Nansen: Not all Bitcoin-heavy firms get equal stock market love

Many firms now hold Bitcoin as a reserve asset, but markets care how they hold it, a Nansen report shows.

Bitcoin (BTC) is rapidly becoming a core part of the traditional financial system. According to a recent report by Nansen, new regulatory standards and macroeconomic factors have changed how corporations view Bitcoin exposure. This has led to the largest firms holding over 700K BTC.

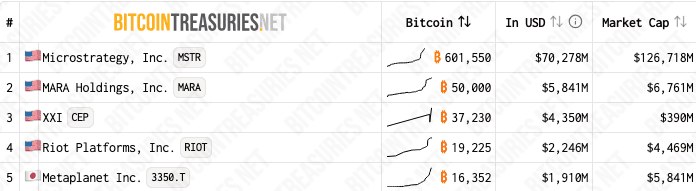

Collectively, Strategy, Marathon Digital, Twenty One Capital, Riot Platforms, and Metaplanet own Bitcoin worth about $81.9 billion. Strategy, formerly MicroStrategy, controls the lion’s share of these holdings, with 601,550 BTC.

Still, not all of these companies are seeing the same effect on their stock prices. Specifically, Strategy trades at nearly double the valuation of its BTC holdings. In contrast, Marathon Digital, where BTC accounts for 85% of its market cap, trades at par with its Bitcoin reserves.

Strategy leverages debt to outperform BTC

This suggests that markets care about how a company structures its BTC holdings. Strategy uses debt, allowing it to consistently accumulate Bitcoin and effectively act as a leveraged bet on its price.

This gives Strategy’s stock both more upside and greater volatility than Bitcoin. For instance, in December 2024, Strategy’s stock fell by 21%, while Bitcoin declined just 2%. However, Strategy’s stock has outperformed Bitcoin over the long term.

Japanese firm Metaplanet also trades above the value of its BTC holdings, at a 3.5x multiple. Nansen notes that traders favor its first-mover advantage in Asia. Like Strategy, Metaplanet is also issuing debt to buy Bitcoin.

You May Also Like

MYX Finance price surges again as funding rate points to a crash

Trump enlists GOP to translate his conspiracy theories into new action