Behind the Volatility: Key Takeaways from Crypto’s Q4 2025

- The latest quarterly report from Brisbane-based crypto exchange Swyftx argues that Bitcoin is behaving more like a “beta for high risk tech socks” than digital gold after a volatile Q4 punctuated by the crypto collapse of October 8.

- Other trends highlighted include the success of altcoin spot ETFs and the rise of privacy coins.

- David Bird (aka ASX Trader) contributed to the report, forecasting a rough 2026 for crypto due to a convergence of several key cycles increasing risk.

In its latest quarterly report, Brisbane-based crypto exchange Swyftx has argued that Bitcoin’s status as digital gold has “materially weakened” in the wake of the October 10 crypto market calamity — the exchange says BTC is currently more like a “beta for risk-on tech stocks” than a safe haven asset.

Swyftx attributed the October 10 crypto market collapse to a number of factors, including macroeconomic and geopolitical drivers, but highlighted the role of lowered US dollar liquidity and all-time high leverage rates in the crypto market.

These liquidity pressures eventually reached boiling point, and, paired with the perfect storm of conditions, the market gave way on October 10.

Pav Hundal, Lead analyst at Swyftx

Pav Hundal, Lead analyst at Swyftx

Bitcoin’s relatively weak performance throughout 2025 — but particularly after October 10 — demonstrates it isn’t behaving at all like ‘digital gold’ in difficult market conditions. “This year saw a significant decoupling between the two [gold and Bitcoin] with the divergence accelerating in Q4 2025,” the report’s authors noted.

Through the year gold was a pre-eminent performer (+70%), while Bitcoin traded largely flat. By late November correlation between the assets was consistently negative, falling as low as -0.9.

The exchange also pointed out that Bitcoin’s price decoupled from global M2 money supply in 2025, with the decoupling accelerating during Q4, which suggests the drivers of Bitcoin’s price action may be changing and the market may be “entering unchartered waters.”

Another important narrative which emerged during Q4 was the launch of altcoin-based spot exchange-traded funds (ETFs) — with ETFs based on Solana, XRP, Hedera, Dogecoin and Chainlink all being launched in quick succession.

While almost all altcoins were weak through Q4, investor demand for these altcoin-based ETFs has actually been quite strong, according to Swyftx. The exchange said that suggests a longer-term investment strategy for those opting to gain exposure through ETFs rather than directly buying altcoins.

Since being launched in November, Solana-based funds have accumulated assets under management (AUM) of over US$700 million (AU$1b), while the XRP-based funds reached a market cap of over US$1 billion (AU$1.4b) in just over a month and didn’t have a single day of net outflows during this time.

Related: Institutions Set to Supercharge Crypto’s Next Wave in 2026

Swyftx Metrics Show Customers Prefer Bitcoin and a Few Other Narrative-Driven Winners

Data on Swyftx customers’ behaviour shows that investors sought the relative safety of Bitcoin, with trades involving Bitcoin on the platform (Bitcoin dominance) surging 70% in Q4 of 2025 to 33.5% — up from 19.6% in Q3.

For a brief period in December, Bitcoin dominance actually hit 50%, showing just how much users were flocking to Bitcoin over alts.

There were a few select winners other than Bitcoin, with trading volumes for Sui, Hedera and Bittensor all significantly higher than what would be expected based on their market caps.

In terms of price action, there was one huge winner in Q4 — privacy coins, led by ZCash (ZEC). Through Q4, Zcash’s price surged by over 600%, largely driven by privacy concerns around Bitcoin.

