — has slipped slightly negative after months of strong positive numbers.

This tends to happen when buying interest cools off and the market is just absorbing selling. It doesn’t mean a meltdown is around the corner, but BTC could be more fragile if fresh buyers don’t jump in.

Bitcoin price prediction: Key levels to watch

If Bitcoin can push back above the $97,000–$98,000 range, it would signal that bulls are regaining control and could break the bearish trend, giving BTC a solid boost.

Looking to the downside, losing channel support at $90,000–$91,000 would raise the odds of a bigger pullback for Bitcoin. That could bring in $62,000, though it’s not a guaranteed outcome.

The Bitcoin price prediction is looking a bit hazy right now. Bearish charts and slowing on-chain activity are warning signs, but BTC has a way of surprising traders. The next moves will be key in shaping the short- to medium-term BTC outlook.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Why Smart Talent Acquisition Leaders are Choosing Nearshore Over Offshore: The 2026 Talent Geography Playbook