Ondo Finance’s USDY to launch on Sei Network

Ondo Finance is set to launch its USDY tokenized Treasury product on Sei, adding to a growing list of supported networks that includes Ethereum, Solana, Mantle, and Sui.

According to a press release shared with crypto.news, Ondo Finance’s flagship tokenized US Treasury product, United States Dollar Yield (USDY), is launching on the Sei (SEI) Network. This marks the first time a tokenized Treasury Bill product will be natively integrated into the ultra-fast Layer-1 blockchain with TVL exceeding $670M and 821% YoY growth.

USDY, which combines the accessibility of stablecoins with the yield and investor protections of traditional finance, currently boasts a market cap of over $681 million and offers a 4.25% APY, updated monthly. With the Sei integration, global (non-U.S.) users gain access to high-quality, composable yield directly on a blockchain known for its parallelized execution and near-instant finality.

“Sei’s breakthrough infrastructure with near instant finality and parallelized execution makes it uniquely suited for institutional-grade financial products, and USDY represents the exact kind of high-quality, composable yield primitive that will unlock new possibilities for developers building the next generation of onchain applications,” said Justin Barlow, Executive Director at the Sei Development Foundation.

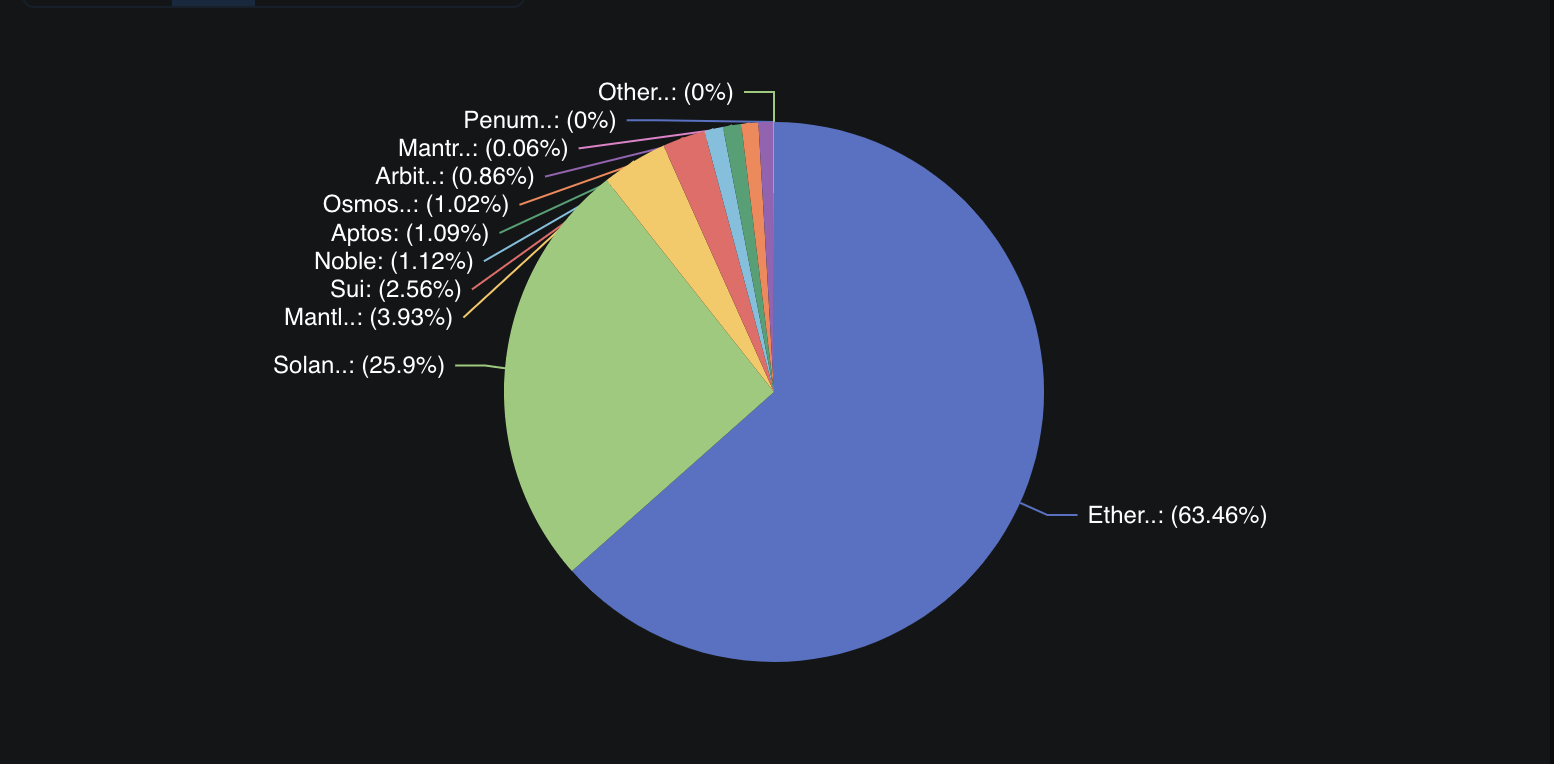

USDY’s expansion to Sei comes as part of a broader multichain strategy. The token is already live across several major blockchains, most notably Ethereum (ETH), which holds 63.46% of USDY’s circulating supply, according to DeFiLlama. Solana (SOL) follows with 25.9%, while Mantle (MNT) accounts for 3.93%, Sui (SUI) holds 2.56%, and other networks, including Aptos (APT), Osmosis (OSMO), and Arbitrum (ARB) collectively host smaller portions.

It’s also worth noting that USDY is now fully fungible across Ethereum, Mantle, and Arbitrum — eliminating the need for wrapping or swapping between chains — following the integration of LayerZero’s omnichain standard in November last year. Support for additional networks is planned.

You May Also Like

Federal Reserve Cuts Rates 25 Basis Points as Officials Remain Split on 2025 Path

Tesla Stock Forecast: Will $1.25T SpaceX-xAI Merge Boost TSLA?