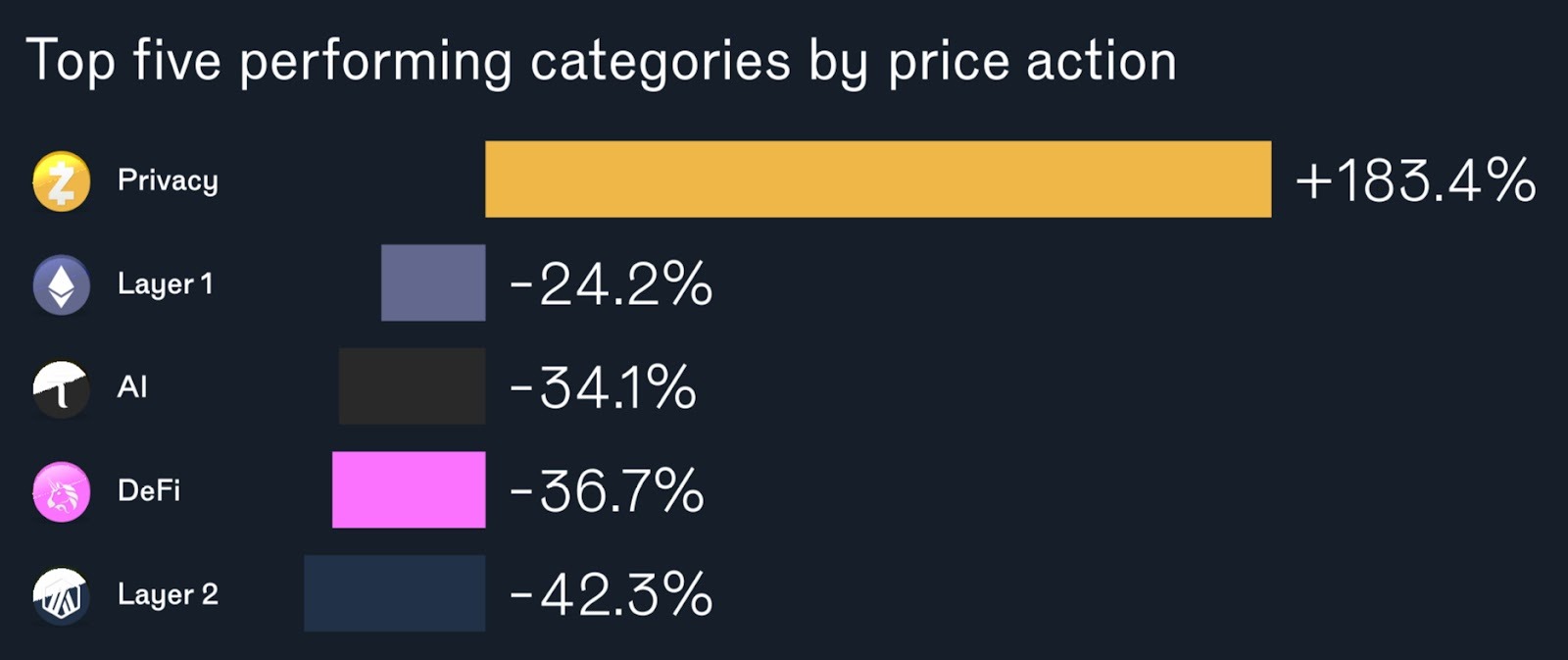

Top 5 performing categories on Swyftx during Q4 2025. Source: Swyftx

Top 5 performing categories on Swyftx during Q4 2025. Source: Swyftx

Privacy-based tokens were the only category on Swyftx to see average price increases in Q4, being up on average 183.4%. All other categories fell, with the second-best-performing category, ‘layer 1s’, dropping by an average of 24.2%.

2026 a Year For “Playing Defence,” Says ASX Trader

Investment adviser and report contributor, David Bird (Aka ASX Trader), said 2026 was likely to see “defensive assets” such as gold outperform higher risk assets such as Bitcoin and crypto.

“From a macro perspective several major cycles appear to be approaching peaks — the Land Cycle, Brenner Cycle, broader economic cycle, the mid-term election cycle and even the 4-year crypto cycle itself. When multiple cycles align this way, risk tends to rise not fall. Crypto, being highly sensitive to liquidity and sentiment, is particularly exposed,” he said.

Related: Crypto Investment Products See Largest Weekly Inflows Since October 2025

Investing YouTuber Jason Pizzino also contributed his insights to Swyftx’s report and shared a similar outlook for 2026: he thinks several indicators are now aligning to confirm crypto has entered a bear market.

“Time and sentiment indicators have now slowed to levels not seen since the prior bear market in late 2021 / early 2022, which led us to believe this time is not different.”

Pizzino suggested one potentially positive indicator is that we haven’t (yet) seen Bitcoin fall 50% from its bull market high. If Bitcoin can continue to hold above this level (around US$71,000 according to Pizzino), we may yet see it rally if other macro conditions become more favourable.

The post Behind the Volatility: Key Takeaways from Crypto’s Q4 2025 appeared first on Crypto News Australia.

You May Also Like

Sonami Token Presale Launches With 53% Staking Rewards, Powering a Solana Layer-Two Network Vision

Will Intel stock keep soaring as Q4 earnings approach?